Article Text

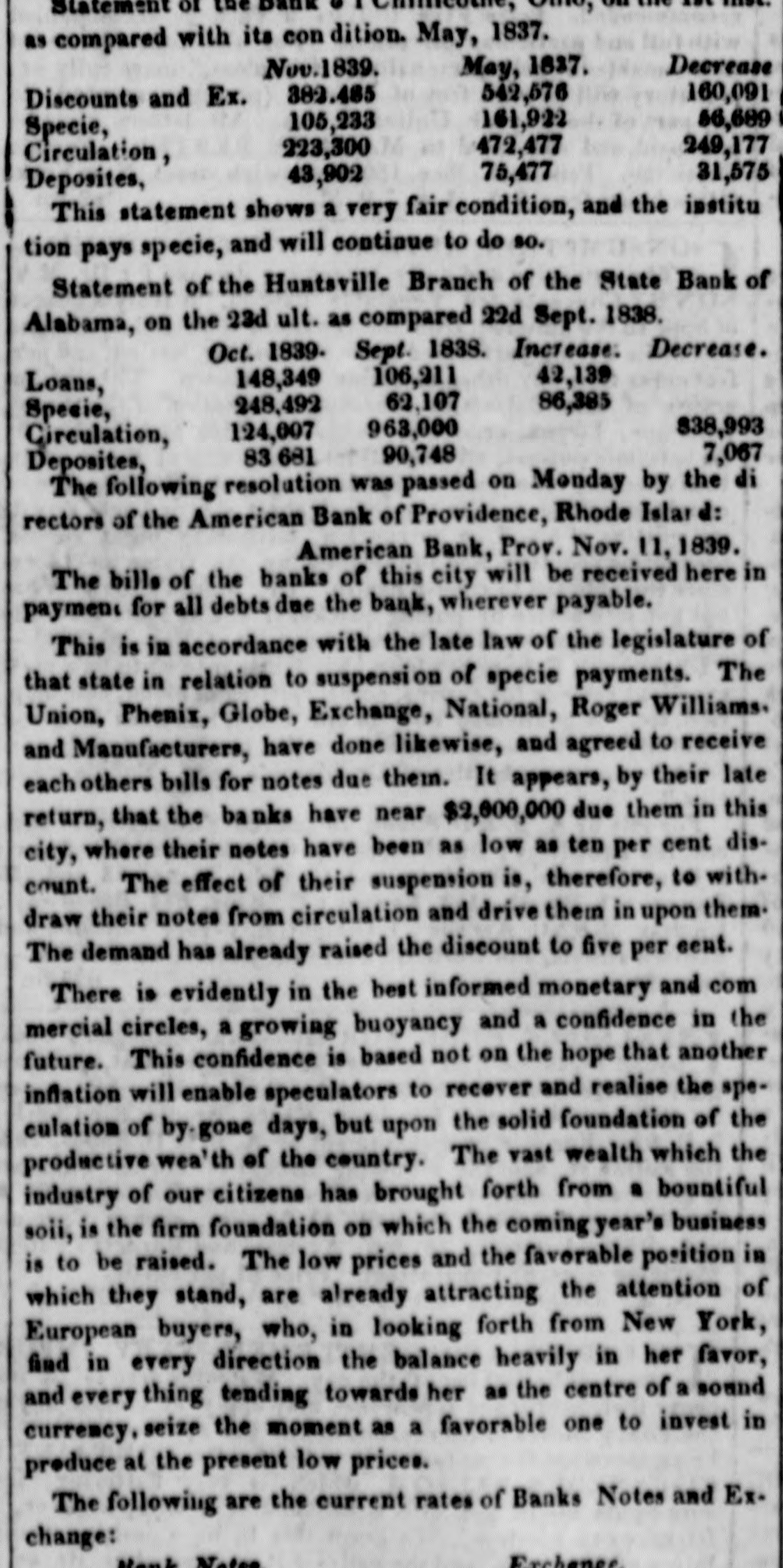

Statement or DAUK U o VLU THE UN as compared with its con dition. May, 1837. Decrease Nov.1839. May, 1837. 160,091 382.485 542,576 Discounts and Ex. 56,689 161,922 105,233 Specie, 472,477 249,177 223,300 Circulation, 31,575 75,477 43,902 Deposites, This statement shows a very fair condition, and the institu tion pays specie, and will continue to do so. Statement of the Huntsville Branch of the State Bank of Alabama, on the 23d ult. as compared 22d Sept. 1838. Oct. 1839- Sept. 1838. Increase. Decrease. 42,139 106,211 148,349 Loans, 62,107 248,492 86,385 Specie, 838,993 963,000 124,007 Circulation, 7,067 83 681 90,748 Deposites, The following resolution was passed on Monday by the di rectors of the American Bank of Providence, Rhode Islar d: American Bank, Prov. Nov. 11, 1839. The bills of the banks of this city will be received here in payment for all debts due the bank, wherever payable. This is in accordance with the late law of the legislature of that state in relation to suspension of specie payments. The Union, Phenix, Globe, Exchange, National, Roger Williams. and Manufacturers, have done likewise, and agreed to receive each others bills for notes due them. It appears, by their late return, that the banks have near $2,000,000 due them in this city, where their notes have been as low as ten per cent discount. The effect of their suspension is, therefore, to withdraw their notes from circulation and drive their in upon them. The demand has already raised the discount to five per cent. There is evidently in the best informed monetary and com mercial circles, a growing buoyancy and a confidence in the future. This confidence is based not on the hope that another inflation will enable speculators to recever and realise the speculation of by gone days, but upon the solid foundation of the productive wea'th of the country. The vast wealth which the industry of our citizens has brought forth from a bountiful soii, is the firm foundation on which the coming year's business is to be raised. The low prices and the favorable position in which they stand, are already attracting the attention of European buyers, who, in looking forth from New York, find in every direction the balance heavily in her favor, and every thing tending towards her as the centre of a sound currency. seize the moment as a favorable one to invest in produce at the present low prices. The following are the current rates of Banks Notes and Exchange: Mark Nates Erchance