Article Text

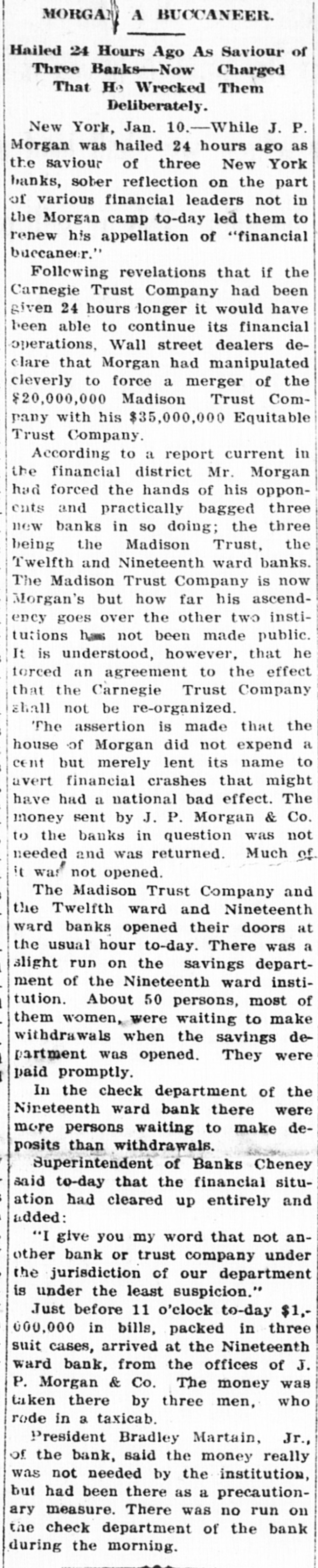

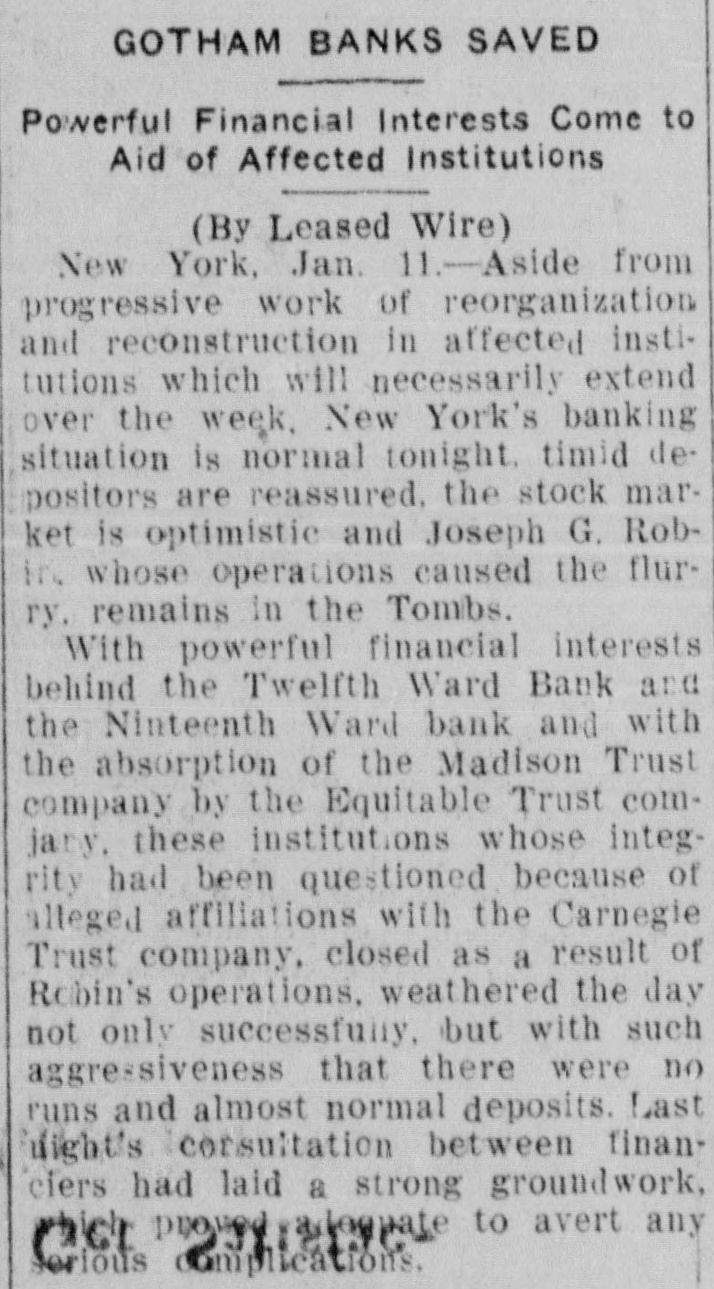

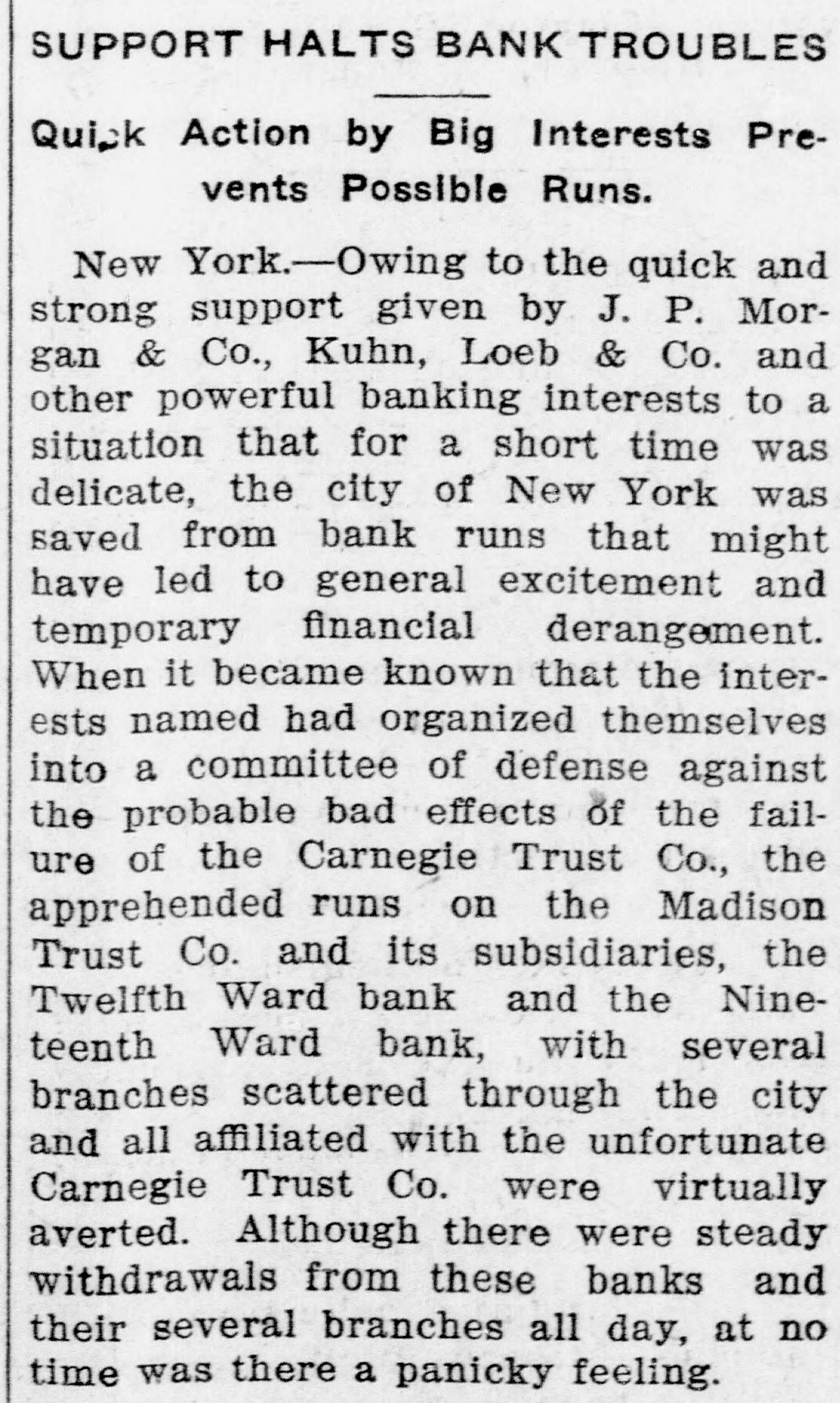

MORGAN HELPS SAVE THE BANK Financiers Take Over Three Institutions. New York, Jan. 9.-After forty-eight hours of conference between representatives of all the big banking houses and the clearing house It was announced that J. P. Morgan & Co. have guaranteed the solvency of the Twelfth Ward bank and the Nineteenth Ward bank, that the Equitable Trust company has bought the Madison Trust company and that these three institutions have been shorn of their Carnegie Trust company connections. The announcement was made by formal statements. They make it clear that whatever danger had been cast on the three banks by the failure of the Carnegie Trust company had been removed. Work For Grand Jury, Perhaps. The Carnegie Trust company, which was closed Saturday by the state banking department, is now beyond hope of salvation. With respectable securities to offer it could have had on the very night before the superintendent of banking descended upon it at least $1,000,000, but these securities were not forthcoming. The deposits in the company had shrunk from $18,500,000 at the time of the company's greatest prosperity in 1909 to hardly more than $1,500,000 in individual deposits subject to check at the time of the failure. To meet this steady drain the company was forced to sacrifice what reliable securities it possessed. The banking department has called in District Attorney Whitman to look into the history of the concern and determine whether or not there was any criminal liability in its management. The district attorney is silent as to what steps he is taking in the matter. It is known, however, that he worked overnight on the trust company matter late into the morning and that he held many consultations about it at his home at the Hotel Iroquois. The outcome of this labor may very well be a matter for the consideration of the grand jury. Nearly Falled In 1907. It has developed that the company nearly went under in the panic days of 1907. The general impression that the influence of Andrew Carnegie was behind the company and the fact that the name of Leslie Shaw, who 80 recently had been secretary of the treasury, was with the concern were two things that saved the trust company at that time. Of course the big steel man asíde from his friendship for Charles M Schwab had no interest In the company. More than that, he was extremely adverse to the use of his name.