Article Text

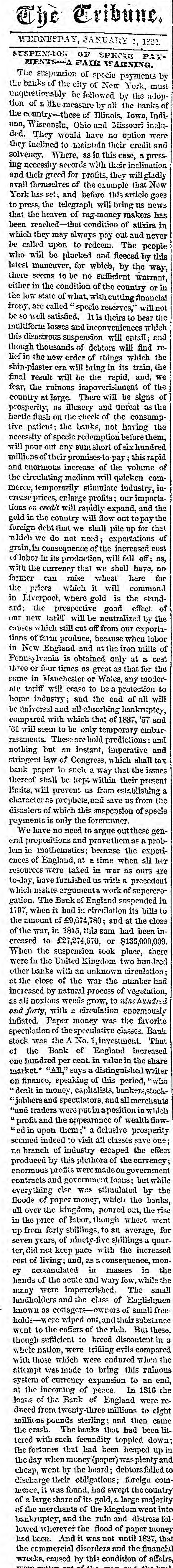

The Tribune. WEDNESDAY, JANUARY 1, 1902. # SUSPENSION OF SPECIE PAYMENTS-A FAIR WARNING. The suspension of specie payments by the banks of the city of New York, must unquestionably be followed by the adoption of a like measure by all the banks of the country-those of Illinois, Iowa, Indiana, Wisconsin, Ohio and Missouri included. They would have no option were they inclined to maintain their credit and solvency. Where, as in this case, a pressing necessity accords with their inclination and their greed for profits, they will gladly avail themselves of the example that New York has set; and before this article goes to press, the telegraph will bring us news that the heaven, of rag-money makers has been reached-that condition of affairs in which they may always pay out and never be called upon to redeem. The people who will be plucked and fleeced by this latest mancuver, for which, by the way, there seems to be no sufficient warrant, either in the condition of the country or in the low state of what, with cutting financial irony, are called "specie reserves," will not be so well satisfied. It is theirs to bear the multiform losses and inconveniences which this disastrous suspension will entail; and though thousands of debtors will find relief in the new order of things which the shin-plaster era will bring in its train, the final result will be the rapid, and, we fear, the ruinous impoverishment of the country at large. There will be signs of prosperity, as illusory and unreal as the hectic flush on the check of the consumptive patient; the banks, not having the necessity of specie redemption before them, will pour out any sum short of six hundred millions of their promises-to-pay; this rapid and enormous increase of the volume of the circulating medium will quicken commerce, temporarily stimulate industry, increase prices, enlarge profits; our importations on credit will rapidly expand, and the gold in the country will flow out to pay the foreign debt that we shall pile up for that which we do not need; exportations of grain, in consequence of the increased cost of labor in its production, will fell off; as, with the currency that we shall have, no farmer can raise wheat here for the prices which it will command in Liverpool, where gold is the standard; the prospective good effect of our new tariff will be neutralized by the causes which still cut off from our exportations of farm produce, because when labor in New England and at the iron mills of Pennsylvania is obtained only at a cost three or four times as great as that for the same in Manchester or Wales, any moderate tariff will cease to be a protection to home industry; and the end of all will be universal and all-absorbing bankruptcy, compared with which that of 1837, '57 and '61 will seem to be only temporary embarrassments. These are bold predictions: and nothing but an instant, imperative and stringent law of Congress, which shall tax bank paper in such a way that the issues thereof shall be kept within their present limits, will prevent us from establishing a character as prophets, and save us from the disasters of which this suspension of specie payments is only the forerunner. We have no need to argue out these general propositions and prove them as a problem in mathematics; because the experiences of England, at a time when all her resources were taxed in war as ours are to-day, have furnished us with a precedent which makes argument a work of supererogation. The Bank of England suspended in 1797, when it had in circulation its bills to the amount of £9,674,780; and at the close of the war, in 1815, this sum had been increased to £27,274,670, or $136,000,000. When the suspension took place, there were in the United Kingdom two hundred other banks with an unknown circulation; at the close of the war the number had increased by natural process of vegetation, as all noxious weeds grow, to nine hundred and forty, with a circulation enormously inflated. Paper money was the favorite speculation of the speculative classes. Bank stock was the A No. 1, investment. That of the Bank of England increased one hundred per cent. in value in the share market. "All," says a distinguished writer on finance, speaking of this period, "who "dealt in money, capitalists, bankers, stock-“jobbers and speculators, and all merchants "and traders were put in a position in which "profit and the appearance of wealth flowed in upon them;" a delusive prosperity seemed indeed to visit all classes save one; no branch of industry escaped the effect produced by this plethora of the currency; enormous profits were made on government contracts and government loans; but while everything else was stimulated by the floods of paper money, which the banks, all over the kingdom, poured out, the rise in the price of labor, though wheat went up from forty shillings, to an average, for seven years, of ninety-five shillings a quarter, did not keep pace with the increased cost of living; and, as a consequence, money accumulated in masses in the hands of the acute and wary few, while the many were impoverished. The small landholders and the class of Englishmen known as cottagers-owners of small freeholds-were wiped out, and their substance went to the coffers of the rich. But these, though sufficient to breed discontent in a whole nation, were trifling evils compared with those which were endured when the attempt was made to bring this ruinous system of currency expansion to an end, at the incoming of peace. In 1816 the loans of the Bank of England were reduced from twenty-three millions to eight millions pounds sterling; and then came the crash. The banks that had been littered with such fecundity toppled down; the fortunes that had been heaped up in the day when money (paper) was plenty and cheap, went by the board; debtors failed to discharge their obligations; foreign commerce, it was found, had swept the country of a large share of its gold, a large majority of the merchants of the kingdom went into bankruptcy, and the ruin and distress followed wherever the flood of paper money had been. And it was not until 1827, that the commercial disorders and the financial wrecks, caused by this condition of affairs,