Article Text

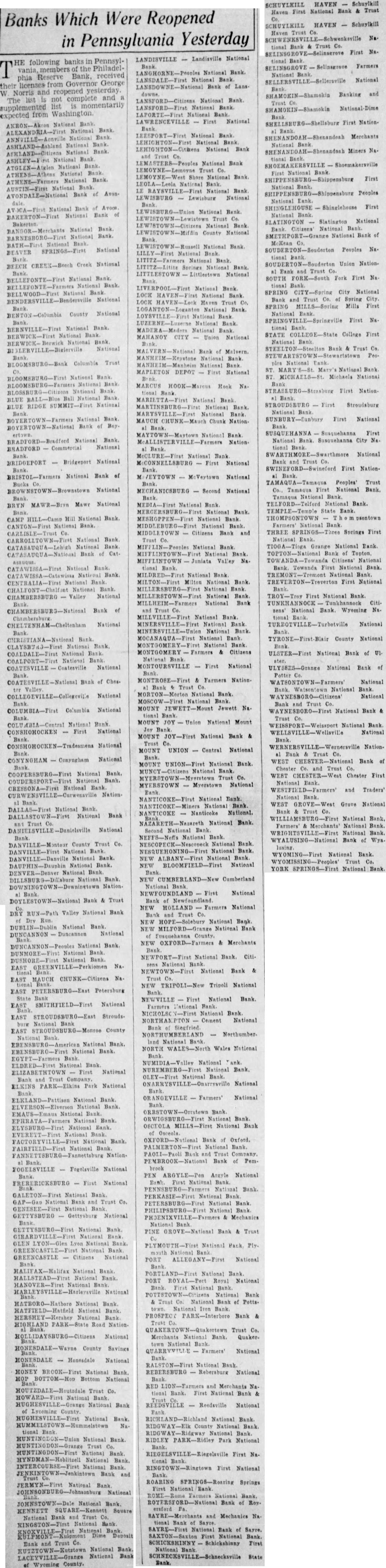

Banks Which Were Reopened in Pennsylvania Yesterday following banks in PennsylTHE members the PhiladelReserve Bank, received their phia licenses Governor George Norris and reopened yesterday. and The not list momentarily supplemented expected from Washington. National Bank National Bank National Bank National Bank. ASHLEY-First National Bank. ATGLEN-Atglen National Bank. National National Bank Bank National Bank National Bank National Bank National National BEAVER CREEK-Beech Creek National BEECH National Bank. Bank National Bank National County National National Bank. Columbia Trust National Bank National BLUE Bank. BLUE RIDGE SUMMIT-First National National Bank BOYERTOWN-National Bank Boy. National Bank. BRADFORD National BRIDGEPORT Bridgeport National National Bank of National BRYN MAWR-Bryn Mawr National National Bank. National Bank Bank Bank of CATAWISSA-First Bank National Bank. CENTRALIA-First National National Bank CHAMBERSBURG Valley National Bank of National Bank COALDALE-First National COALPORT-First National National COATESVILLE-National of Ches. National COLUMBIA-First Columbia National National Bank CONSHOHOCKEN First National National CONYNGHAM National National Bank. National Bank. CRESSONA-First National Bank Nation National Bank DALLASTOWN-First National Bank National County Trust Co. National National Bank DAUPHIN-Dauphin National DENVER-Denver National Bank. DOYLESTOWN-National Bank Trust DRY RUN-Path Valley National Bank DUBLIN-Dublin National Bank DUNCANNON National National Bank. DUNMORE-First National Bank DUSHORE-First Bank. Na. EAST CHUNK-Citizens Na. Petersburg SMITHFIELD-First National National EAST County National National Bank. National Bank ELDRED-First Bank ELIZABETHTOWN First National Bank ELKINS PARK-Elkins Park National National Bank. National Bank. National National Bank. National National Bank. FAIRFIELD-First National Bank Nation FOGELSVILLE Fogelaville National First National Bank Bank Trust Co. National GETTYSBURG Gettysburg National National Bank National GREENCASTLE Citizens National National Bank. National Bank National National National Bank. National National HIGHLAND PARK-State Road Nation National County Savings HONESDALE Honesdale National HONEY BROOK-First Bank National Trust Co. National Bank National Bank tional Bank. Trust National Bank National Bank. National Bank. Bank and JERMYN-First National National National Bank. KENNETT Square National Bank and Trust National Bank and Trust National Bank National Bank Wyoming County. LANDISVILLE Landisville National National Bank LANSDALE-First Bank Bank of National Bank LAPORTE-First LAWRENCEVILLE First National National Bank. LEHIGHTON-First National National Bank Trust National Bank Trust Shore National Bank National National Bank LEWISBURG Lewisburg National National Bank Trust National Bank LEWISTOWN-Mifdin County National National Bank National Bank. National Bank Bank. LITTLESTOWN National National Bank. LOCK National Bank HAVEN-Lock Haven Trust Co. National Bank National MAHANOY CITY Union National MANHEIM-Keystone National National Bank MAPLETON DEPOT First National MARCUS HOOK-Marcus Hook Na. National Bank National Bank National Bank. MAUCH Chunk Nation. National National Bank McCONNELLSBURG First National McVeytown National MECHANICSBURG Second National National Bank National Bank. MESHOPPEN-First National Bank. National Bank Citizens Bank and Trust National Bank Bank. Valley Na. National Bank MILTON-First National Bank. National National Bank. National Bank National Bank. National Bank MINERSVILLE-Union National Bank National Citizens National MONTOURSVILLE First National Farmers Nation National Bank. MOUNT JEWETT-Mount Jewett Na. tional Bank MOUNT National Mount MOUNT JOY-First National Bank & MOUNT UNION Central National Bank. MOUNT UNION-First National Bank. Trust Co. MYERSTOWN Myerstown National National Bank. Bank. NANTICOKE Nanticoke National. National Bank. Second National Bank National Bank National Bank National Bank. NEW Bank BLOOMFIELD-First National NEW Cumberland National NEWFOUNDLAND First National Bank NEW HOLLAND Farmers National Trust NEW HOPE-Solebury National Bank. MILFORD-Grange National Bank Eusquehanna County. NEW OXFORD-Farmers Merchants National Bank. CitiNational NEWTOWN-First National Bank & Trust NEW TRIPOLI-New Tripoli National NEWVILLE National Bank Farmers Bank. National Bank. Cement National NORTHUMBERLAND NORTH WALES-North Wales National Bank NUMIDIA-Valley National Tank National Bank. National Farmers' National Bank OSCEOLA MILLS-First National Bank National Bank. Bank of PEN ARGYLE-Pen Argyle National Bank First National Bank. National Bank National Bank National Bank Mechanics National PINE GROVE-National Bank Trust PORT ALLEGANY-First National National Bank ROYAL-Port National National National Bank National Bank Potts. PROSPECT PARK-Interboro Bank & Trust Co. Merchants National Bank Quaker. National Farmers' National National Bank REBERSBURG Rebersburg National RED Merchants Na. tional Bank. National Bank Reedsville National National Bank. RIDGWAY-Elk County National Bank Bank. RIDLEY PARK-Ridley Park National First Na. tional First National Bank. ROARING SPRINGS-Roaring Springs National Bank, Bank of Roy. and Mechanics Na. National Bank SAXTON-Saxton First National Bank. Schickshinny First National State Bank. SCHUYLKILL HAVEN Schuylkill First Bank Trust Haven HAVEN Schuylkill SCHUYLKILL Trust Co. First tional SELINSGROVE Farmers National Banking and Merchants National Bank Miners Na. National First National Peoples First SLATINGTON Slatington National Bank. Citizens' National National Bank Peoples Na. Union NationSOUTH FORK-South Fork First Na SPRING City National SPRING Mills First National First Na STATE College First Bank Trust Co. PeoNational National Bank MICHAELS-St. Michaels National First Nation STROUDSBURG First Stroudsburg National National First National Bank. City Na. National Trust First Nation. Peoples' Trust Tamaqua First National Bank. Bank. National Bank. TEMPLE-Temple State THOMPSONTOWN Farmers' National Bank THREE Springs First National National Bank. Bank. Towanda First National Bank National First National First National Bank National Bank Wyoming NaNational ULSTER-First National Bank of U1. ULYSSES-Granse National Bank of National Watsontown National Trust National Bank Trust National Bank. Nation WEST Bank of Trust WEST CHESTER-West Chester First National and Traders' WEST GROVE-West Grove National National Bank Farmers' Merchants' National Bank. National Bank. WYALUSING-National Bank Wya. WYOMING-First National Bank. Trust YORK SPRINGS-First National Bank.