Article Text

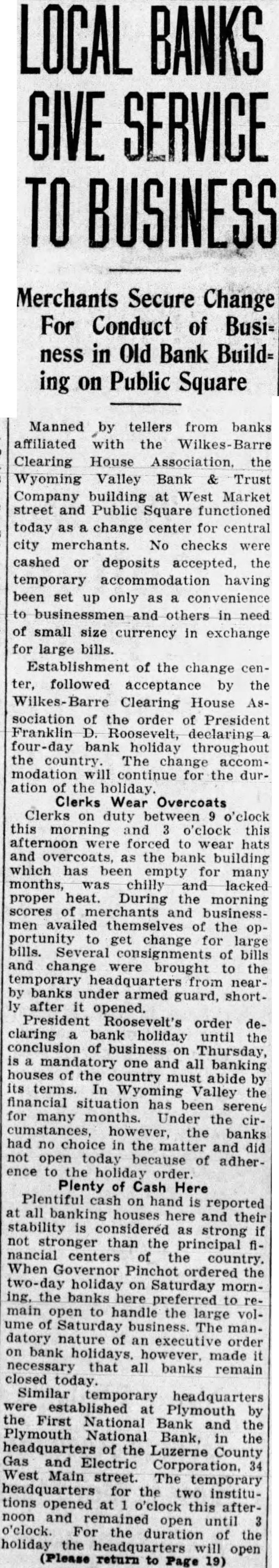

LOCAL BANKS GIVE SERVICE BUSINESS Merchants Secure Change For Conduct of Busi= ness in Old Bank Build= ing on Public Square Manned by tellers from banks affiliated with the Wilkes Barre Clearing House Association. the Wyoming Valley Bank & Trust Company building West Market street and Public Square functioned today as change center for central city merchants. checks cashed or deposits accepted, the temporary accommodation having been set up only as convenience to businessmen and others in need of small size currency in exchange for large Establishment of the change center, followed acceptance by the Wilkes- Clearing House Association the order of President Franklin Roosevelt, declaring bank holiday throughout the country. The accomwill continue for the duration the holiday Clerks Wear Overcoats Clerks on duty between o'clock this morning and o'clock this afternoon were forced to wear hats and overcoats, as the bank building which has been empty for many months, chilly and lacked proper heat. During the morning scores of and businessmen availed themselves of the portunity get change for large bills. Several consignments of bills and change were brought to the temporary nearby banks under armed guard, shortafter opened. President Roosevelt's order declaring bank holiday until the conclusion of business Thursday, is mandatory one and all banking houses of the country must abide by its terms. In Valley the financial situation has for many months. Under the cumstances, however, the had no choice in the and did not open today because of adherence holiday order Plenty of Cash Here on is reported at all here and their stability considered as strong not stronger than the principal nancial centers the country. When Governor Pinchot ordered the two-day holiday Saturday morning. the banks here preferred to main open to handle the large volume Saturday business. The mandatory nature of an executive order on bank holidays made necessary that all banks remain closed today Similar temporary headquarters were established at Plymouth the First National Bank and Plymouth National Bank, the the Luzerne County Gas and Electric Corporation, 34 West Main street. The temporary headquarters for the institutions opened o'clock this afternoon and remained open until o'clock. For the duration the holiday the headquarters will open (Please return to Page 19)