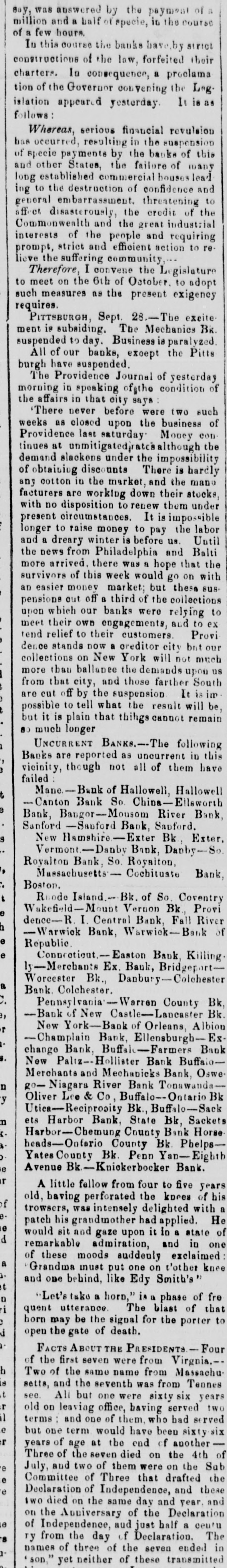

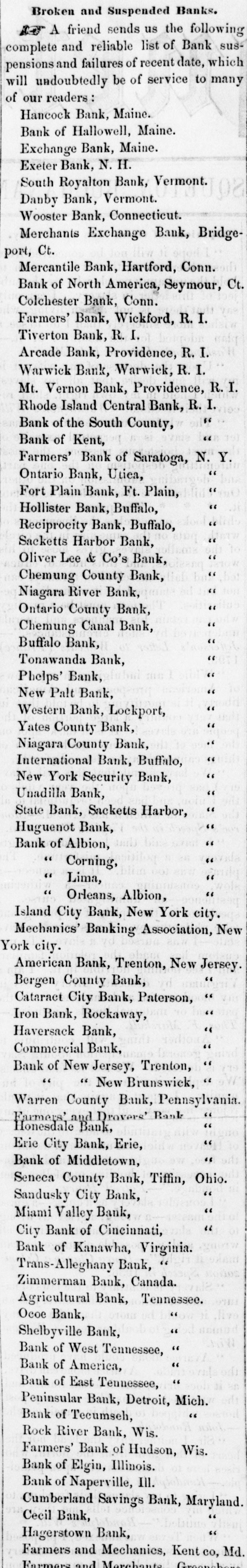

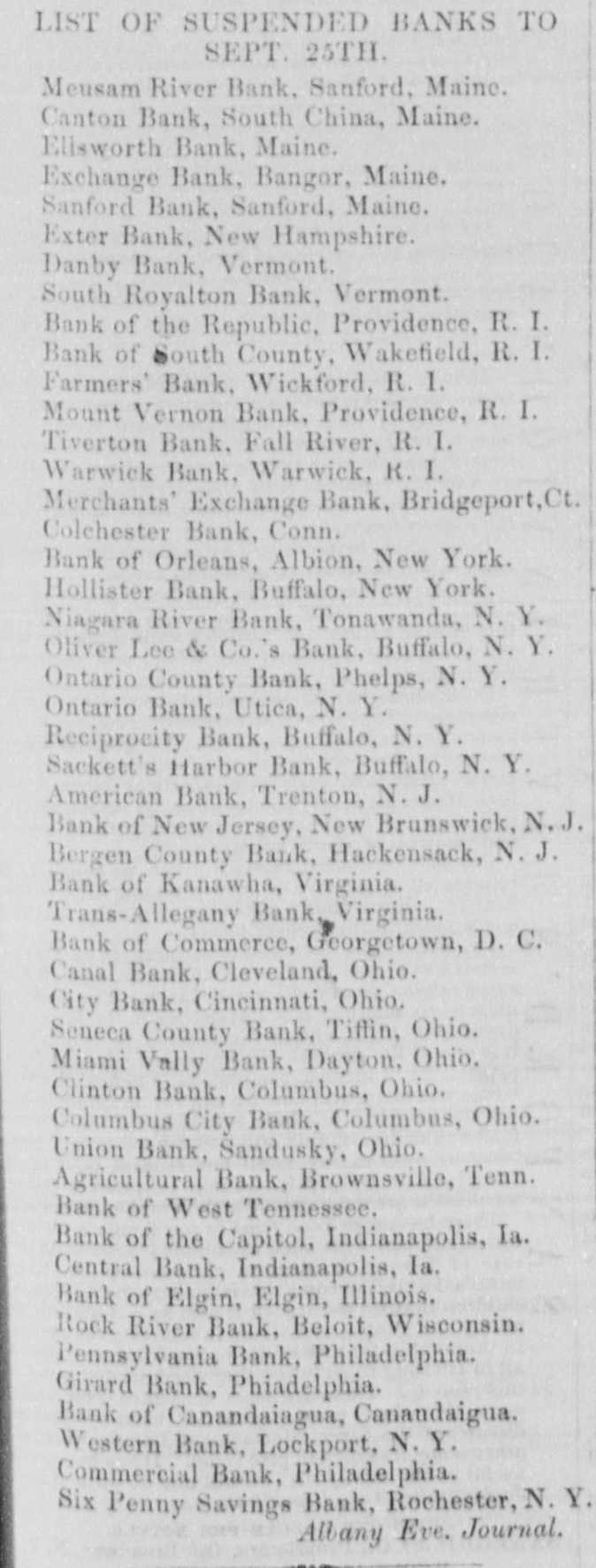

Article Text

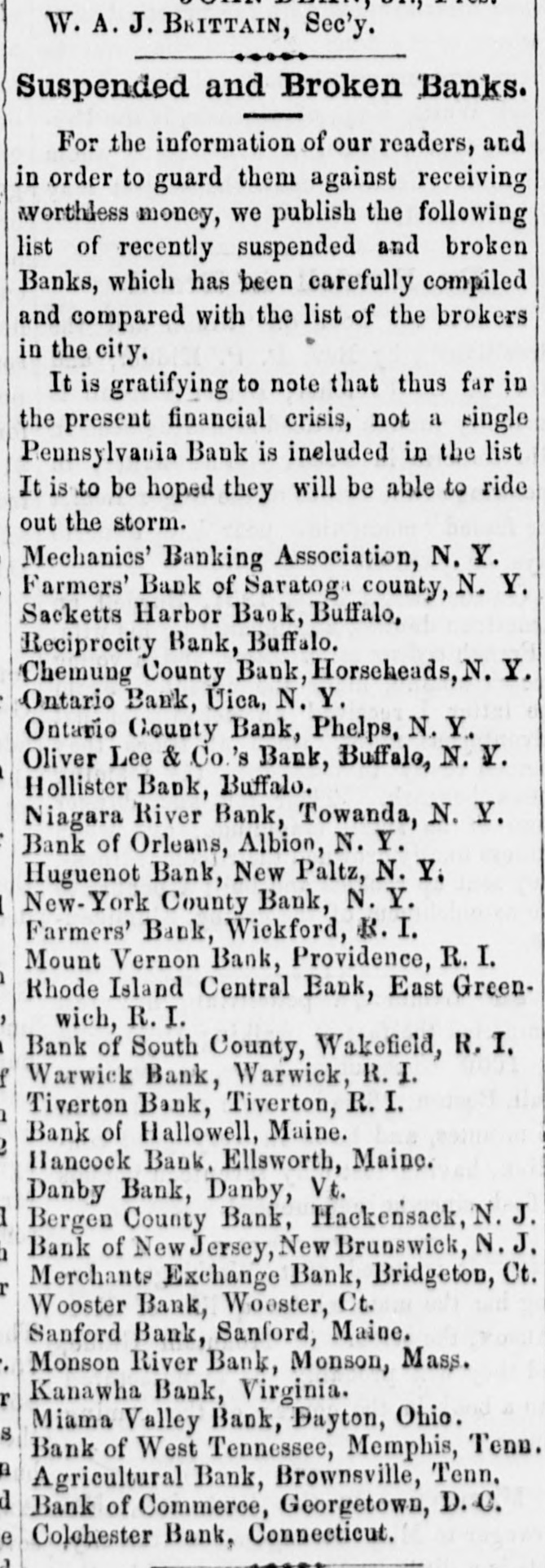

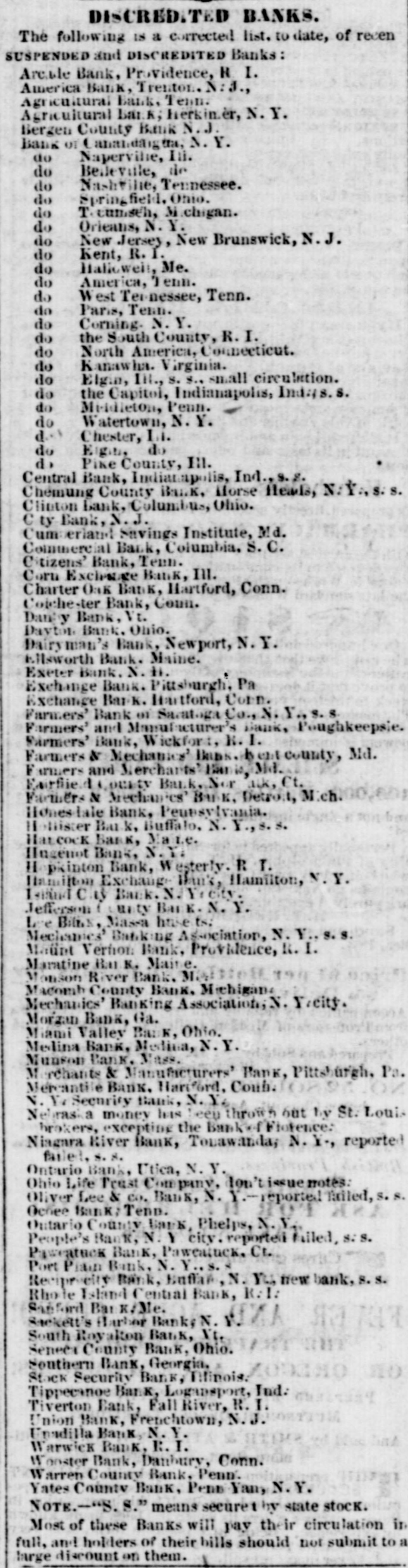

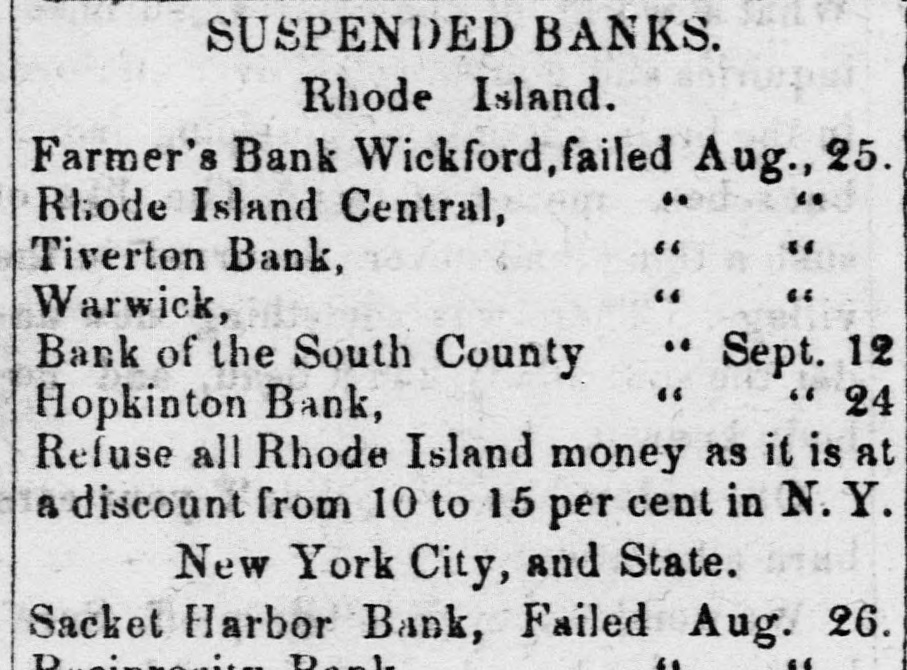

W. A. J. BRITTAIN, Sec'y. Suspended and Broken Banks. For the information of our readers, and in order to guard them against receiving worthless money, we publish the following list of recently suspended and broken Banks, which has been carefully compiled and compared with the list of the brokers in the city. It is gratifying to note that thus far in the present financial crisis, not a single Pennsylvania Bank is included in the list It is to be hoped they will be able to ride out the storm. Mechanics' Banking Association, N. Y. Farmers' Bank of Saratoga county, N. Y. Sacketts Harbor Baok, Buffalo, Reciprocity Bank, Buffalo. Chemung County Bank, Horseheads, N. Y. Ontario Bank, Vica, N. Y. Ontario County Bank, Phelps, N. Y. Oliver Lee & Co.'s Bank, Buffalo, N. V. Hollister Bank, Buffalo. Niagara River Bank, Towanda, N. Y. Bank of Orleans, Albion, N. Y. Huguenot Bank, New Paltz, N. Y. New-York County Bank, N. Y. Farmers' Bank, Wickford, B. I. Mount Vernon Bank, Providence, R. I. Rhode Island Central Bank, East Greenwich, R. I. Bank of South County, Wakefield, R. I. Warwick Bank, Warwick, R. I. Tiverton Bank, Tiverton, R. I. Bank of Hallowell, Maine. Hancock Bank, Ellsworth, Maine. Danby Bank, Danby, Vt. Bergen County Bank, Hackensack, N. J. Bank of New Jersey, New Brunswick, N. J. Merchants Exchange Bank, Bridgeton, Ct. Wooster Bank, Wooster, Ct. Sanford Bank, Sanford, Maine. Monson River Bank, Monson, Mass. Kanawha Bank, Virginia. Miama Valley Bank, Dayton, Ohio. S Bank of West Tennessee, Memphis, Tenn. a Agricultural Bank, Brownsville, Tenn, d Bank of Commerce, Georgetown, D.C. Colchester Bank, Connecticut.