Article Text

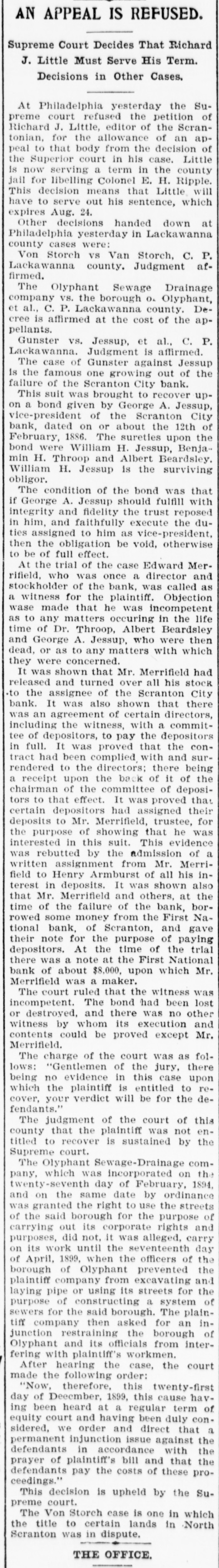

# AN APPEAL IS REFUSED. Supreme Court Decides That Richard J. Little Must Serve His Term. Decisions in Other Cases, At Philadelphia yesterday the Su- preme court refused the petition of Richard J. Little, editor of the Scran- tonian, for the allowance of an ap- peal to that body from the decision of the Superior court in his case. Little is now serving a term in the county jail for libelling Colonel E. H. Ripple. This decision means that Little will have to serve out his sentence, which expires Aug. 24. Other decisions handed down at Philadelphia yesterday in Lackawanna county cases were: Von Storch vs Van Storch, C. P. Lackawanna county. Judgment af- firmed. The Olyphant Sewage Drainage company vs. the borough o. Olyphant, et al., C. P. Lackawanna county. De- cree is affirmed at the cost of the ap- pellants. Gunster vs. Jessup, et al., C. P. Lackawanna. Judgment is affirmed. The case of Gunster against Jessup Is the famous one growing out of the failure of the Scranton City bank. This suit was brought to recover up- on a bond given by George A. Jessup, vice-president of the Scranton City bank, dated on or about the 12th of February, 1886. The sureties upon the bond were William H. Jessup, Benja- min H. Throop and Albert Beardsley. William H. Jessup is the surviving obligor. The condition of the bond was that if George A. Jessup should fulfill with integrity and fidelity the trust reposed in him, and faithfully execute the du- ties assigned to him as vice-president, then the obligation be void, otherwise to be of full effect. At the trial of the case Edward Mer- rifield, who was once a director and stockholder of the bank, was called as a witness for the plaintiff. Objection wase made that he was incompetent as to any matters occuring in the life time of Dr. Throop, Albert Beardsley and George A. Jessup, who were then dead, or as to any matters with which they were concerned. It was shown that Mr. Merrifield had released and turned over all his stock to the assignee of the Scranton City bank. It was also shown that there was an agreement of certain directors, including the witness, with a commit- tee of depositors, to pay the depositors in full. It was proved that the con- tract had been complied with and sur- rendered to the directors; there being a receipt upon the back of it of the chairman of the committee of deposi- tors to that effect. It was proved that certain depositors had assigned their deposits to Mr. Merrifield, trustee, for the purpose of showing that he was interested in this suit. This evidence was rebutted by the admission of a written assignment from Mr. Merri- field to Henry Armburst of all his in- terest in deposits. It was shown also that Mr. Merrifield and others, at the time of the failure of the bank, bor- rowed some money from the First Na- tional bank, of Scranton, and gave their note for the purpose of paying depositors. At the time of the trial there was a note at the First National bank of about $8,000, upon which Mr. Merrifield was a maker. The court ruled that the witness was incompetent. The bond had been lost or destroyed, and there was no other witness by whom its execution and contents could be proved except Mr. Merrifield. The charge of the court was as fol- lows: "Gentlemen of the jury, there being no evidence in this case upon which the plaintiff is entitled to re- cover, your verdict will be for the de- fendants." The judgment of the court of this county that the plaintiff was not en- titled to recover is sustained by the Supreme court. The Olyphant Sewage-Drainage com- pany, which was incorporated on the twenty-seventh day of February, 1894, and on the same date by ordinance was granted the right to use the streets of the said borough for the purpose of carrying out its corporate rights and purposes, did not, it was alleged, carry on its work until the seventeenth day of April, 1899, when the officers of the borough of Olyphant prevented the plaintiff company from excavating and laying pipe or using its streets for the purpose of constructing a system of sewers for the said borough. The plain- tiff company then asked for an in- junction restraining the borough of Olyphant and its officials from inter- fering with plaintiff's workmen. After hearing the case, the court made the following order: "Now, therefore, this twenty-first day of Deecmber, 1899, this cause hav- ing been heard at a regular term of equity court and having been duly con- sidered, we order and direct that a permanent injunction issue against the defendants in accordance with the prayer of plaintiff's bill and that the defendants pay the costs of these pro- ceedings." This decision is upheld by the Su- preme court. The Von Storch case is one in which the title to certain lands in North Scranton was in dispute. THE OFFICE.