Article Text

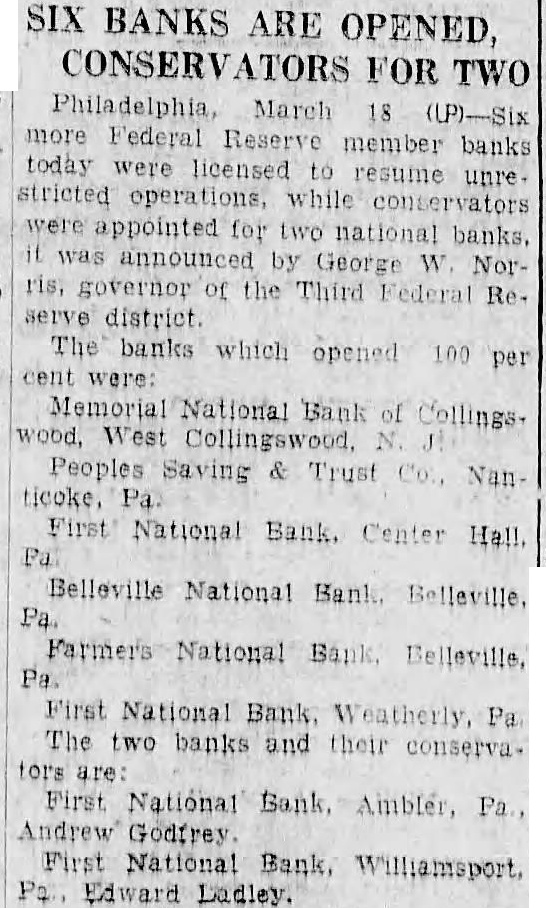

SIX BANKS ARE OPENED, FOR TWO Philadelphia, March 18 more Federal Reserve member banks today were licensed resume unre stricted operations, conservators were appointed for two national banks. was announced by George Norris, governor the Third Federal ReThe banks which opened 100 per cent were: Bank of wood, West Peoples Saving Trust NanFirst National Bank. Center Hall. Belleville National Bank. Belleville, Bank Belleville, Pa. First National Bank Weatherly, Pa The two banks and their are First National Bank Ambler, Andrew First National Bank, Williamsport, Edward Ladley.