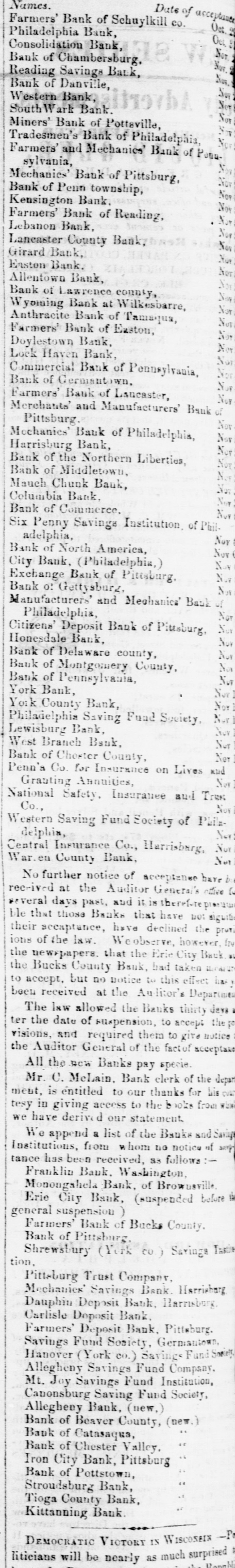

Article Text

Consolidation Bank, Nov. Bank of Chambersburg, Nov. Reading Savings Bank, Bank of Danville, Nov.1 Western Bank, ,Nove South Wark Bank Nov. Miners' Bank of Pottaville, WE Tradesmen's Bank of Philadelphia, Nov, Farmers' and Mechanics' Bank of Ponasylvania, Nov: Mechanics' Bank of Pittsburg, AGA Bank of Penn township, Nov: Kensington Bank, Nov, Farmers' Bank of Reading, Nov. Lebanon Bank, Nor: Laneaster County Bank, Nov Girard Bank, Nor Easton Bank, Nov, Allentown Bank, Nov, Bank of Lawrence county, Novi Wyoming Bank at Wilkesbarre, Nor, Anthracite Bank of Tamaqua, Nov, Farmers' Bank of Easton, Nov. Doylestown Bank, Nov. Lock Haven Bank, Nor Commercial Bank of Pennsylvania, Nov. Bank of Germantown, Nov. Farmers' Bank of Lancaster, Nov. Merchants' and Manufacturers' Bank of Pittsburg. Nov. Mochanies' Bank of Philadelphia, Nov Harrisburg Bank, Nov. Bank of the Northern Liberties, Nov, Bank of Middletown, Nov. Mauch Chunk Bank, Nov. Columbia Bank, ,Now, Bank of Commerce. Nov Six Penny Savings Institution, of Philadelphia, Nov / Bank of North America, Nov City Bank, (Philadelphia,) Nov Nov Exchange Bank of Pittsburg, Bank 0: Gettysburg, Nov Manufacturers' and Mechanica' Bank of Philadelphia, Nov Nov Citizens' Deposit Bank of Pittsburg, Honesdale Bank, No Bank of Delaware county, Nov. Nov Bank of Montgomery County, Bank of Pennsylvania, NW York Bank, Nov1 York County Bank, Nor] Nor] Philadelphia Saving Fund Society, Lewisburg Bank, Nov West Branch Bank, Nor Not Bank of Choster County, Penn'a Co. for Insurance on Lives and Granting Annuities, Nov.] National Safety, Insurance and Trust Co., Nov Western Saving Fund Society of Philadelphia, Nov. Central Insurance Co., Harrisbarg, Nov War. en County Bank, Not No further notice of acceptance have be received at the Auditor General's office (4 several days past, and it is therefore preus ble that those Banks that have not signition their accaptance, have declined the provi ions of the law. Woobserve, however. fre the newspapers. that the Erie City Back au the Bucks County Bank, bad taken to accept, but no notice to this effect has : been received at the Author's Department The law allowed the Banks thirty days ter the date of suspension, to accept the pr visions, and required them to give notice the Auditor General of the factor acceptant All the new Banks pay specie. Mr. C. McLain, Bank clerk of the depart ment, is entitled to our thanks for his tesy in giving access to the books from which we have derive di our statement We append a list of the Banks and Savings Institutions, from hom no notice of servy tance has been received, as follows :-