Article Text

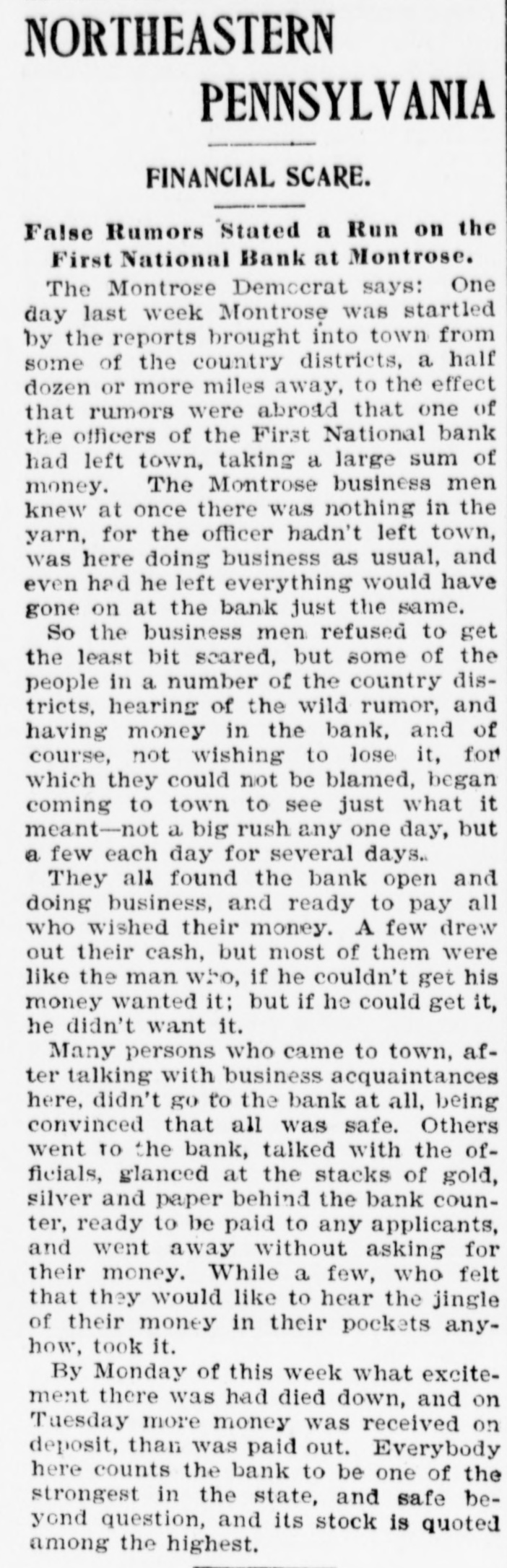

NORTHEASTERN PENNSYLVANIA FINANCIAL SCARE. False Rumors Stated a Run on the First National Bank at Montrose. The Montrose Democrat says: One day last week Montrose was startled by the reports brought into town from some of the country districts, a half dozen or more miles away, to the effect that rumors were abroad that one of the officers of the First National bank had left town, taking a large sum of money. The Montrose business men knew at once there was nothing in the yarn, for the officer hadn't left town, was here doing business as usual, and even had he left everything would have gone on at the bank just the same. So the business men refused to get the least bit scared, but some of the people in a number of the country districts, hearing of the wild rumor, and having money in the bank, and of course, not wishing to lose it, for which they could not be blamed, began coming to town to see just what it meant-not a big rush any one day, but a few each day for several days. They all found the bank open and doing business, and ready to pay all who wished their money. A few drew out their cash, but most of them were like the man who, if he couldn't get his money wanted it; but if he could get it, he didn't want it. Many persons who came to town, after talking with business acquaintances here, didn't go to the bank at all, being convinced that all was safe. Others went to the bank, talked with the officials, glanced at the stacks of gold, silver and paper behind the bank counter, ready to be paid to any applicants, and went away without asking for their money. While a few, who felt that they would like to hear the jingle of their money in their pockets anyhow, took it. By Monday of this week what excitement there was had died down, and on Tuesday more money was received on deposit, than was paid out. Everybody here counts the bank to be one of the strongest in the state, and safe beyond question, and its stock is quoted among the highest.