Article Text

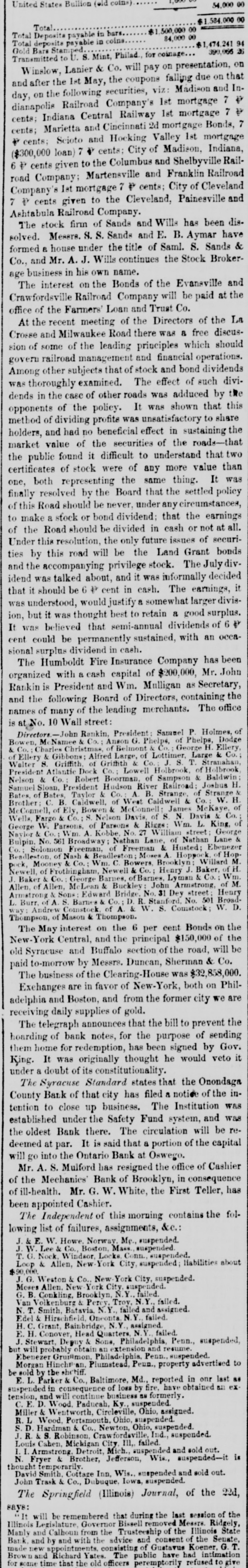

United States Bullion (old coins) 54,000 00 00 Total 00 Total Deposits payable in hars. 84,000 00 94 Total deposits payable in coins $1,474,241 Gold Bars Stamped. 26 Transmitted to U. S. Mint, Philad., for coinage 390,066 Vinslow, Lanier & Co. will pay on presentation, on and after the 1st May, the coupons falling due on that day, on the following securities, viz: Madison and Indianapolis Railroad Company's 1st mortgage 7 P cents; Indiana Central Railway 1st mortgage 7 P cents; Marietta and Cincinnati 2d mortgage Bonds, 7 P cents; Scioto and Hocking Valley 1st mortgage ($300,000 loan) 7 + cents: City of Madison, Indiana, 6 P cents given to the Columbus and Shelbyville Railroad Company; Martensville and Franklin Railroad Company's 1st mortgage 7 P cents; City of Cleveland 7 P cents given to the Cleveland, Painesville and Ashtabula Railroad Company. The stock firm of Sands and Wills has been dissolved. Messrs. S. S. Sands and E. B. Aymar have formed a house under the title of Saml. S. Sands & Co., and Mr. A. J. Wills continues the Stock Brokerage business in his own name. The interest on the Bonds of the Evansville and Crawfordsville Railroad Company will be paid at the office of the Farmers' Loan and Trust Co. At the recent meeting of the Directors of the La Crosse and Milwaukee Road there was a free discussion of some of the leading principles which should govern railroad management and financial operations. Among other subjects that of stock and bond dividends was thoroughly examined. The effect of such dividends in the case of other roads was adduced by the opponents of the policy. It was shown that this method of dividing profits was unsatisfactory to share holders, and had no beneficial effect in sustaining the market value of the securities of the roads-that the public found it difficult to understand that two certificates of stock were of any more value than one, both representing the same thing. It was finally resolved by the Board that the settled policy of this Road should be never, under any circumstances, to make a stock or bond dividend: that the earnings of the Road should be divided in cash or not at all. Under this resolution, the only future issues of securities by this road will be the Land Grant bonds and the accompanying privilege stock. The July dividend was talked about, and it was informally decided that it should be 6 P cent in cash. The earnings, it was understood, would justify a somewhat larger division, but it was thought best to retain a good surplus. It was believed that semi-annual dividends of 6 P cent could be permanently sustained, with an occasional surplus dividend in cash. The Humboldt Fire Insurance Company has been organized with a cash capital of $200,000, Mr. John Rankin is President and Wm. Mulligan as Secretary, and the following Board of Directors, containing the names of many of the leading merchants. The office is at No. 10 Wall street: Directors Rankin, President: Samuel P. Holmes, of Bowen. Namee & Co.; Anson G. Phelps, of Phelps, Dodge & Co. harles Christmas, of Belmont & Co.: George H. Ellery, of Ellery & Gibbons: Alfred Large, of Lottimer, Large & Co.; Walter S. Griffith, of Griffith & Co.: T. Stranahan, President Atlantic Dock Co.; Lowell Holbrook, of Holbrook Nelson & Co.: Robert Boorman, of Sampson & Baldwin: Samuel Sloan, President Hudson River Railroad: Joshua H. Bates of Bates, Taylor & Co. B. Strange, of Strange Brother: C. B. Caldwell, of West Caldwell & Co. W. H 4cConnell, of Ely, Bowen & McConnell; James McKaye, of Wells. Fargo Co.: Nelson Davis, of S. N. Davis & Co. George W. Parsons, of Parsons & Riggs: Wm. L. King, of Naylor & Co. Wm. A. Kobbe No. 27 William street: George Bulpin. No. 361 Broadway; Nathan Lane, of Nathan Lane & Co.: Solomon Freeman, of Freeman & Husted; Ebenezer Beadleston. of Nash & Beadleston; Moses A. Hoppoel of Hoppock, Mooney & Co.: Wm. C. Bowers, Brooklyn: Willard M. Newell, of Frothingham, Newell & Co.; Henry J. Baker, of H. J. Baker & Co. George Barnes, of Barnes, Lyman & Co.: Wm. Allen, of Allen, -Lean & Buckley John Armstrong, of M. Armstrong & Sons: Edward Bridge, No. 31 Dey street Henry L. Burr. of A S. Barnes & Co.: D. R. Stanford, No. 501 Broadway: Andrew Comstock of A & W. S. Comstock; W. D. Thompson, of Mason & Thompson. The May interest on the 6 per cent Bonds on the New-York Central, and the principal $150,000 of the old Syracuse and Buffalo section of the road, will be paid to-morrow by Messrs. Duncan, Sherman & Co. The business of the Clearing-House was $32,858,000. Exchanges are in favor of New-York, both on Philadelphia and Boston, and from the former city we are receiving daily supplies of gold. The telegraph announces that the bill to prevent the hoarding of bank notes, for the purpose of sending them home for redemption, has been signed by Gov. King. It was originally thought he would veto it under a doubt of its constitutionality. The Syracuse Standard states that the Onondaga County Bank of that city has filed a notice of the intention to close up business. The Institution was established under the Safety Fund system, and was the oldest Bank there. The circulation will be redeemed at par. It is said that a portion of the capital will go into the Ontario Bank at Oswego. Mr. A. S. Mulford has resigned the office of Cashier of the Mechanics' Bank of Brooklyn, in consequence of ill-health. Mr. G. W. White, the First Teller, has been appointed Cashier. The Independent of this morning contains the following list of failures, assignments, &c.: J. &E. W. Howe, Norway, Me., suspended. J. W. Lee & Co., Boston, Mass. suspended T. G. Nock, Windsor, Locks Conn. suspended. $90,000. Loop & Allen, New York City, suspended; liabilities about J. G. Weston & Co., New York City, suspended. Moses Allen. New York City, suspended. G. B. Conkling, Brooklyn, N.Y., failed. Van olkenburg & Percy, Troy, N.Y., failed. N.T. Smith, Batavia. N.Y., failed and assigned. Edel & Hirschfield. Oneonta N.Y., failed. H.C. Grant, Bainbridge, N.Y., assigned. E. H. Conover, Head Quarters, N.Y. failed. J. Stewart. Depuy & Sons, Philadelphia, Penn., suspended, but will probably obtain an extension and resume. Ebenezer Gruitmon, Philadelphia, Penn., suspended. Morgan Hinchrea Plumstead, Penn., property advertised to be sold by the shetiff. E.L. Parker & Co., Baltimore, Md., reported in our last as suspended in consequence of loss by fire, have obtained an extension, and will continue business as formerly. C.E. D. Wood. Paducah. Ky., suspended. Miller & Wentworth, Circleville, Ohio, assigned. R.L Wood, Portsmouth, Ohio, suspended S.D. Hardman & Co., Newton, Ohio, suspended. J.R. & S. Robinson, Crawfordsville, Ind., suspended. Louis Cahen, Michigan City, III,, failed. I.I. Armstrong. Detroit, Mich., suspended and sold out. N. Fryer & Brother, Jefferson, Wis., suspended-it is thought temporarily. David Smith. Cottage Inn. Wis. suspended and sold out. John Trask & Co., Dubuque, Iowa, suspended. The Springfield (Illinois) Journal, of the 22d, says: "It will be remembered that during the last session of the Illinois Legislature Governor Bissell removed Messrs. Ridgely, Manly and Calhoun from the Trusteeship of the Illinois State Bank and by and with the advice and consent of the Senate, made new appointments, consisting of Gustavus Koener, G.T. Brown and Richard Yates. The public have had intimation for some time that the old officers peremptorily refused to give