Article Text

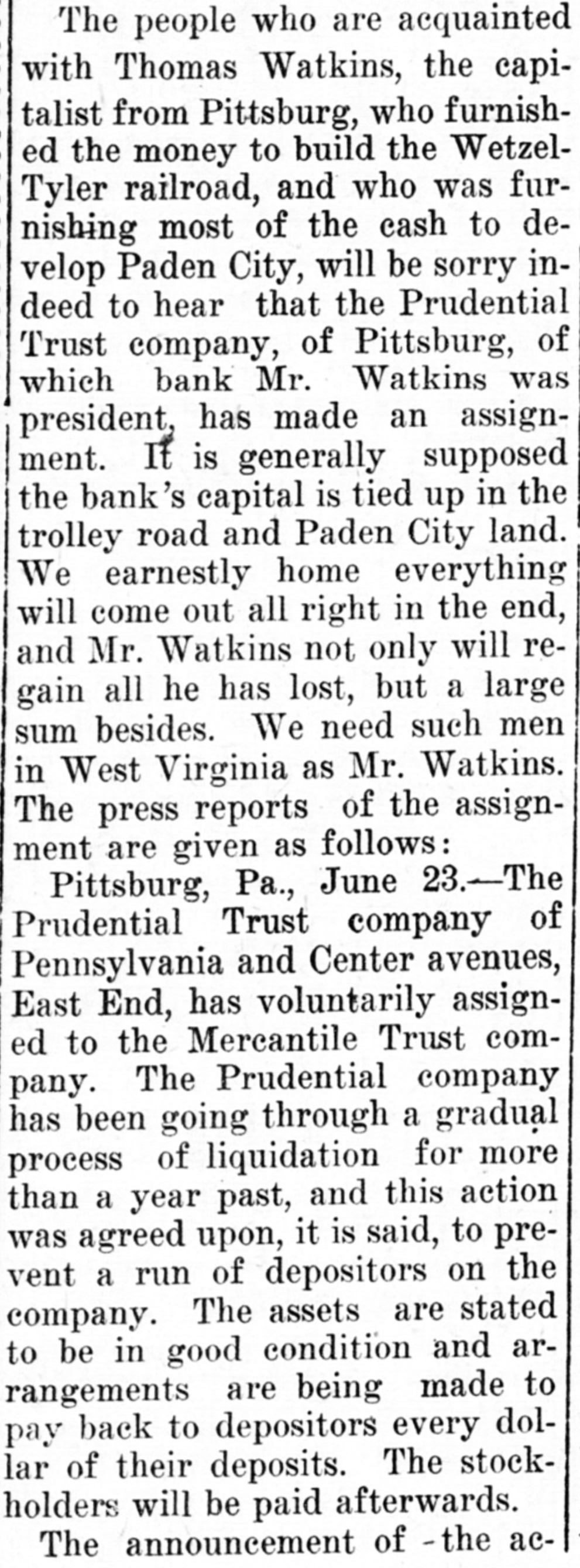

The people who are acquainted with Thomas Watkins, the capitalist from Pittsburg, who furnished the money to build the WetzelTyler railroad, and who was furnishing most of the cash to develop Paden City, will be sorry indeed to hear that the Prudential Trust company, of Pittsburg, of which bank Mr. Watkins was president, has made an assignment. It is generally supposed the bank's capital is tied up in the trolley road and Paden City land. We earnestly home everything will come out all right in the end, and Mr. Watkins not only will regain all he has lost, but a large sum besides. We need such men in West Virginia as Mr. Watkins. The press reports of the assignment are given as follows: Pittsburg, Pa., June 23.-The Prudential Trust company of Pennsylvania and Center avenues, East End, has voluntarily assignpany. ed to the The Mercantile Prudential Trust company comhas been going through a gradual process of liquidation for more than a year past, and this action was agreed upon, it is said, to prevent a run of depositors on the company. The assets are stated to be in good condition and arrangements are being made to pay back to depositors every dollar of their deposits. The stockholders will be paid afterwards. The announcement of - the ac-