Article Text

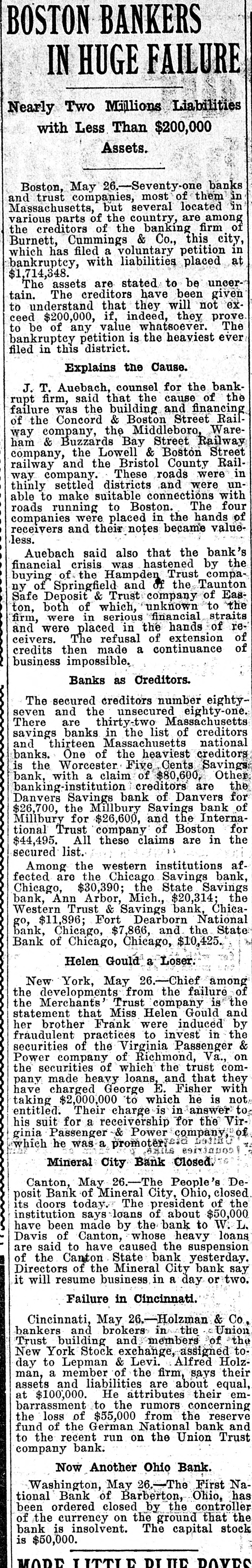

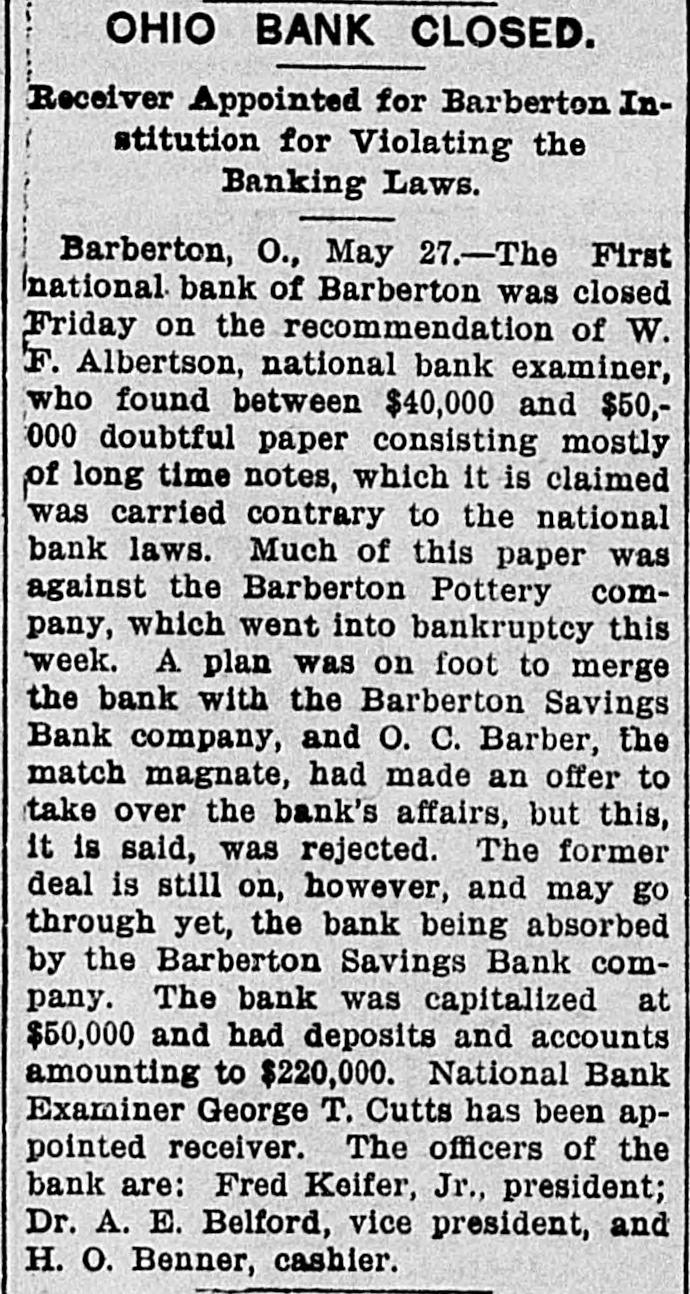

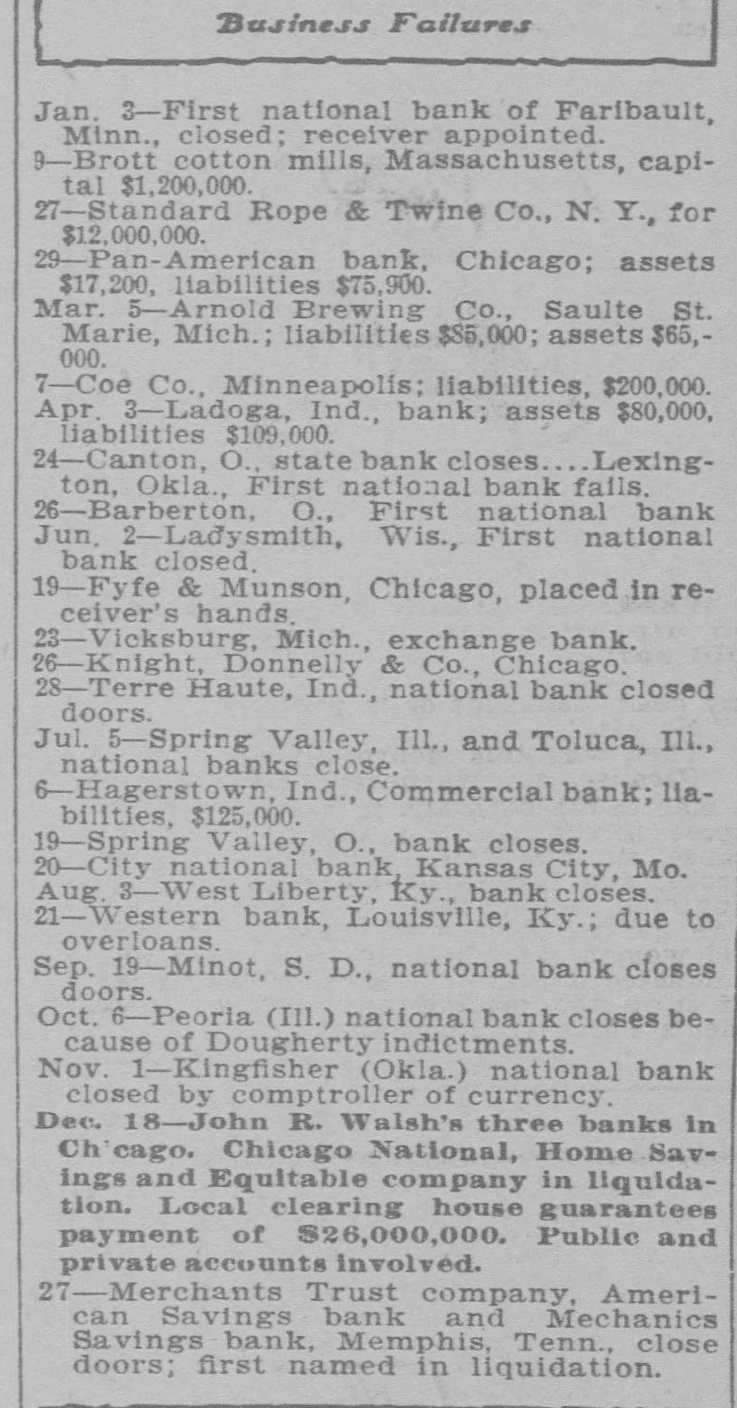

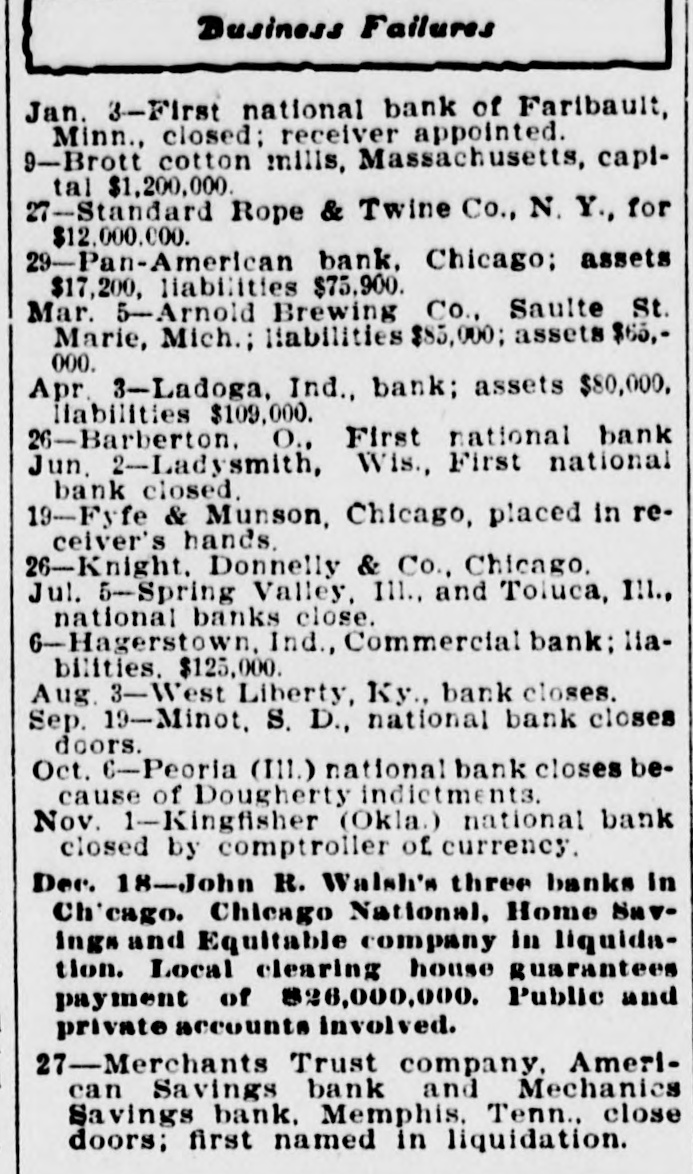

BOSTON BANKERS IN HUGE FAILURE Nearly Two Millions Liabilities with Less Than $200,000 Assets. Boston, May 26.-Seventy-one banks and trust companies, most of them in Massachusetts, but several located in various parts of the country, are among the creditors of the banking firm of Burnett, Cummings & Co., this city, which has filed a voluntary petition in bankruptcy, with liabilities placed at $1,714,348. The assets are stated to be uncertain. The creditors have been given to understand that they will not exceed $200,000, if, indeed, they prove to be of any value whatsoever. The bankruptcy petition is the heaviest ever filed in this district. Explains the Cause. J. T. Auebach, counsel for the bankrupt firm, said that the cause of the failure was the building and financing of the Concord & Boston Street Railway company, the Middleboro, Wareham & Buzzards Bay Street Railway company, the Lowell & Boston Street railway and the Bristol County Railway company. These roads were in thinly settled districts and were unable to make suitable connections with roads running to Boston. The four companies were placed in the hands of receivers and their notes became valueless. Auebach said also that the bank's financial crisis was hastened by the buying of the Hampden Trust company of Springfield and of the Taunton Safe Deposit & Trust company of Easton, both of which, unknown to the firm, were in serious financial straits and were placed in the hands of receivers. The refusal of extension of credits then made a continuance of business impossible. Banks as Creditors. The secured creditors number eightyseven and the unsecured eighty-one. There are thirty-two Massachusetts savings banks in the list of creditors and thirteen Massachusetts national banks. One of the heaviest creditors is the Worcester Five Cents Savings bank, with a claim of $80,600, Other banking-institution creditors are the Danvers Savings bank of Danvers for $26,700, the Millbury Savings bank of Millbury for $26,600, and the International Trust company of Boston for $44,495. All these claims are in the secured list. Among the western institutions affected are the Chicago Savings bank, Chicago, $30,390; the State Savings bank, Ann Arbor, Mich., $20,314; the Western Trust & Savings bank, Chicago, $11,896; Fort Dearborn National bank, Chicago, $7,866, and the State Bank of Chicago, Chicago, $10,425. Helen Gould a Loser. New York, May 26.-Chief among the developments from the failure of the Merchants' Trust company is the statement that Miss Helen Gould and her brother Frank were induced by fraudulent practices to invest in the securities of the Virginia Passenger & Power company of Richmond, Va., on the securities of which the trust company made heavy loans, and that they have charged George E. Fisher with taking $2,000,000 to which he is not entitled. Their charge is in answer to his suit for a receivership for the Virginia Passenger & Power company, of which he was a promoter. befine AMILS of Mineral City Bank Closed. Canton, May 26.-The People's Deposit Bank of Mineral City, Ohio, closed. its doors today. The president of the institution says loans of about $50,000 have been made by the bank to W. L. Davis of Canton, whose heavy loans are said to have caused the suspension of the Canton State bank yesterday. Directors of the Mineral City bank say it will resume business in a day or two. Failure in Cincinnati. Cincinnati, May 26.-Holzman & Co, bankers and brokers in the Union Trust building and members of the New York Stock exchange, assigned to. day to Lepman & Levi. Alfred Holzman, a member of the firm, says their assets and liabilities are about equal, at $100,000. He attributes their embarrassment to the rumors concerning the loss of $55,000 from the reserve fund of the German National bank and to the recent run on the Union Trust company bank. Now Another Ohio Bank. Washington, May 26.-The First National Bank of Barberton, Ohio, has been ordered closed by the controller of the currency on the ground that the bank is insolvent. The capital stock is $50,000. snn VIVDL