Article Text

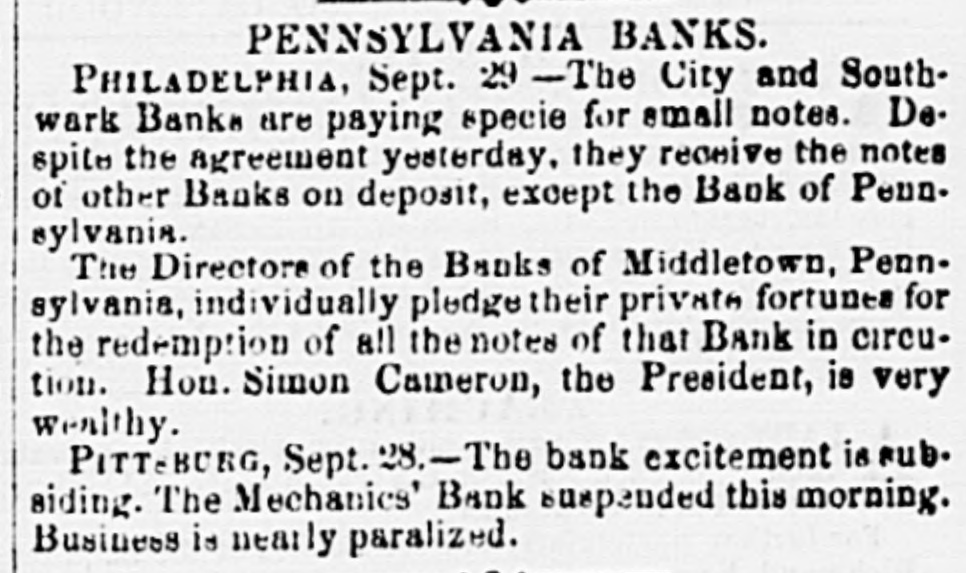

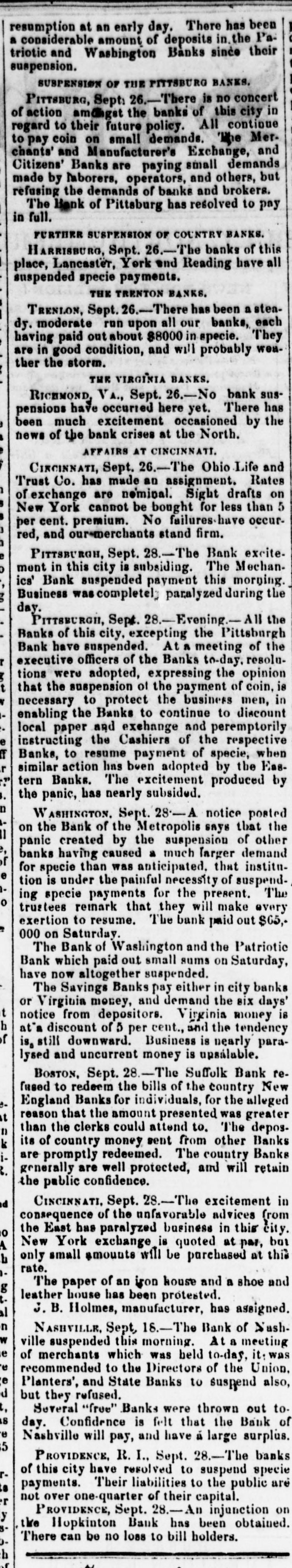

escaped, but subsequently drowned gether with his family. BANK EX ITEMENT. PITTSBURGH, Sept. 28. -The excitement relative to the Banks is subsiding. This morning the Mechanics Bank suspended specie payment on all notes. [SECOND DISPATCE] Although the Pittsburgh Banks have suspended, at a meeting of the Executive offivers of the Banks, to day, they addopted resolutions that temporary suspension of payment of specie was necessary to protect business men, enabling the Banks to discount local paper and exchange. That the Cashiers of the respective Banks, are pre-emptorily instructed by the Board, to re sume when a similar action is adopted by the Eastern Banks. Excitement nearly subsided. PHILADELPHIA, Sept. 28.-It is understood that the Governor will issue a proclamation tomorrow, calling the legislature together on the first Tuesday in October, to take action on the Bank suspensions. [SECOND DISPATCH] There is no concert of action among the Banks. They commenced paying five dollar bills, but 11 o'clock the bank of North America, which previously redeemed all notes, suspended specie payment. The same course will now become universal. The Philadelphia Bank suspended specie payment, but redeemed checks with notes. PHILADELPHIA Sept. 28-The Governor has not decided about the proclamation. Much ill-feeling between the banks. ALEXANDRIA, VA., Sept. 28.-The Banks are paying out small sums of specie only. WASHINGTON, Sept. 28.-A notice posted on the bank of the Metropolis, says that the panic created by the suspension of other banks, hav. ing caused much larger demand for specie than was anticipated, that institution is under the painful necessity of suspending specie payments for the present. The trustees remarked that they will make every exertion to resume, and that the bank paid out $65,000 on Saturday.The Bank of Washington and Patriotic Bank. which paid only small sums on Saturday, have not altogether suspended. The Savings Banks pay either in City Bank or Virginia money, and demand the six days notice from depositors.Virginia money is at a discount of 0 per cent, and the tendency is still downward. Business nearly paralized. Money unsaleable, BOSTON, Sept. 28,-Jewett & Co., publishers of this city, have suspended. Their liabilities are $100,000. BOSTON, Sept. 28.-The Suffolk Bank refuses to redeem the bills of the New England county Banks. NEW YORK, Sept. rumored failures of Clark, Dodge & Co. and Phelps, Dodge & Co., is entirely false. Exchange on Philadelphia ten per cent per month. The assignment of the Ohio Trust Co. is expected. President Stetson returns to Cincinnati to-morrow to procure a stay of proceedings. The Metropolitan, Republic and Merchants Bank of New York, Mechanics American, Exchange, Union and Phoenix Banks have issued circulars assuring the public of their ability and determination to sustain a specie basis for their circulation, and expressing an opinion that the tendency of specie and produce to this point will soon relieve the Banks of the present pressure. NORFOLK, Va., Sept. 28.-Some feeling is manifested here about the Baltimore and Philadelphiá suspensions, but the Banks, so far, have remained firm. CINCINNATI, Sept. 28.-The excitement consequent upon the continued vorable advices from the east, paralized business, and the atten* tion of business men is entirely turned from the ordinary rotine, to the absorbing question of the Intest news from the east. The banking houses continue to quote New York exchange at par, but only small amounts can be purchased at this rate, sums of 5,000 and upwards cannot be bought at less than five per cent premium. No paper can be negotiated, so that it is useless to give quotations. The paper of an Iron House and a Shoe & Leather house, went to protest, and J. B. Holmes manufacture, has made an assignment. None of them are insolvent however. J. J. Anderson & Co., and Danby & Barksdale, Bankers of St. Louis, have suspended. The Nashville Bank of Nashvill, Tenn., has suspended. NEW YORK, Sept. 28.-The money market is very stringent, but banks remain firm in their position. Some very heavy failures are reported here. Advices from Albany mention a run on the Savings department. RICHMOND, Sept. 28-The banks are paying specie, and it is generally believed that they have determined to go on. There is no run as yet. Both of the Staunton banks, the Central Bank, and the Bank of the Valley have all suspended BALTIMORE 11 P. M.-No material change has occurred in money matter to-day. The banks in some instances redeemed their 5's as a matter of accommodation. Specie commands a premium of seven to ten per cent on exchange for Balt funds. AGUSTA, GA.-The Banks of North and South Carolina and Georgia are all right. The question of suspension is not entertained. YELLOW FEVER. WASHINGTON, Sept. 28.-Several cases of yellow fever at Key West and one death. The origin of the decease is from admitting seamen