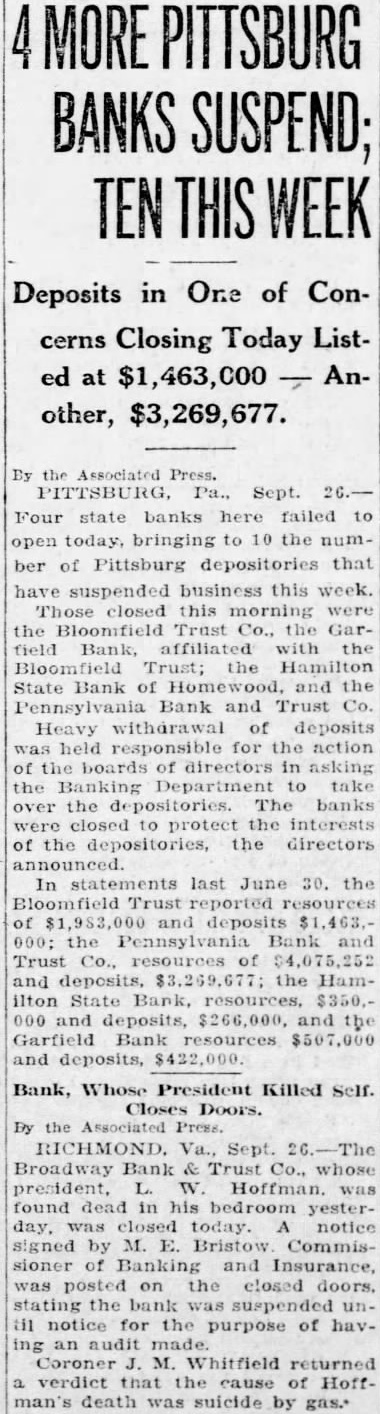

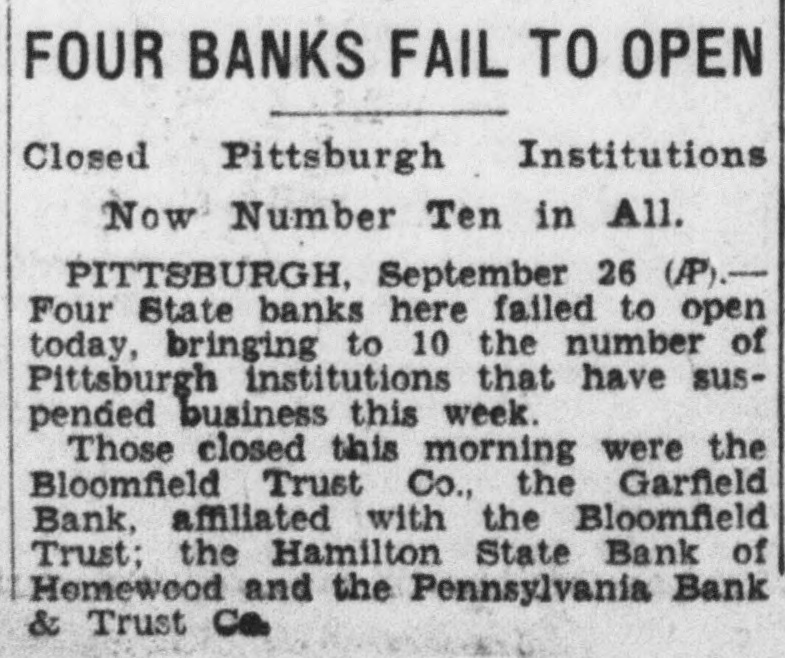

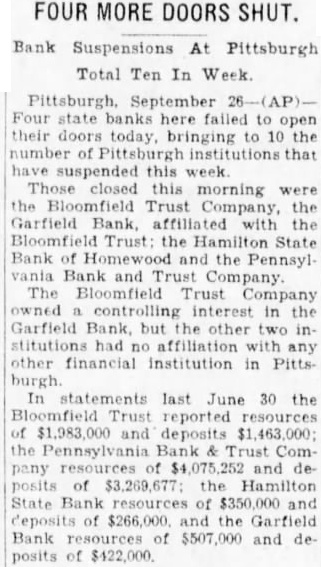

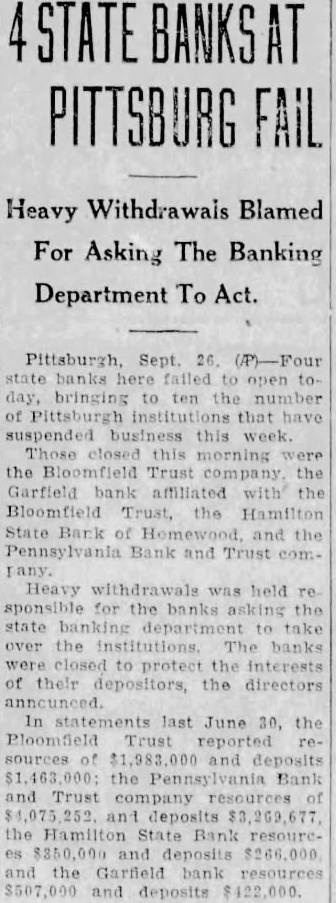

Article Text

MORE BANKS SUSPEND; Deposits in One of Concerns Closing Today Listed at other, $3,269,677. By the Associated Press. Pa., Sept. Four state banks here failed to today, bringing to the numopen ber of Pittsburg depositories that have suspended business this week. Those closed this the Bloonifield Trust Co., Garfield Bank, affiliated with the Bloomfield Trust; the Hamilton State Bank of Bank and Trust Co. Heavy withdrawal of deposits was held responsible for the action the boards of directors asking the Banking Department to take the The banks closed to protect the interests of the depositories, the directors In statements last June 30. the Bloomfield and deposits the Bank and Trust of and deposits, Hamilton State Bank, $350.and deposits, $266,000, and Garfield Bank resources and deposits, Bank, Whose President Killed Self. Closes the Associated Va., Sept. Broadway Bank Trust whose president, Hoffman. found dead bedroom yesterday, was closed today. signed by Bristow Commissioner of Banking and Insurance was posted on the closed doors. the bank notice for the purpose of havan audit Coroner M. Whitfield returned verdict that the of Hoffdeath was suicide by gas.'