Article Text

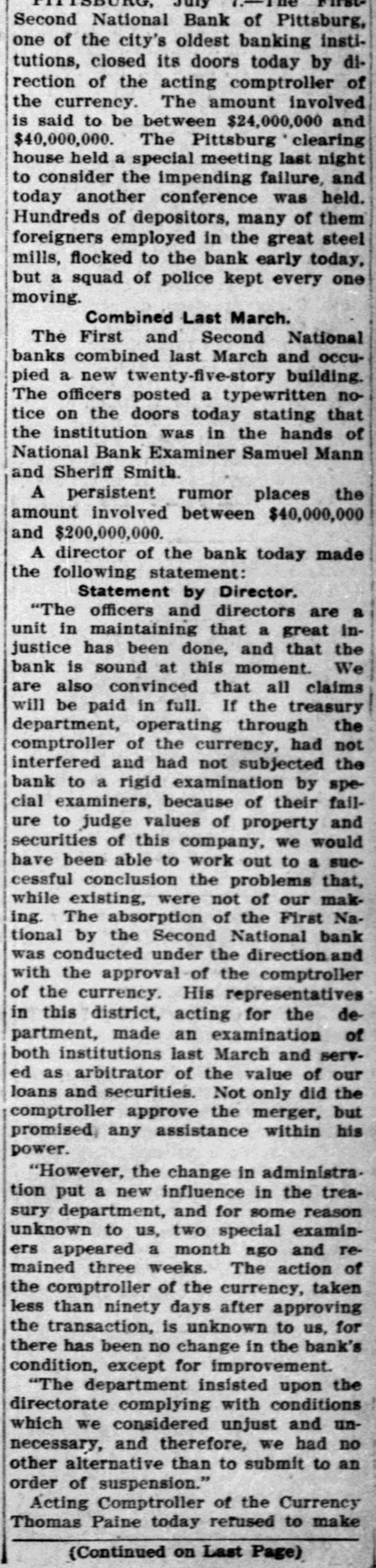

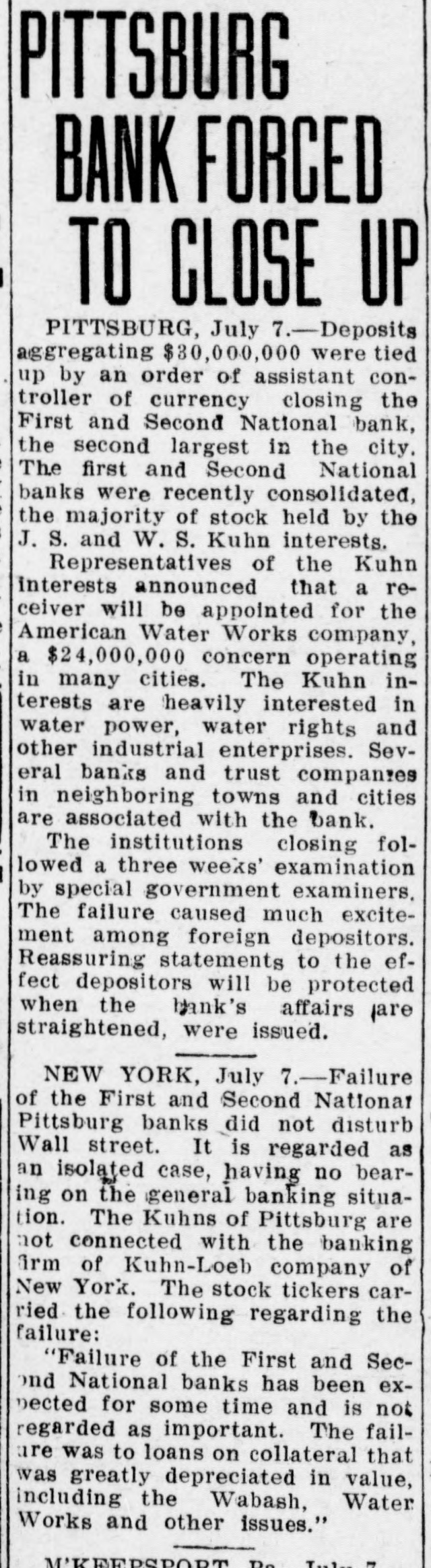

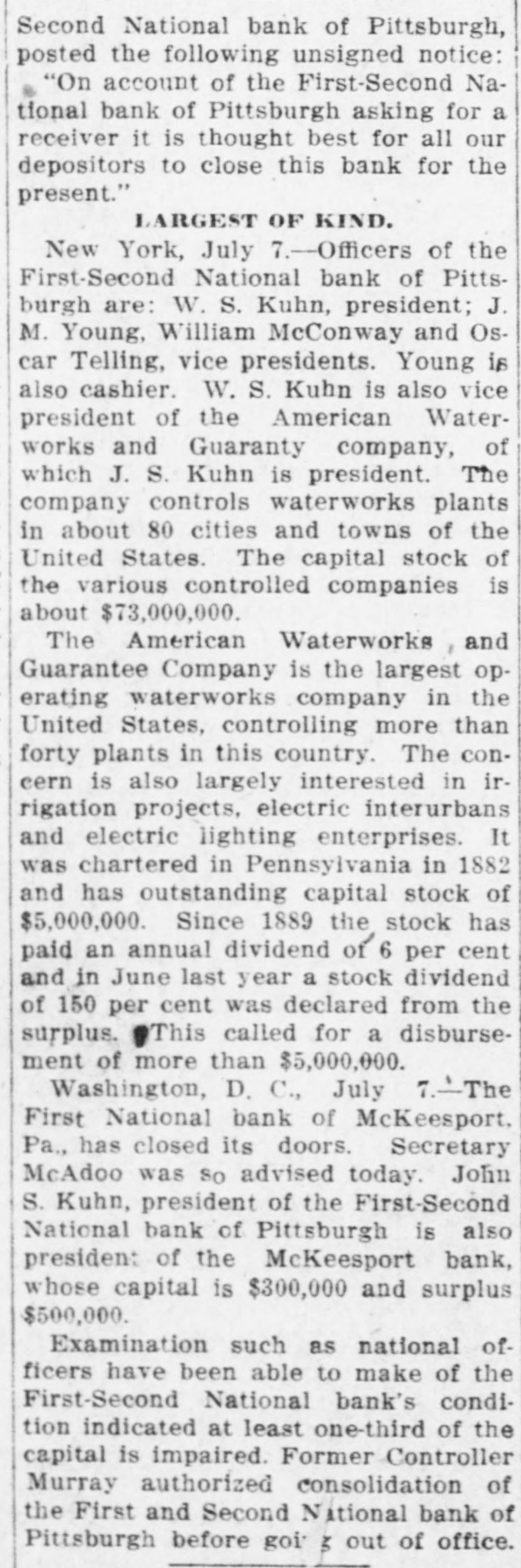

Second National Bank of Pittsburg, one of the city's oldest banking institutions, closed its doors today by direction of the acting comptroller of the currency. The amount involved is said to be between $24,000,000 and $40,000,000. The Pittsburg clearing house held a special meeting last night to consider the impending failure, and today another conference was held. Hundreds of depositors, many of them foreigners employed in the great steel mills, flocked to the bank early today. but a squad of police kept every one moving. Combined Last March. The First and Second National banks combined last March and occupied a new twenty-five-story building. The officers posted a typewritten notice on the doors today stating that the institution was in the hands of National Bank Examiner Samuel Mann and Sheriff Smith. A persistent rumor places the amount involved between $40,000,000 and $200,000,000. A director of the bank today made the following statement: Statement by Director. "The officers and directors are a unit in maintaining that a great injustice has been done, and that the bank is sound at this moment. We are also convinced that all claims will be paid in full. If the treasury department, operating through the comptroller of the currency, had not interfered and had not subjected the bank to a rigid examination by special examiners, because of their failure to judge values of property and securities of this company, we would have been able to work out to a successful conclusion the problems that, while existing, were not of our making. The absorption of the First National by the Second National bank was conducted under the direction and with the approval of the comptroller of the currency. His representatives in this district, acting for the department, made an examination of both institutions last March and served as arbitrator of the value of our loans and securities. Not only did the comptroller approve the merger, but promised any assistance within his power. "However, the change in administration put a new influence in the treasury department, and for some reason unknown to us, two special examiners appeared a month ago and remained three weeks. The action of the comptroller of the currency, taken less than ninety days after approving the transaction, is unknown to us, for there has been no change in the bank's condition, except for improvement. "The department insisted upon the directorate complying with conditions which we considered unjust and unnecessary, and therefore, we had no other alternative than to submit to an order of suspension." Acting Comptroller of the Currency Thomas Paine today refused to make (Continued on Last Page)