Click image to open full size in new tab

Article Text

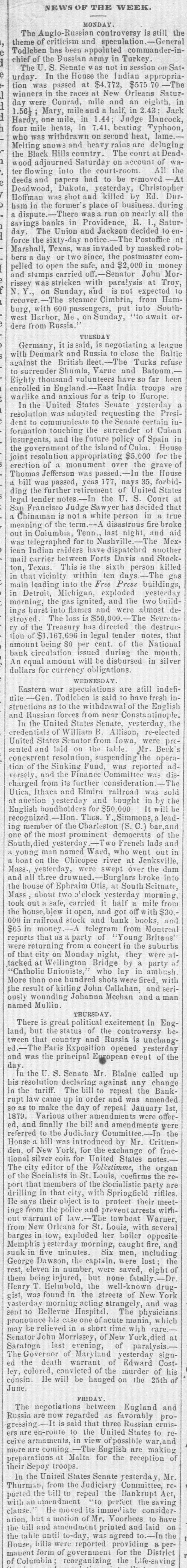

NEWS OF THE WEEK. MONDAY the The Anglo- Russian controversy is still theme of criticism and speculation Todleben has been appointed commander-in chief of the Bussian army in Turkey The U S Senate was not urday In the House the Indian tion was passed at $4 772, $575 70 winners in the races at New Orleans in day were Conrad, mile and 1.56} Mary mile and half in .43 Jack .44 one in Judge Hancock mile. Hardy 7.41. in beating Typhoon, heats, four mile who WAS withdraw on second heat, lame deluging snows Melting The court Dead Hills Black the of wood adjourned Saturday or the into the ter flowing and papers had to be Dakota, vesterday, Deadwood, killed Ed shot Durwas and Hoffman in the former place of There on run was dispute in SaturR Providence, banks savings day The Union and Jackson decided to en force the sixty -day notice The Postoffice Marshall, Texas, was invaded by masked bers day or two since, the pelled to open the safe, and $2,000 in off John carried Mor Senator and stamps rissey was stricken with paralysis Troy to on Sunday, and not expected from HamThe Cimbria, steamer burg with 600 passengers, put into South await Harbor, Me on Sunday ders from Russia TUESDAY Germany, it is said. negotiating a league with Denmark and Russia to close the Balti against the British fleet The Turks nder Shumla Varue and Batoum Eighty thousand vol unteers have so far been enrolled in England East India troops warlike and for trip to Europe. In the United States Senate was adout the resolution to the Senate dent the touching formation it insurgents, and the future policy of Spain island Cuba the House the government the resolution appropriating joint the monument of a of grave erection House Thomas Jefferson passed the 177. 35, navs a bill yeas was passed, of United States retirement the further ding U the S notes Court at tender legal Francisco Judge Saw has decided white not is person Chinaman fire of the disastrous meaning out in Columbia, Tenn last night Nashvill "he for telegraphed have dispatched another ican raiders Indian mail carrier between Forts Davis and Stock killed Texas This is the sixth person ten within The days vicinity the Free Press main leading Detroit, and the the ignited morning, into almost and flames $50,000 The the legal the Nationa amount being 80 month the bank during amount will be disbursed in silver dollars for currency obligations. WEDNESDAY still are Eastern to fresh said is nite of the and Russian forces from near In the United States B Allison William from United Mr the suspending Fund, tion the charged from its further Utica, Ithaca and Elmira a bought English bondholders for $50,000 recognized Hon Thos Simmons member of the Charleston (S. C. one of the most prominen democrats Two Frenel lads resterday South,d young named Ward. who went Chicopee river at Jenksville swept the Mass drow Burgla broke the house of Ephraim Otis, at South clock Mass esterday half it carried took out the house, open, and got off and bank stock books railroad from $65 telegran party of Young from concert in suburbs the of that city on Monda night. they tacked at Wellington Bridge by a party who ambust Unionists lay 'Catholic More than one hundred shots were fired with the result of killing John Callahar and man ously wounding Johanna Meehan and named Mullio. THURSDAY There is great political excitement in Eng land. but status of the controversy tween that country and Russia is unchange ed The Paris Exposition opened yesterday and was the principal European event of the da In the U. S. Senate Mr Blaine called up his resolution declaring zainst any change in the tariff The bill repea the Bank rupt came up in order and was amended so to make the day of repeal January 1st 1879. Various other amen dments were offer ed. and finally the bil! and amendments were the referred to the Judiciary Comm In House bill introduced by Mr Crittenden. of New York, for the exchange of fractional silver coin for United States notes The editor of the Volkstimme, the organ of the Socialists in Louis. coefirms the of the Socialistic party are with rifles Springfiel drilling to their their protect and with ings from The towboat Warner from New Orleans for St Louis ith barges in tow, exploded her boiler opposite Memph yesterday morning caught fire. and in five minutes suck men, Six including the the Dawson, lost George captain. number, saved, rest, eleven eight Dr them being injured, but none fatall the -known Henry drug gist, found in the streets of New York acting was and The Hospital ph of one acute short time with may New of York John at died Senator Morrissey of last paraly of Maryland yesterday Governor signof warrant death Edward Cost of the his of convicted cousin He will be hanged on the 25th June FRIDAY and The negotiations ween England Russia are now regarded as favorably that three Russian gressing cruis United the States of view in The English Malta for the reception their Sepoy troops In the United States Senate yesterday, Mr from the Committee the Bankrupt repeal Act the perfect its iate motion Mr Voorhees the printed and laid to agreed was to-day until providing reported verninent for the of form District Life the of