Click image to open full size in new tab

Article Text

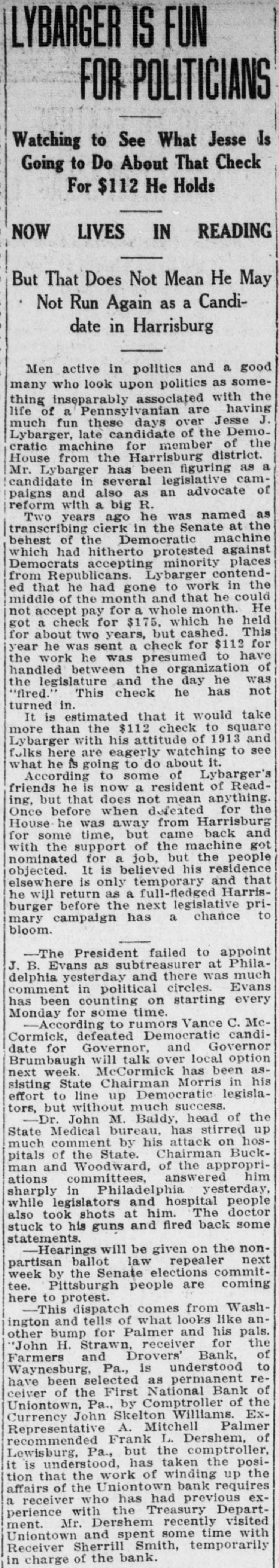

LYBARGER IS FUN FOR POLITICIANS Watching to See What Jesse Is Going to Do About That Check For $112 He Holds READING IN LIVES NOW But That Does Not Mean He May Not Run Again as a Candidate in Harrisburg Men active in politics and a good many who look upon politics as something inseparably associated with the life of a Pennsylvanian are having much fun these days over Jesse J. Lybarger, late candidate of the Democratic machine for member of the House from the Harrisburg district. Mr. Lybarger has been figuring as a candidate in several legislative campaigns and also as an advocate of reform with a big R. Two years ago he was named as transcribing cierk in the Senate at the behest of the Democratic machine which had hitherto protested against Democrats accepting minority places from Republicans. Lybarger contended that he had gone to work in the middle of the month and that he could not accept pay for a whole month. He got a check for $175, which he held for about two years, but cashed. This year he was sent a check for $112 for the work he was presumed to have handled between the organization of the legislature and the day he was "fired." This check he has not turned in. It is estimated that it would take more than the $112 check to square Lybarger with his attitude of 1913 and folks here are eagerly watching to see what he is going to do about it. According to some of Lybarger's friends he is now a resident of Reading, but that does not mean anything. Once before when defeated for the House he was away from Harrisburg for some time, but came back and with the support of the machine got nominated for a job, but the people objected. It is believed his residence elsewhere is only temporary and that he will return as a full-fledged Harrisburger before the next legislative primary campaign has a chance to bloom. -The President failed to appoint J. B. Evans as subtreasurer at Philadelphia yesterday and there was much comment in political circles. Evans has been counting on starting every Monday for some time. According to rumors Vance C. McCormick, defeated Democratic candidate for Governor, and Governor Brumbaugh will talk over local option next week. McCormick has been assisting State Chairman Morris in his effort to line up Democratic legislators, but without much success. -Dr. John M. Baldy, head of the State Medical bureau, has stirred up much comment by his attack on hospitals of the State. Chairman Buckman and Woodward, of the appropriations committees, answered him sharply in Philadelphia yesterday, while legislators and hospital people also took shots at him. The doctor stuck to his guns and fired back some statements. -Hearings will be given on the nonpartisan ballot law repealer next week by the Senate elections committee. Pittsburgh people are coming here to protest. -This dispatch comes from Washington and tells of what looks like another bump for Palmer and his pals. "John H. Strawn, receiver for the Farmers and Drovers' Bank, of Waynesburg, Pa., is understood to have been selected as permanent receiver of the First National Bank of Uniontown, Pa., by Comptroller of the Currency John Skelton Williams. ExRepresentative A. Mitchell Palmer recommended Frank L. Dershem, of Lewisburg, Pa., but the comptroller, it is understood, has taken the position that the work of winding up the affairs of the Uniontown bank requires a receiver who has had previous experience with the Treasury Department. Mr. Dershem recently visited Uniontown and spent some time with Receiver Sherrill Smith, temporarily