Article Text

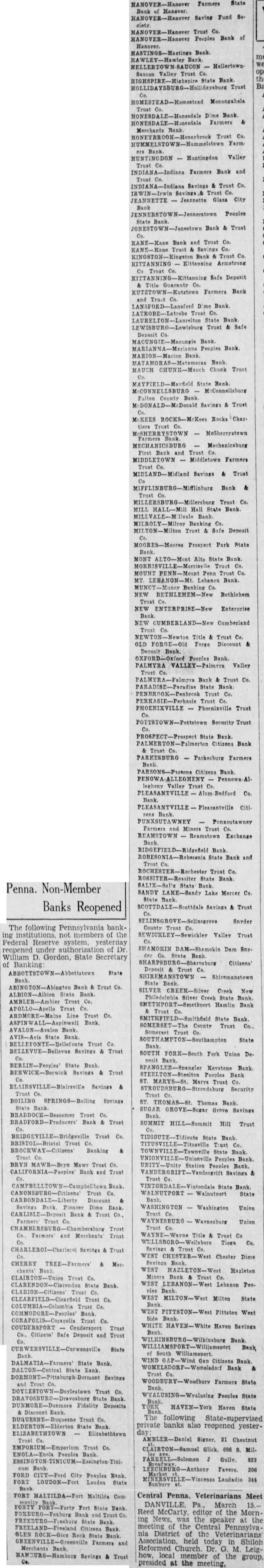

Non-member Banks to Reopen in State The following Pennsylvania banking institutions. not members of the Federal Reserve system. last night were authorized by Dr. William D Gordon State Secretary of Banking, to reopen today for normal business: ABBOTTSTOWN State Bank BELLEFONTE Trust BOILING SPRINGS State Bank Bank CARLISLE Deposit Bank & Trust Trust Co. CHAMBERSBURG Co. CHAMBERSBURG Farmers and Merchants Trust COLUMBIA Trust BERLIN Peoples State Bank PROSPECT State Bank Trust Co. ENOLA Peoples Bank FORT State Bank GLEN State Bank Savings Trust Co. HANOVER. Farmers State Bank Hanover HANOVER Saving Fund Society HANOVER Trust HANOVER Peoples Bank of HanHIGHSPIRE State Bank Farmers Bank JONESTOWN Bank Trust Co. KUTZTOWN Farmers Bank and County Bank MARION Bank First Bank Trust MIDDLETOWN Farmers Trust MILLERSBURG Trust Co. MILROY Banking MONT ALTO State Bank MOUNT PENN Trust NEW MBERLAND Trust Co. PALMYRA VALLEY Trust PALMYRA Bank Trust Co. PARADISE State Bank PENBROOK Trust FORT Maltilda Community Bank REAMSTOWN Exchange Bank RIDGEFIELD Bank ROBESONIA State Bank and Trust State Bank THOMAS Bank STEELTON Peoples Bank WOMELSDORF Bank Trust YORK HAVEN State Bank State Bank BERWICK Savings Trust Co. BRADFORD Producers Bank Trust CARBONDALE Liberty Discount Bank CARBONDALE Pioneer Dime Bank Citizens Safe Trust Co. DALMATIA State Bank DALTON Central State Bank DUNMORE Fidelity Deposit Discount Bank EMPORIUM Trust Co. FORTY FORT State Bank FREEBURG State Bank FREELAND Citizens Bank HAWLEY Bank Farmers & Merchants Dime Bank KANE Bank and Trust Co. KANE Trust Savings KINGSTON Bank Trust Co. LANSFORD Dime Bank LAURELTON State Bank. LEWISBURG Trust & Safe Deposit MATAMORAS Bank MAUCH CHUNK Trust Co. MAYFIELD State Bank MIFFLINBURG Bank & Trust MILL HALL State Bank MILTON Trust Safe Deposit Banking Co. SILVER New PhiladelPhia Silver Creek State Bank FORGE Discount Deposit Bank PALMERTON Citizens Bank Trust Citizens Bank Trust SELINSGROVE Snyder County Trust Co. SHAMOKIN DAM Snyder Co. State SMETHPORT Hamlin Bank STROUDSBURG Security Trust HILL Trust Co. WELLSBORO Tioga Co. Savings Trust HAZLETON Miners Bank WEST MILTON State Bank. WEST PITTSTON West Side Bank WHITE HAVEN Savings Bank WILLIAMSPORT Bank of South Williamsport VYALUSING Peoples State Bank ABINGTON Trust Co. AMBLER ARDMORE Main Line Trust Co. BRISTOL Trust Co. BRYN MAWR Trust Co. DOYLESTOWN Trust Bank. Valley Trust Trust Co. HUNTINGDON VALLEY Trust Bank MORRISVI Trust Co. NEWTON Title Trust Co. OXFORD Bank Farmers Bank PERKASIE Trust Co. PHOENIXVILLE Trust Co. POTTSTOWN Security Trust Co. MOORES Prospect Park. State Bank State Bank UNIONVILLE Peoples Bank State Bank WAYNE Title Trust WEST CHESTER Dime Savings Bank WIND GAP Citizens Bank ALBION State Bank APOLLO Trust Bank AVALON Bank BELLEVUE Savings & Trust Co. BLAIRSVILLE Savings Trust BRADDOCK Bessemer Trust Co. Trust Citizens Banking Trust Peoples Bank and Trust CANONSBURG Citizens Trust CHARLEROI Savings Trust CHERRY TREE Farmers Merchants Bank CLAIRTON Union Trust Co. CLARENDON State Bank CLARION Citizens Trust Co. CLEARFIELD Trust Co. COMMODORE Peoples Bank CORAOPOLIS Trust Co. State Bank Savings Trust DRAVOSBURG State Bank DUQUESNE Trust Co. ELDERTON State Bank FORD CITY Peoples Bank Bank and Trust Co. GREENVILLE Farmers and Merchants Bank HASTINGS Bank Trust Co. Monangehela Trust INDIANA Farmers Banks and Trust INDIANA Savings and Trust Co. IRWIN Savings Trust JEANNETTE City Bank JENNERSTOWN Peoples State Bank Armstrong Co. Trust Safe Deposit Title Guaranty LATROBE Trust McDONALD Savings Trust Co. MARIANNA Peoples Bank McKEES ROCKS Chartiers Trust Co. MIDLAND Savings Trust Co. Bank MT LEBANON Bank NEW BETHLEHEM Trust Co. NEW ENTERPRISE Bank ford Co. Bank Citizens Bank PUNXSUTAWNY Farmers and Miners Trust Trust Co. ROSSITER State Bank SALIX State SANDY LAKE Mercer Co. State Bank Savings Trust SEWICKLEY Valley Trust Co. Citizens' Deposit Trust SMITHFIELD State Bank County Trust SOMERSET Trust Co. SOUTH FORK Union Deposit Bank Keystone Bank SUGAR GROVE Savings Bank TIDIOUTE Bank TITUSVILLE Trust TOWNVILLE State Bank UNITY Station Peoples Bank VANDERGRIFT Savings & Trust Valley Trust VINTONDALE State Bank WASHINGTON Union Trust Co. Union WEST LEBANON Peoples Bank WOODBURY State Bank The following private banks were authorized open today: LEECHBURG. Anthony Favero, 206 Market CLAIRTON. Samuel Glick, 606 Miller FARRELL Solomon J. Gully, 823 adio, 344 Sunbury AMBLER Daniel Signor, 21 Chestnut MAYSVILLE State National MT. STERLING Montgomery National MT. STERLING National MT. STERLING Traders' NationNEWPORT National First National RICHMOND State Bank and Trust SOMERSET Citizens' National SOMERSET First National WINCHESTER Clark County National CORRY National Bank First National BRADY Peoples National EMLENTON First National EVANS Citizens' National FRYBURG GROVE First National GROVE National HERMINIE First National HOUSTON First National KITTANNING Farmers' National KNOX Clarion County National MANOR National MARS National Bank McKEESPORT National Bank MEADVILLE Crawford County Trust MEADVILLE First National National Bank and Trust Citizens' National NEW CounNEW BRIGHTON Old National Bank NORTHEAST National Bank OAKDALE First National PARKERS LANDING First National POINT MARION First National County tional National REYNOLDSVILLE First National ROCHESTER First National SALISBURY First National SCALP LEVEL Merchants' and Miners' SCENERY HILL First National SHEFFIELD First National SIPESVILLE First National STONEBORO First National TIONESTA Forest County Na. tional UNION CITY Home National VOLANT First National WASHINGTON Peoples' National WATERFORD National WEST NEWTON First National WINDBER Trust CENTRAL National DAWSON First National PERRYOPOLIS First National SHARPSVILLE First National YOUNGWOOD First National ZELIENOPLE First National AVONMORE National CLINTONVILLE People's Nation ELLSWORTH National EMLENTON Farmers' National FRIEDENS First National JEROME First National First National Citizens' National MONACA National MONONGAHELA City First Na. tional TITUSVILLE National WASHINGTON Citizens' Nation- WEST ALEXANDER People's National WILMERDING First National MERCER First National SOMERSET First National WEST MIDDLESEX First National Bank ZELIENOPLE People's National. ALIQUIPPA First ALIQUIPPA Woodlawn Trust AHBRIDGE Economy National BRADDOCK National BROWNSVILLE National DeCASTLE SHANNON First tional CHARLEROI National Bank and Trust National National Bank and Trust DONORA Union National ELLWOOD People's National ETNA First National FREEDOM National GREENVILLE National HAYS National KITTANNING Farmers' National KITTANING Merchants National LIGONIER First National LYNDORA McKEESPORT First National, McKEESORT People's City Bank Second National MIDLAND First National NEW THLEHEM First Nation- NEW BRIGHTON-Union National ARNOLD National Deposit NEW KENSINGTON First Na NEW KENSINGTON Logan Na. tional Bank and Trust NEW SALEM First National OAKMONT First National People's National First National First National SHARON National SMITHTON First National SPRINGDALE National National EAST PITTSBURGH Savings MARION CENTER National NATRONA First National AMBRIDGE National CLAYSVILLE Farmers' National CORAOPOLIS National GREENVILLE First National HOMESTEAD First National INDIANS First National National LATROBE First National NEW KENSINGTON Parnassus National SEWICKLEY First National SHARON Merchants' and Manufacturers' National SLIPPERY ROCK-First National UNIONTOWN Second National WARREN National Rhode Island PROVIDENCE March State-controlled banks outside City Providence which will reopen Wednesday include Trust Company. Trust Com SOUTH Trust Trust Com- Trust Com WEST Trust Com Authorization for the reopening five other Rhode Island banks, members of the Federal Reserve, outside of Providence is expected late tonight or early tomorrow from Boston These banks are National National Bank NORTH National National National