Article Text

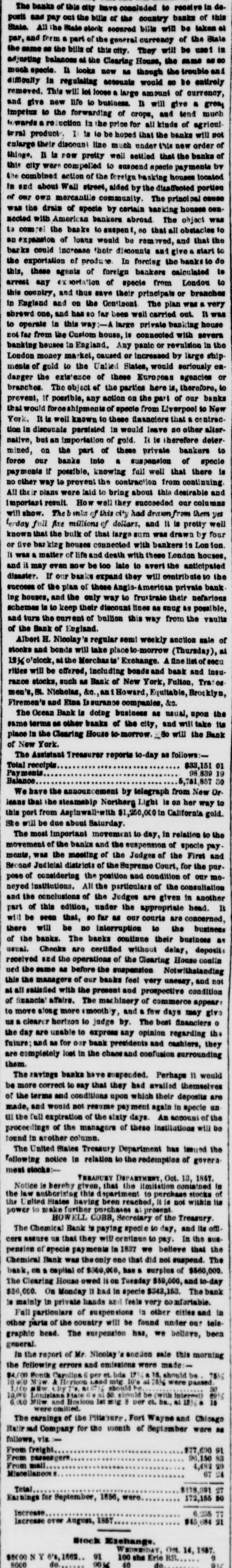

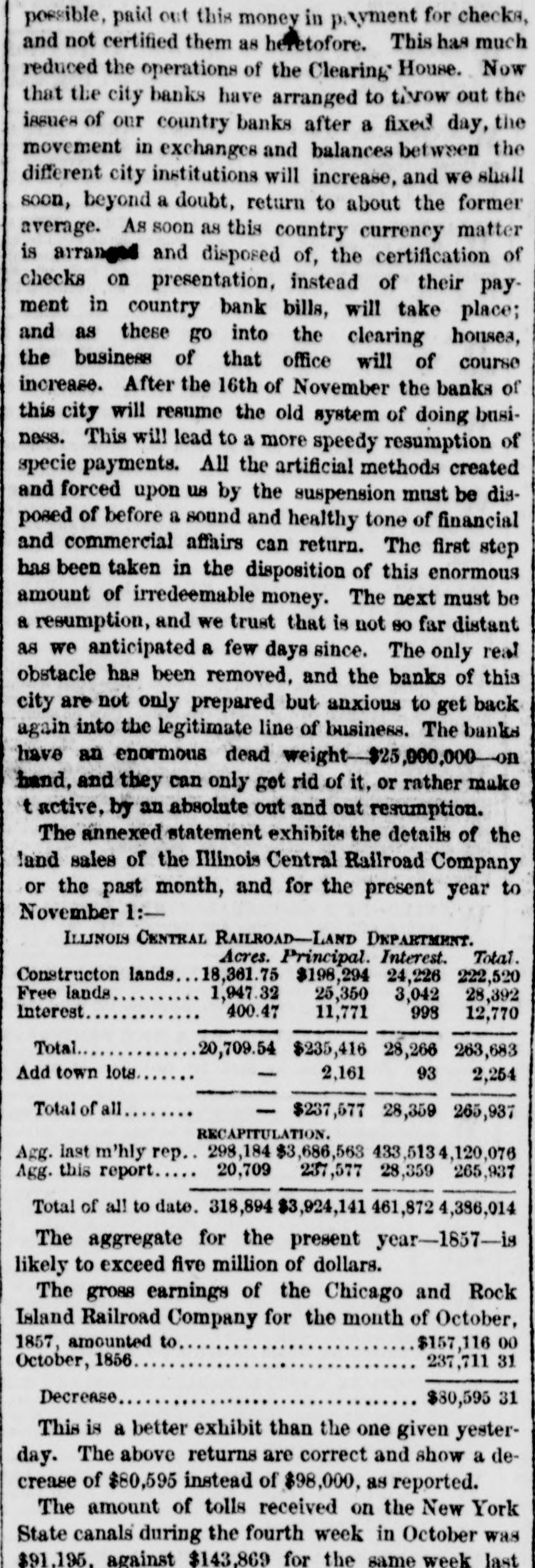

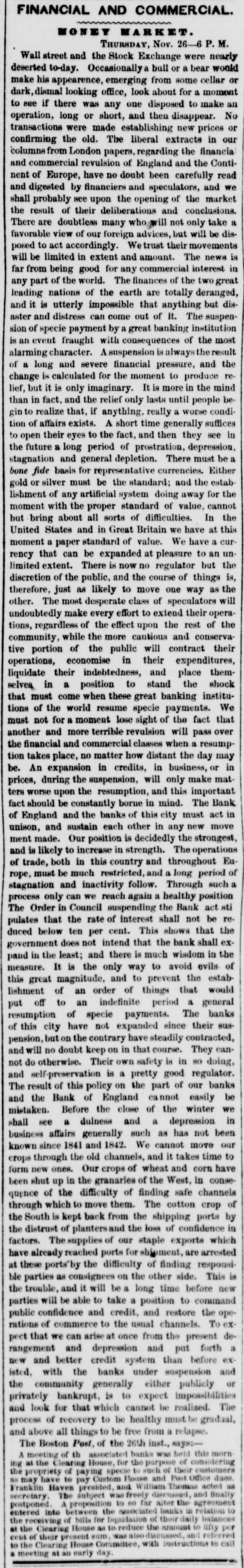

State. All the State stock secured bills will be taken at par, and form a part of the general currency of the State the same - the bills of this city. They will be use 1 in adjusting balances at the Clearing House, the same as so much specie. It looks now as though the trouble and difficulty in regulating accounts would so be entirely removed. This will let loose large amount of currency, and give new life to business. It will give a great impetus to the forwarding of crops, and tend much towards a reduction in he price for all kinds of agricul tryal product I is to be hoped that the banks will not enlarge their discount line much under this new order of things. It is now pretty well settled that the banks of this city were compelled to suspend specie payments by the combined action of the foreign backing houses located in and about Wall street, alded by the disaffected portion of our own mercantile community. The princip cause was the drain of specie by certain backing houses cenmeeted with American bankers abroad The object was to comrel the banks to suspent, 60 that all obstacles to an expansion of loans would be removed, and that the barks could increase their discounts and give & start to the exportation of produce In forcing the banks to do this, these agents of foreign bankers calculated to arrest any exportation of specie from London to this country, and thus save their principals or branches in England and on the Continent The plan was a very sbrewd one, and has so far been well carried out. It was to operate in this way :-A large private banking house not far from the Custom house, is connected with severa banking heuses in England, Any panic or revulsion in the London money market, caused or increased by large shipments of gold to the United States, would seriously emdanger the existence of these Europeas agencies or branches. The object of the parties here is, therefore, to prevent, If possible, any action on the part of our banks that would shipments of specie from Liverpool to New York, It is well known to these disanciers that a centrac. tion in discounts persisted in would leave no other alternative, but an importation of gold. It is herefore deter. mined, on the part of these private bankers to force our banks into a suspension of specie payments if possible, knowing fall well that there is no other way to prevent the contraction from continuing All their plans were laid to bring about this desirable and important result. How well they succeeded our columns will show. The walcs of this city had drawnfrom them yes terday full five millions of dollars. and It is pretty well known that the bulk of that large sum was drawn by four or five bar king houses connected with bankers in Lon ion. It was a matter of life and death with these London houses, and it may even now be too late to avert the anticipated disaster. If our banks expand they will contribute to the success of the plan of these Anglo- American private bank ing houses, and the only way to fruitrate their nefarious schemes is to keep their discount lines as snug as possible. and turn the current of bullion this way from the vaults of the Bank of England. Albert H. Nicolay's regular semi weekly anotion sale of stocks and bonds will take e to-morrow (Thursday), at 19½ o'cleck, at the Merchaz Exchange. A fine list of secu rities will be offered, including bonds and bank and Insuracce stocks, such as Bank of New York, Fulton, Trates men's, St. Nicholas, &c., an Howard, Equitable, Brocklyn, Firemen's and Etna surance companies, &o. The Ocean Bank is doing business as usual, upon the same terms as other banks of the city, and will take its place in the Clearing House to-morrow. So will the Bank of New York. The Assistant Treasurer reports to-day as follows:Total receipts $33,151 01 Payments 98 839 19 Balance 5,761 30 We have the announcement by telegraph from New Or. leans that the steamsbip Northerg Light is on her way to this port from Aspinwall-with $1,250,000 in California gold. She will be due about Saturday. The most important movement to day, in relation to the movement of the banks and the suspension of specie pay. ments, was the meeting of the Judges of the First and Second Judicial districts of the Supreme Court, for the pur. pose of considering the position and condition of our moneyed Institutions. All the particulars of the consultation and the conclusions of the Judges are given in another part of this edition, under the appropriate head. It will be seen that, so far as our courts are concerned, there will be no interruption to the business of the banks. The banks continue their business as usual. Checks are certified without delay, deposits received and the operations of the Clearing House contin ued the same as before the suspension Netwithstanding this the managers of our banks feel very uneasy, and not at all satisfied with the present and prospective condition of financial affairs. The machinery of commerce appear to move along more smoothly, and a few days may give us a clearer horizon to judge by. The best financiers 0 the day are unable to express any opinion regarding the future; and as for OUR bank presidents and cashiers, they are completely lost in the chaos and confusion surrounding them. The savings banks have suspended. Perhaps 11 would be more correct to say that they had availed themselves of the terms and conditions upon which their deposits are made, and would not resume pay ment again in specie un til the full expiration of the sixty days. An account of the proceedings of the managers of these institutions will be found in another column. The United States Treasury Department has issued the following notice in relation to the redemption of govera ment stocks:TREASURY DEPARTMENT, Oct. 13, 1867. Notice is bereby given, that the limitation contained in the law authorizing this spartment to purchase stocks of the United States having been reached, It is not within its power to make further purchases at present. HOWELL COBB, Secretary of the Treasury. The Chemical Bank to paying specie to day, and its offlcers assure us that they will continue to pay. In the suspension of specie payments in 1837 we believe that the Chemical Bank was the only one that did not suspend. The bank, on a capital of $300,000, has a surplus of $560,000. The Clearing House owed It on Tuesday $59,000, and to-day $36,000. On Monday It had in specie $343,153. The bank is mainly in private hands and feels very comfortable. Full particulars of suspensions in other cities and in other parts of the country will be found under our telegraphic head. The surpension has, we believe, been general. In the report of Mr. Nicolay anction sale this morning the following errors and omissions were made $4,000 South Carolina per et bds & 15. should be 7536 10 000 Miw & Hericon Land mtg 10's at 7836 were passed 1,100 sHw City should be 50 10,000 Louisiana State 50. should be (with Interest) 6916 6,000 Milw and Boricon 1st mig 8 per ct. bs., at 1336 a 15 were omitted. The earnings of the Pittsburg, Fort Wayne and Chicago Railr ad Company for the month of September were as follows, via $77,690 91 From freight 96,150 83 From passengers From mail 4,482 29 Miscellaneous 67 24 Total $178,391 27 Earnings for September, 1856, were 172,155 50 Increase 6,335.77 Increase over August, 1857 $45,684 21 Stock Exchange WEDNESDAY, Oct. 14, 1887. 91 9 $5000 N Y 6'a,1862.. 100 she Erie RR. 012 do do. 8000 9016 40