Click image to open full size in new tab

Article Text

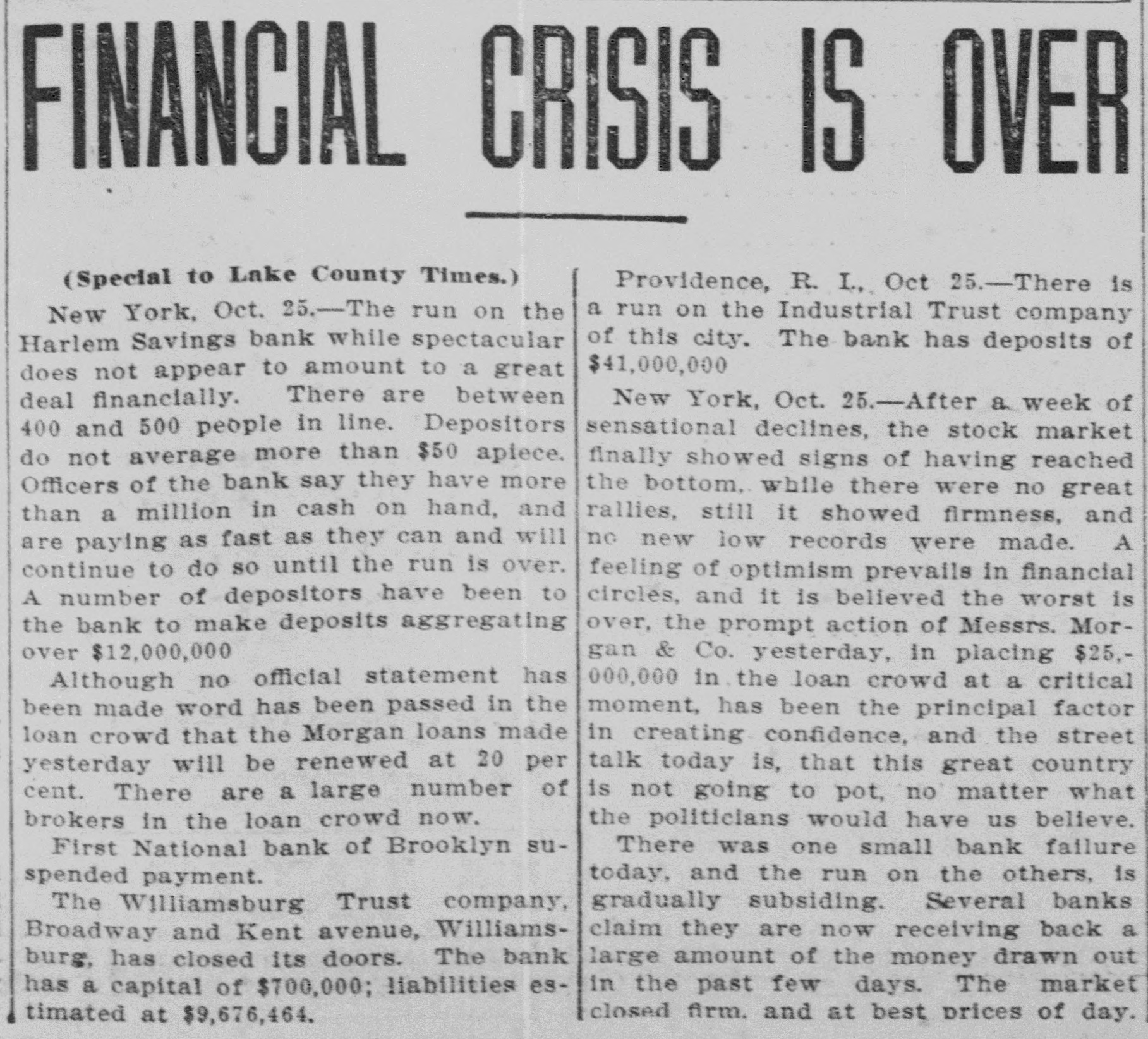

PROVIDENCE CRISIS MET After Eventful Day Banking Circles Feel Confident. Providence, R. I., Oct. 25.-Although a temporary receiver has been appointed for one trust company, another company is enforcing the rule requiring a notice of ninety days for the withdrawal of deposits and a third has withstood throughout the day an unusual drain caused by the withdrawal of deposits, it is believed generally in Providence banking circles to-night that the crisis has been met and passed successfully. The bank for which a receiver was appointed was the Union Trust Company, an institution with headquarters at Westminster and Dorrance streets, in this city, and operating branches in Olneyville, Central Falls and East Greenwich. This is the bank on which the run started yesterday noon and continued until the close of business hours. Long before the hour of opening to-day there was a long line of depositors waiting to withdraw their accounts, and it was decided by the bank officials not to open the institution. Notices were posted in the headquarters of the bank in this city and in the three branches at 9 o'clock that the bank would not open on account of the stringency of the money market. The next step was the application for a temporary receiver. The petitioner was Archibald G. Loomis, one of the vice-presidents of the institution, who in his petition alleged that the company was insolvent Justice William H. Sweetland, of the Superior Court, appointed Cornellus S. Sweetland, another vice-president of the company, temporary receiver. The New England Trust Company, with banking rooms at Westminster and Eddy streets, put into operation to-day the rule requiring all depositors to give ninety days notice of the withdrawal of deposits. The officers of the bank declined to discuss the matter, referring all inquiries to General Charles A. Wilson, the bank's counsel, who stated that, in his opinion, the company was in no condition to stand a run and that the ninety days' rule had been invoked for the protection of the bank and its depositors. According to the last report made by the New England Trust Company to the state auditor the resources of the institution were $642,884, against a capital stock of $140.000, deposits of $464,755 and undivided profits of $27,754. William R. Dunham is president of the company and William A. Taylor its vicepresident and secretary. The chief interest of the day centred, however, about the Industrial Trust Company, at Westminster and Exchange streets, one of the leading financial institutions in New England, operating nine branches throughout the state. At this bank a run was in progress throughout the day. The bank officials, fearing that the timidity of the depositors might be affected adversely by the general financial situation, were prepared for the emergency, and four paying tellers were stationed at the windows ready to pay the depositors who wished to close their accounts. The tellers worked rapidly, paid all demands and at no time during the day did the line of persons seem to grow faster than the tellers were able to care for it. The bank stood the strain successfully and when business closed at 3 o'clock there were no signs of excitement or disorder on the part of the depositors. During the day a committee of nine prominent business men of the city, in their desire to avert a panic, made an examination of the books and securities and cash of the Industrial Trust Company and its branches, and reported that the institution was in sound condition. When business closed at the Industrial Trust Company this afternoon the report of the committee of nine was read to the crowd, after which Arthur L. Kelley, one of ,the directors. addressed the depositors and told them that one person who had withdrawn his money had again deposited it, as he was satisfied that the bank was on a sound basis. He extended an offer on the part of the bank to receive any other books which depositors might care to return on condition that they also draw interest as if they had not been taken out. As a result of this announcement several persons regained their confidence and handed back their accounts. Waldo M. Place, assistant treasurer of the Industrial Trust Company, stated to-night that the bank would be open for business as usual to-morrow morning The cause for the extraordinary demands upon the three trust companies is not absolutely known, but they are believed to be due in part to the New York situation and partly to the fact that Marsden J. Perry, first vice-president of the Union Trust Company, was supposed to be closely connected with the Trust Company of America, the New York institution on which such unusual demands have been made for the last few days. In a statement late to-day Mr. Perry said that the situation seemed very encouraging and that he was confident that the bank would be reopened. He said, however, that he could not