Article Text

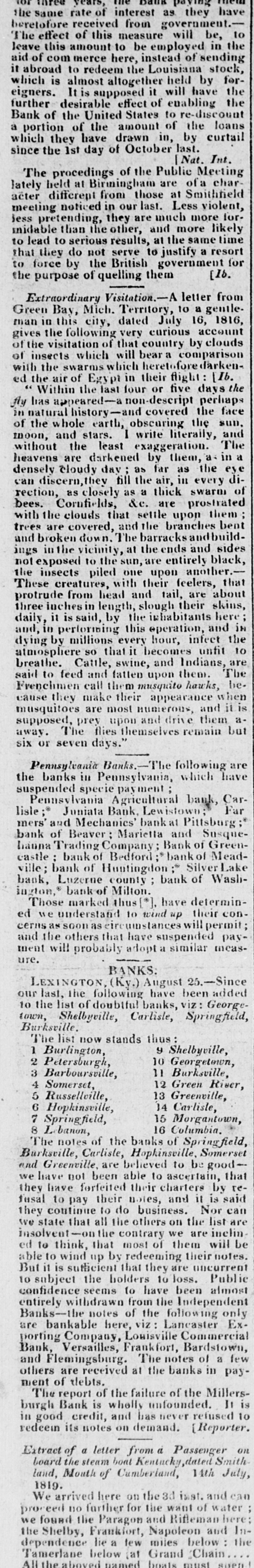

acter ancrep those a meeting noticed in our last. Less violent, less pretending, they are much more forunidable than the other, and more likely to lead to serious results, at the same time that they do not serve to justify a resort to force by the British government for [Ib. the purpose of quelling them Extraordinary Visitation.-A letter from Green Bay, Mich. Territory, to a gentleman in this city, dated July 16, 1816, gives the following very curious account the visitation of that country by clouds of insects which will bear a comparison with the swarms which heretofore darkened the air of Egypt in their flight: [Ib. Within the last four or five days the fly has sappeared-anon-descript perhaps in natural history-and covered the face of the whole earth, obscuring the SUB. moon, and stars. I write literally, and without the least exaggeration. The heavens are darkened by them, a in a densely cloudy day as far as the eye can discern,they till the air, in every direction, as closely as a thick swarm of bees. Cornfields, &c. are prostrated with the clouds that settle upon them ; trees are covered, and the branches bent and broken down. The barracksandbuildings in the at the ends and sides to the sun, are exposed vicinity, entirely another.- black, the insects piled one upon These with their creatures, tail, feelers, about that protrude from head and are inches in slough it is by the three daily, said, length, inhabitants their and skins, here; and, in performing this operation, in dying by millions every hour, infect the atmosphere so that it becomes untit 10 breathe. Cattle, swine, and Indians, are said to feed and fatten upon them. The call them musquito hawks, be. make their appearance cause Frenchmen they when it musquitoes are most numerous, and is supposed, prey upon and drive them aaway. The flies themselves remain but six or seven days." Pennsylvania Banks.-The following are the banks in Pennsylvania, which have suspended specie payment ; Pennsylvania Agricultural bank, CarFar lisle; Juniata Bank, Lewistown; mers' and Mechanics' bank at Pittsburg;* bank of Beaver Marietta and Susquehauna Trading Company; Bank bankol of Green- Meadcastle ; bank of Bedford; bank of Huntingdon: Luzerne county; bank bank, ville; Silver Lake of Washington," bank of Milton. Those marked thus *], have determined we understand to wind up their concerns as soonas circumstances will permit; and the others that have suspended payment will probably adopt a similar measure. BANKS: LEXINGTON (Ky.) August 25.-Since our last, the following have been added 10 the list of doubtful banks, viz: Georgetown, Shelbyville, Carlisle, Springfield, Burksville. The list now stands thus: y Shelbyville, 1 Burlington, 10 Georgetmun, 2 Petersburgh, 11 Burksville, 3 Barboursville, 4 Somerset, 12 Green Riser, 5 Russellville, 13 Greenville, 14 Carlisle, 6 Hopkinsville, 15 Morgantown, 7 Springfield, 8 Labon, 16 Columbia. The notes of the banks of Springfield, Burksville, Carlisle, Hopkinsville, Somerset and Greenville, are believed to be good- that have not been able to ascertain, we have forfeited their charters by said refusal they to pay their notes, and it Nor is continue to do business. can that all the others on contrary we are to that most of them wind up by redeeming insolvent-on the able we ed they state to think, their the uncurrent will list inelin- notes. are be Buti is sufficient that they are Public subject the holders 10 loss. almost 10 confidence seems to have been entirely withdrawn from the Independent only Banks-the notes of the following Exbankable here, viz : Lancaster are Company, Louisville Commercial Bardstown, Bank, porting Versailles, Frankfort, of a few Flemingsburg. The notes others and are received at the banks in payment of debts. report of the failure of the Millers- It is The Bank is whelly unfounded. refused 10 burgh credit, and has never redeein in good its notes on demand. {Reporter. Extract of a letter from a Passenger dated Smith on the steam boat Kentucky, July, board land, Mouth of Cumberland, 14th for We 1819. arrived here on the the 3d want last. of and water can ;