Article Text

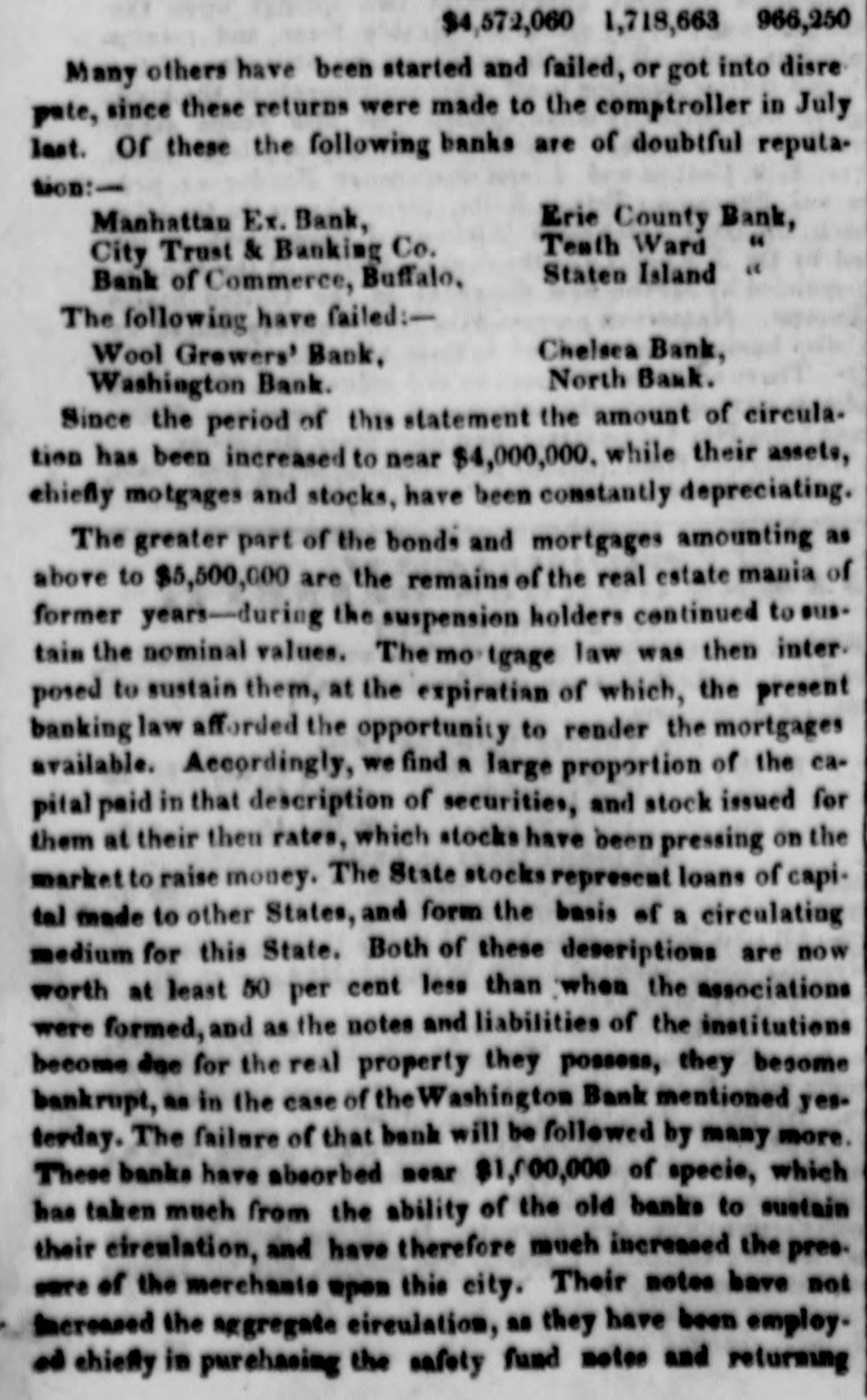

# MONEY MARKET. Sunday Nov. 10-6, P. M. The stock market was again buoyant yesterday morning, and prices closed generally higher than on Friday. United States Bank improved ¼ per cent-Bank of Commerce ¾ per cent-Utica and Schenectady ⅜ per cent-Stonington 2¼ per cent-North American Trust & Banking 3 per cent-Harlem 1 per cent. Sales of Corporation bonds were made at 6 per cent discount, and drafts on Philadelphia at 12¼ a 12½-on Baltimore at 12¼. Southern Exchanges generally are a little better, but prices cannot be quoted with any pretension to accuracy. Uncurrent money remains without variation in price, but with a greater demand. Counterfeit notes purporting to be on the Mechanics' Bank of New Nork, of the following description, are in circulation-No. 1920, letter A. J. Hormer, cashier. H. V. Warren, Prest. pay to A. Hamilton. The legislature of Tennessee voted on the 29th, fourteen against instructing the banks to resume, and nine for it. It is however probable that the banks will resume of their own accord.-$50,000 arrived at St Louis from Galena, Ill. recently, for the bank at the former place. Also, 5690 pigs lead, to various firms. $20,00 in specie reached New Orleans on the 2d from Vicksburg, probably on its way to this city. Every New Orleans packet brings a large amount. It is confidently stated in the Ohio papers that the Banks of Cincinnati, within the thirty days fixed by law as the period of suspension, will resume. Yesterday the pressure was very severe, and the number of failures large, six or eight dry goods jobbing houses were reported, a shipping and importing house, chiefly in the grocery line; also a flour house, somewhat concerned in flouring at Black Rock. The failure of an eminent French importing house also took place. This is a wealthy house, and shows assets far beyond its liabilities, but its assets are, like a large proportion of our dry goods houses, maturing in Baltimore and Philadelphia, and in consequence of the fraudulent suspension in those cities, cannot be realised but at the ruinous loss of 12 a 15 per cent; to pay this would so far impair their means that the loss would ultimately fall upon their creditors. They have, therefore, suspended. These movements are all working out a healthy result. In all classes of business those who have not been very much curtailed must unavoidably go down. The dry goods trade, for reasons heretofore explained by us, are peculiarly exposed to the storm. Tne jobbers have most of them done business greatly beyond any prudent proportion to their capital; a loss amounting to a very small per centage on their aggregate business, therefore, renders them insel-vent; while importing houses of large capital, like the one here alluded to, have sold at eight months for notes payable in Philadelphia and Baltimore, and a loss of 15 per cent on their aggregate assets is a severe blow after the heavy loss sustained by many of them in 1836-7. This system will henceforth be entirely altered, and short credits for notes payable in New York in specie funds will be the only terms listened to. The credit of the south is gone with our merchants. While this revolution is going forward in the commercial world the weaker portion of the Banks is giving way. Yesterday the notes of the Washington Bank, of this city, were protested - The following is a copy: