Article Text

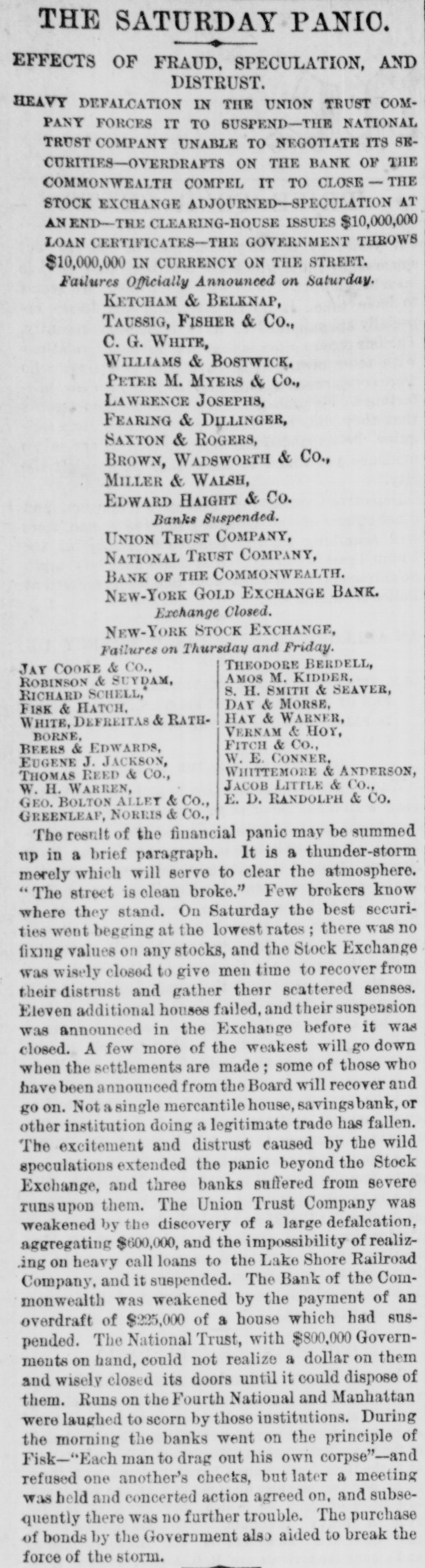

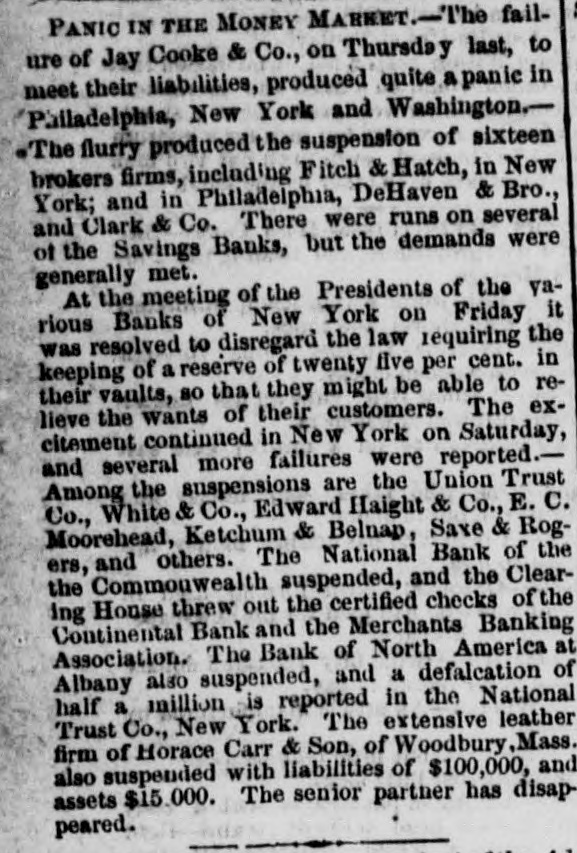

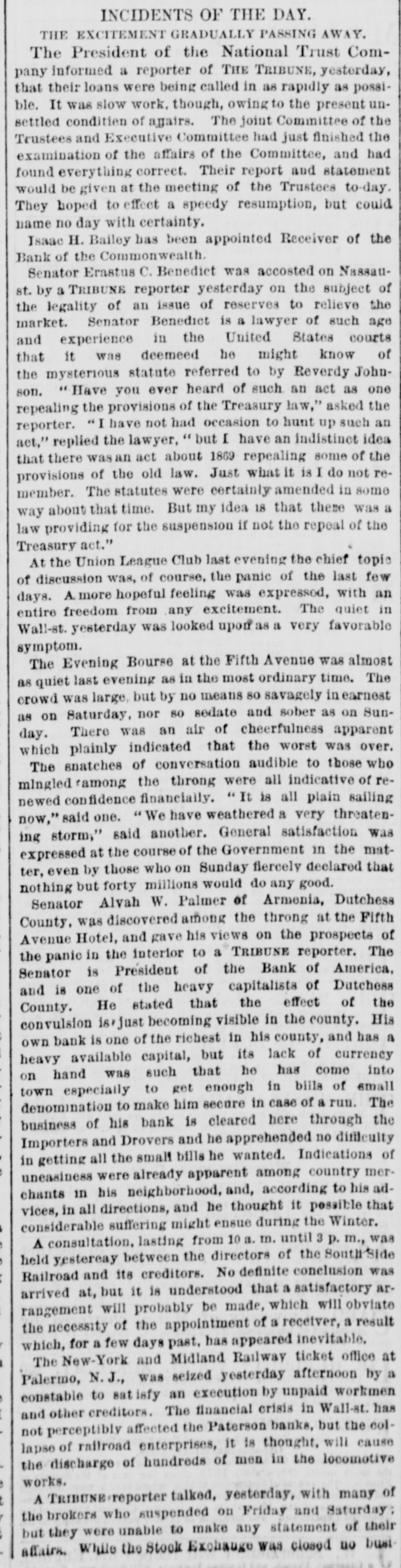

MEASURES FOR RELIEF. NEW YORK. # UNPRECEDENTED PANIC AT THE OPENING OF THE STOCK EXCHANGE-GREAT TUMBLE IN VALUES-GENERAL DISASTER IMMINENT-THE EXCHANGE CLOSED -A STARTLING DEFALCATION-BETTER FEELING IN THE EVENING. [Special telegram to the Dispatch.] NEW YORK, September 20.-To-day has witnessed one of the greatest panics that ever occurred on the Stock Exchange. At the opening there was an improvement of two to six per cent. in values, and great hopes were entertained that the end had been reached. But these hopes were soon destroyed when it was announced that the Union Trust Company had decided to stop until Monday. The suspension of the Trust Company was followed by that of the Bank of the Commonwealth, which closed its doors at an early hour. The excitement and panic which followed the suspension of these institutions were beyond description. The Stock Exchange RESEMBLED A MAD-HOUSE, and the streets were blocked with people, all laboring under great excitement and frenzy. Prices tumbled from two to sixteen per cent., and stocks were slaughtered without any apparent regard to values. Amid the surging of an excited crowd in the Stock Exchange and continued destruction of values there were some few cool and level heads. These men conceived the idea of imitating the Vienna plan of CLOSING THE EXCHANGE, and immediately the Governing Committee was convened to take action thereon. In a few moments the Board was called to order, and from the rostrum the announcement was made that the Exchange would be closed until further orders from the President. This was received with great joy, and the Exchange resounded with cheers. The gong was sounded, and in less time than it takes to record the fact the wild excitement was over, the surging crowd of frantic brokers disappeared, and the Stock Exchange was nothing but a deserted hall. All this happened in so short a time that it seems almost impossible, and only those on the spot can realize the remarkable change. All dealings on the street are strictly prohibited under penalty of expulsion, and therefore no business can be transacted. MORE SUSPENSIONS. Soon after the suspension of the Union Trust Company was reported the suspension of the National Trust Company was announced, and this served, if possible, to intensify the excitement. The failures of brokers then began to be announced, and in a short time the following names were read out: C. G. White & Co.; Ketchumn & Belknap; W. G. Broadhead & Co.; Saxton & Rogers; Williams & Bostwick; Miller & Walsh; E. Haight & Co.; Laurens & Joseph; P. M. Myers & Co.; Taussig, Fisher & Co.; Feasing & Bellinger; S. B. White. It is impossible to say where the list would have ended had not the Governing Committee of the Exchange decided to close the institution until the panic was over. About this time UGLY RUMORS BEGUN TO GAIN CURRENC. on the street of irregularities in the Union Trust Company, and it is found that Carleton, the secretary, son of Rev. Dr. Carleton, of the Methodist Book House, was a defaulter, some fixing the amount at $250,000, others at $500,000. It was not known that Carleton was a defaulter until some time yesterday afternoon, when his absence begun to give rise to suspicions. He remained at his desk until 12 o'clock yesterday, conversing freely but exhibiting signs of excitement and trepidation. He left the Trust Company saying he was too unwell to remain, and desired some rest. When it was necessary to consult him in regard to certain matters, he was not to be found, and then it was that the trustees began to SUSPECT HE WAS A DEFAULTER. Under a hurried examination into his affairs it soon became quite certain that he had