Click image to open full size in new tab

Article Text

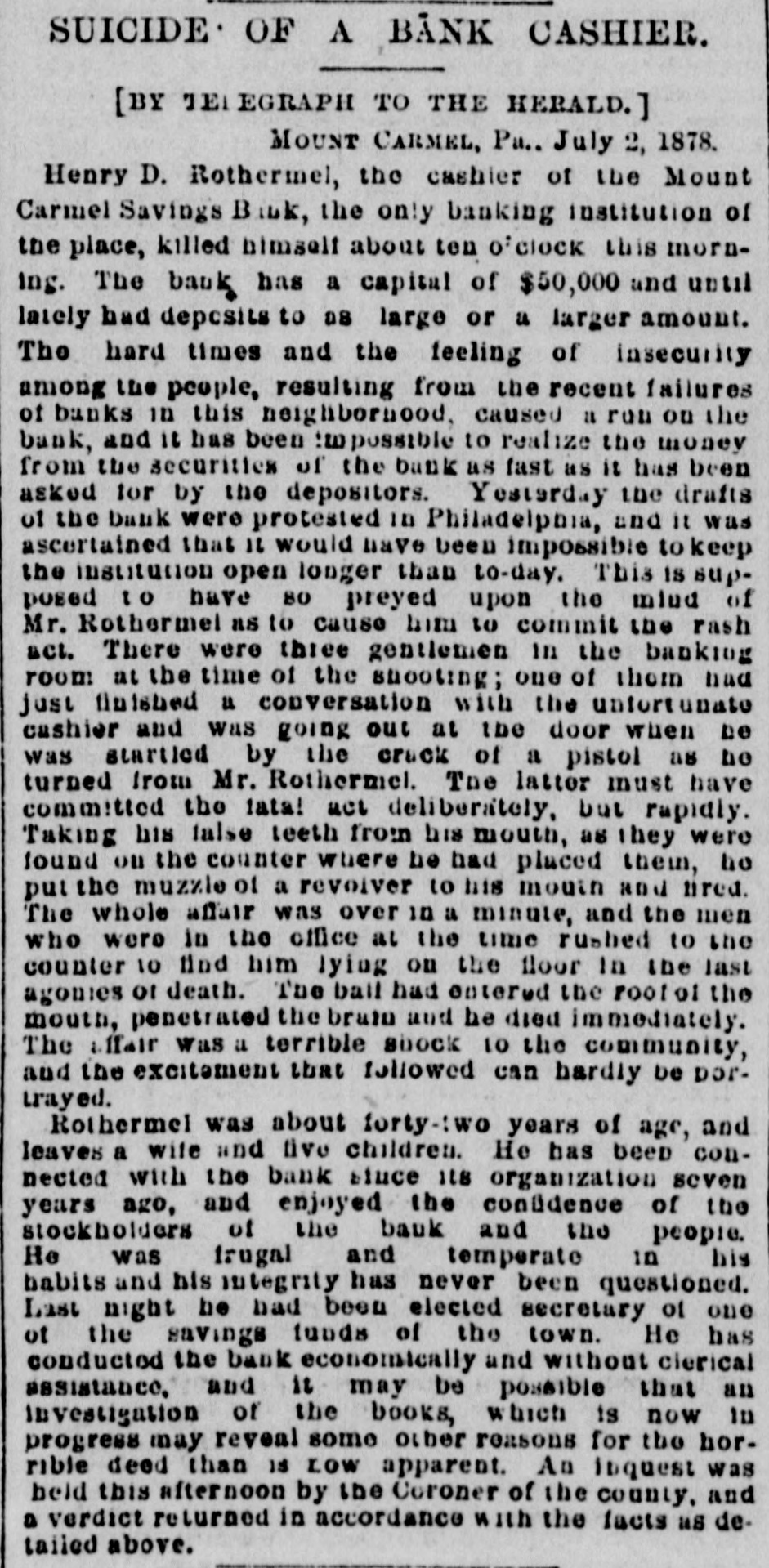

SUICIDE OF A BANK CASHIER. [BY TEL EGRAPH TO THE HERALD. MOUNT CARMEL, Pa.. July 2, 1878. Henry D. Rothermel, the cashier of the Mount Carmel Savings Bank, the only banking institution of the place, killed himself about ten o'clock this morning. The bauk has a capital of $50,000 and until lately had deposits to as large or is larger amount. The hard times and the feeling of insecurity among the people, resulting from the recent failures of banks in this neighborhood, caused a run ou the bank, and it has been impossible to realize the money from the securities of the bank as fast as it has been asked for by the depositors. Yestarday the drafts of the bank were protested in Philadelphia, and 11 was ascertained that 11 would have been impossible to keep the institution open longer than to-day. This IS supposed to have 80 preyed upon the mind of Mr. Rothermel as to cause him 10 commit the rash act. There were three gentlemen in the banking room at the time of the shooting; one of them naa just finished u conversation with the unfortunate cashier and was going oui at the door when be was startled by the cruck of a pistol as be turned from Mr. Rothermel. The lattor must have committed the tata! ace deliberately, but rapidly. Taking his false teeth from his mouth, as they were found ou the counter where be had placed their, ho put the muzzle of a revolver to his mouth and nred. The whole affair was over in a minute, and the men who were in the office at the time rushed to the counter 10 find him lying ou the floor In the last agonies or death. The ball had entered the root of the mouth, penetrated the brato and he died immediately. The affair was a terrible shock 10 the community, and the excitement that followed can hardly be portrayed. Rothermel was about forty-:wo years of age, and leaves a wife and five children. He has been connected with the bank sluce 118 organization seven years ago, and enjoyed the condidence of the stockholders of the bauk and the people. He was trugal and temporate in his habits and his integrity has never been questioned. Last night be had been elected secretary of one ot the savings funds of the town. He has conducted the bank economically and without cierical assistance, and it may be possible that an investigation of the books, which is now in progress may reveal some other reasons for the horrible deed than 15 LOW apparent. An liquest was held this afternoon by the Coroner of the county. and a verdict returned in accordance with the facts us detailed above.