Click image to open full size in new tab

Article Text

16 THE LATEST MARKET NEWS

ACTIVE DEMAND FOR HOGS.

Reductions in receipts of hogs at the Kansas City stockyards were partially offset by more liberal supblies elsewhere. and the active local trade failed to boost prices quotably. although sales were generally on steady to strong The top was unchanged from terday at 25 on choice 200 to 240. pound Only under offerings sold $5. Hogs heavy as 300 to 320 pounds brought $5 and $5.05. Chicago prices were 5 to 10 cents lower. July the latter market which was up were 15 cents Packing lower $3 to $4.60, and pigs steady The upturn followed three days of at 75 to sharply lower markets that had sent of hogs at Kansas City prices into new low ground for the Average price Monday $5.05, average weight pounds; futures pounds: Omaha, $4.60, weight, 258 face of an upturn in sterling. showed advances of sales for various weights to cent bushel Range and classes of follows Foreign interest in North American Light wheat for export remained disappointingly with only few scattered sales of Manitobas No inMedium Medium in hard quiries were weights 290 pounds up. winters to advices from excenters. Corn the trend in wheat, all deliveries rising 1½ 1% cents for the Native fed steers and yearlings were again in supply and of prices for wheat. corn and oats The was on for delivery Kansas steady prices. yearling steers and mixed yearlings and Low. Tuesday Monday High. WHEAT comprised the bulk Western steers and sold somewhat 41% to with grassers sold two of for and some City steers ranged from 30% Straight grass steady at $3 Fat cows slow and Range of and for lower grade to while was and cows Monday cutters at $1.50 to $2.75 however, quoted steady steady at Bulls were calves were again weak 50 cents The top was and bulk lower. went to packers at and down Stockers and feeders were in liberal but sold steady supply Bulk brought to loads of feeders at $5 to range of for the Nominal various classes of cattle is as follows: Opening prices for grain futures in March July and fed grass May and closed at up Canners and prices Louis pounds up No. red sold at hard wheat Stocker and feeder No. white held while lambs were Sheep 25 cents lower. Natives for wheat futures in weak decline while pool the minimum March 55c: May best rangers brought $6.25 UD price of Nominal Prices in shillings and pence are here classes of sheep and lambs October December 58 11d: sample hard wethers winter 5s 3d: Kansas City Carlot Grain Prices. Carlots were good medium on the market today. premium basis Livestock receipts here nominally Kansas City dark hard nominally sales markets dark hard nominally sales Kansas City markets dark nominally Kansas City hard nominally markets nominally Tomorrow's Livestock Estimates. Bureau hard nominally sales estimates of for Kansas City. 6,000 hogs nominally 12,000 sheep. and 5,000 sheep hard. sales

Livestock Elsewhere Chicago. cents lower: packing light weights to choice and $10.50 for weighty for long grade steers and yearlings weak cents she market slow and decline: good grade offercomprising bulk most killing classes steady to lower sales 25 cents lower: good choice native Louis. and lights tending lower: No. and western steady mixed yearlings and other cars western steer fat mixed and 25 cents asking few bids around holding best to $7.00 indications steady Receipts 10 tives. fed steers and steady strictly choice light steers held above western range cattle in liberal supply tend. ing two loads good Kansas fed steers. 88.35: bulls and about steady bidding lower on range top bulk. Receipts and butchers steady choice fed steers and yearlings uneven: weighty and steady strong and dium to good grades. weak: she stock bulls strong: vealers and feeders bulls fed steers and liberal sprinkling of choice $10.25 one load choice 1.380-pound weights 16,000: lambs 50 cents sheep and feeders and range Pork Products in Chicago. for ture delivery Low. BELLIES 710 720

Metal Quotations. New York. Unchanged spot and 22.25 cents No. Eastern Alabama New Louis St. and

New York Rates for Money Oct. days. Prime Bankers' unchanged days. per cent.

1%

Expectations of some bullish news arising from the between President Hoover and of finance in Washington together with rally in stocks and an improved tone in foreign wheat markets, duced some speculative buying of wheat futures this morning and prices made the best showing in several Closing were near the high level, up cents for all delivertes at City and Chicago, except red 43c nominally sales was slow demand at advances to nominally sales No. nominally sales nominally sales nominally nominally sales No. No. Prices oats advanced Demand good white nominally white sales 21c white Kafir and milo met fair demand unchanged Milo No. Ryesales No. feed sales for carloads of which local dealers will sell, are here shown: 7.50: pure $7.50 ground barley linseed fine ground per cent cold pressed seed No fine No. No. No. feed bean 40 per tankage. carlots. $30.00 ton. to transmit this ruling to their corresondents immediately by wire. Making allowance for the 40 per cent dividend distributed in June, 1927. present price of United States Steel around 62, is equivalent to about 85. good many corporations with strong cash would find it profitable to buy their own stock and retire it. or keep the stocks are selling far below their asset value and the purchase of its own stock by corporation not only is good but It benefits stockholders, by tending to sustain the prices of the stock. Some corporations are in position to do this: others are not

WALL STREET COMMENT. further step to check up on short selling taken day by the New York Stock Exchange The on business conduct directed that before executing any selling members shall ascertain and notify their floor brokers whether such orders are for or "short" account. out of town correspondents were further directed

Farm distress and the fear of widespread defaults in interest and installments on principal. are playing with quotations for farm bank bonds. Bid for some the cents are down to 70: asked. 74 Some are higher these ranging up to 96 bid for 4½ per cents maturing next year or year after. The 41/48 that may be bought for 74 yield about 6 per cent on that price. These bonds not long ago were at par. The federal land bank board would have hard time now raising new money on bonds secured by farm mortgages. Holders of United States Steel Corporation the end of September numbered 166,788 an increase of since the end of Preferred stockholders at the end August totaled 57,966, decrease of 325 in three months. The continued increase in the number of stockholders of large corporations has been feature of the prolonged decline the market and means that stockholders have been their holdings. When the turn of the market comes as it must some time. it probably will be found that large investors are accumulating stock and small holders are selling. Arrangements have been made for the sale of New York Curb Exchange for $40,000. decrease $5,000 from the previous sale. Excessive nature of the deflation in stocks which has resulted from the hysterical selling of late indicated by the position of National Dairy Products. At the low levels yesterday the stock was selling to offer indicated yield of 13 cent Thomas H. McInnerney, turning from abroad. stated today that carnings in the first eight months the year had more than covered the full year's dividend requirements $2.60 share. August business. he said, was much better than had been expected. adding that September ahead of last year. The company had more than 24 million dollars cash and no bank loans Action the next dividend will be taken Thursday BIG GAIN IN BANK DEPOSITS.

Reporting Member Banks Show an Increase of 340 Million Dollars.

Washington. Oct 6.-The federal reserve board's condition statement weekly reporting member banks in leading cities on September 30 showed increases for the week of 35 million dollars in loans and investments, 80 million dollars reserves with federal reserve banks, 340 million dollars net demand deposits and million dollars in borrowings from federal reserve Decreases included 62 million dolbanks. deposits and 28 million Loans on million dollars at banks. and "all dropped off 22 dollars at all reporting Holdings institut ions United States government million dollars. and other securities investments 46 lion dollars. CHEERFUL TONE IN LONDON

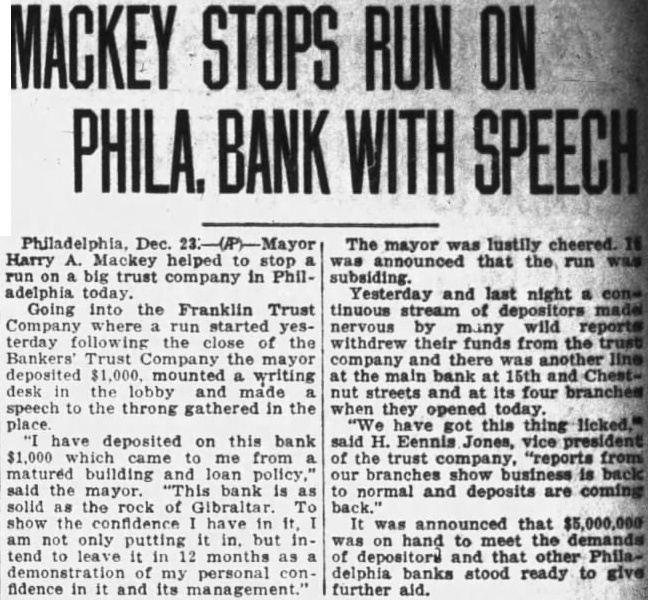

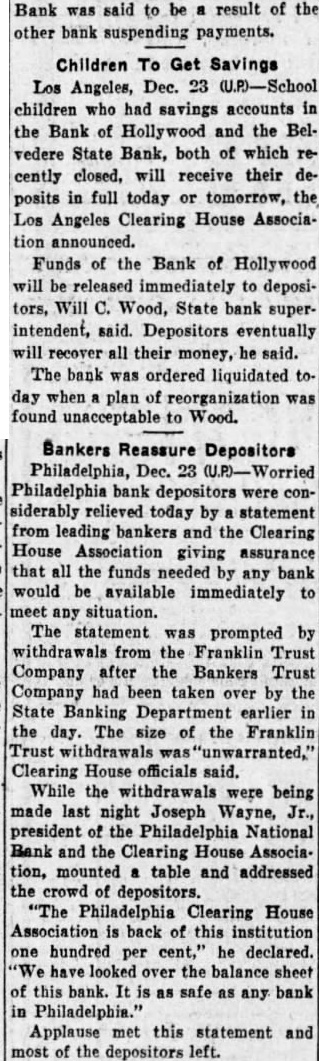

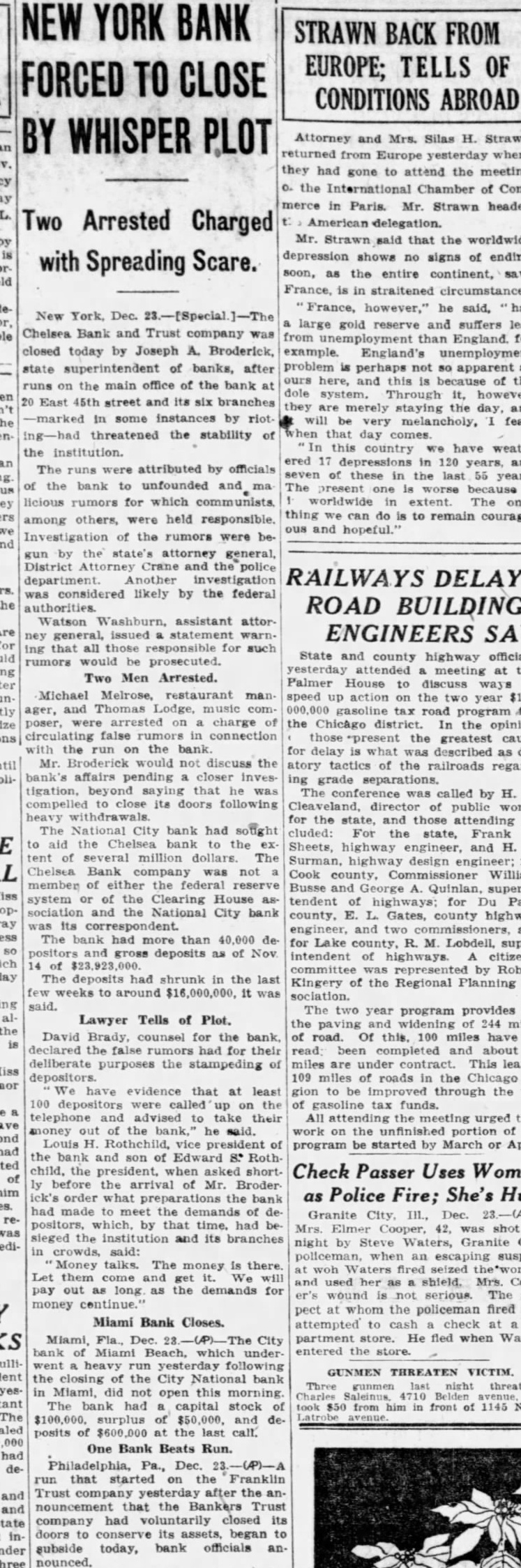

London Oct stock market closed cheerful with further gains in edge securities and industrials and slight recovery issues proved sterling exchange and Wall street advices the and Paris 98 78 centimes In Paris price movements on the bourse were irregular but some substantial gains were recorded. PHILADELPHIA BANK FAILS. today took over state banks. Franklin Trust Company Phila operated four Institution and Jordan State Bank of The Franklin Trust had deposits of $19. 664 the 000 and the Jordan bank TWENTY ONE BANK FAILURES.

Chicago Oct. 6-Bank suspensions nounced this ten West Virginia and Pennsylvania four in Nebraska four Minneapolis, one Ohio. one in South and Maryland Most of are small banks A THIRD MONTREAL FAILURE. were suspended by the Montreal Stock Exchange today follow ing the filing of petitions bankruptcy. Two occurred for the same

GAIN IN SOFT COAL OUTPUT.

MOST BOND PRICES RISE. NEW YORK Oct. The bond market advanced today on mod. erate activity Foreign obligations made some of the largest gains. German 5½ were especially active and they and the 7s were points higher French 7s and 7½. German Central Agricultural Bank of October 1960 and Italian 7a of 1951 gained fractionally Belgian 7s of 1956 weakened points to Stock privilege obligations were gen. erally moderately higher. but the volume in many of them was limited General Theaters Equipment 6s and Kreuger Toll 5s with warrants gained more than point each on few sales. Atchison 41/28 of 1948 and International Telephone 41/28 of 1939 were fractionally higher American Telephone of 1939 and Philadelphia & Reading Coal and Iron 6s about lower Public utility loans lost fractions as In the industrial group. Armour of 1939, Chile Copper 55, Dodge Brothers 6s, International Match 5s and Sinclair Oil 6½8 lost about one point Shell Union Oil 5s were higher United government issues declined slightly.

[Closing bond quotations will appear in later editions.]

ADVANCE IN COTTON United States Government Issues. New Oct. 6.-Strength (Figures after decimals denote buying this and after quiet 5.85. 31 to per cent net was up According to made York Cotton Exchange the expecting of bales New York Sugar Quotations. New 3.45 Futures to In one of 10 effective the close 4.50 for fine STOCK MARKET OPINIONS. New York Oct. day commented as Redmond has way to to how far carry Current prices cheap year is no will lower tape own is and the Weeksthe market current believing that than outside should the for the Shields never before the is maintaining liquid sible and confining trades The number of buyers increasing daily but mand will not develop until down and there is tion that has run Hutton in did unexpected but the of Foreign values the resen was during 1929 boom many small will best the decline until dependable bility are Those able willing to take of should do From standpoint our feeling turn likely almost any Webber- Suggest that close watch for flush of which an automatic matter With September the R is the names of the months and oyster season is on

Johns WHEAT ADVANCES 2 CENTS. STOCKS BOUND UP STRONGLY. South. prices upward in an excited and short covering. The rise was one of the swiftest in stock exchange history Stocks were traded in blocks of 1.000 to 8,500 shares, and many issues made gains of to 15 points or more. United States Steel rose about and there were gains of about to 10 points in Can, American Carb house and Public Service of New Jersey, Issues up to General Motors, General Electric and Atchison led the rally in the rails with gain of 16 points. New York Central gained about Trucks The two news developments were the of the conference at the White House this evening among Hoover and leading members of congress, and the British decision for general election late month. As regards the Washington meeting there have been of an important statement pending at the national and Wall has conjectured widely as to its was recalled that prior to the June debt moratorium proposal Mr. Hoover met with of legislators Some brokerage houses referred to the Monday wave in the security markets as "hysterical" and said in many instances had lit. the or no relationship to actual values. It was reported that foreign buying was being done here, much of it from France Transactions in the first half hour were 900,000 to shares to 30 200,000; to 2:30 million; total, about 4,100 3½ Am 000 shares. Net 100s) Rume Dye Note Sh Banking of bituminous coal during the week ended September 7,435,000 week. tons: same week last year, 000 Young Bank's Stockholders Must Pay. Los de Nem United States National Zenith Radio Bank were million dollars 100 per cent of their cents today the comptroller received of the currency at The assessment may be paid Novem four NEW YORK, Oct. -Directors of ber Topeka Santa Fe. meeting at noon today, declared the regu- ARGENTINE GOLD TO U. S. lar quarterly of $2.50 share New Oct. shipment of milon the stock. which has been lion gold has left Argentina despaid since 1927 Atchison almost tined for New York. was announced the only important railroad which will today carn its regular dividend this year. It had such margin between earn- WESTERN AUTO SUPPLY SALES Grain Privileges. Fox ings and dividends for several years Privileges on Western Auto Supply Company reports past that could experience big reto under sales for $972,500. comclose bids cent duction in earnings without endanand over pared with $1,044,500 for September year offers gering its dividends. Earnings were ago, per cent. Sales for Bids good all this $22.70 in 1929 and $12.85 in first nine months this year were cents and 1930. The slump in the 971/2 compared with $10,234,000 for 1% to cents the yesterday was followed by brisk the period of last year. Bids on good next are this morning. even before the dividend decrease of 9.4 per cent. quoted to cents under the close The stock was up to offers to 3% cents over the No Hay Market Today. nearly $300 share in 1929. on Receipts hav Kansas City today are cent too light to regular Declaration of the regular Atchison close bids and over session. and arrivals were held over for dividend was especially sigtomorrow's nificant because of the prominence good this are quoted close men on the board. They CHICAGO STOCKS MOVE UP. the to 1% over the close. Myron O. Taylor, chairman of Bids on the of the United are quoted cents under the close and States Steel Corporation: William scored on the Chicago Stock Ex. offers 216 to 3% cents the close. change Potter. president of the Guaranty Insull rose to 8%. UD %: Bendix gained Grain Futures Transactions. Trust Company: Charles Steele, part% 13%: and ner J.P Morgan Co.: Gen. James interest "In wheat and corn futures other shares also were active and the volume trade are here shown G. Harbord, chairman of the Radio on the in Corporation of America: Clarence M. KANSAS CITY OPEN INTEREST man of the American Bar Silver in New York. ago Radiator CorWheat New York cents Futures man of the Berwind White Coal Com- sales tions cents November pany. December 31. 1930, the company had balance in cash and govCity ernment securities of more than 50 million dollars New York Coffee Quotations INTEREST New No. Sanios No. Rio futures closed 10 to 29 points higher Wheat 5.25 Chicago Sanios futures closed week 000 year Waiting thousands will read your want ad in The Star.