Article Text

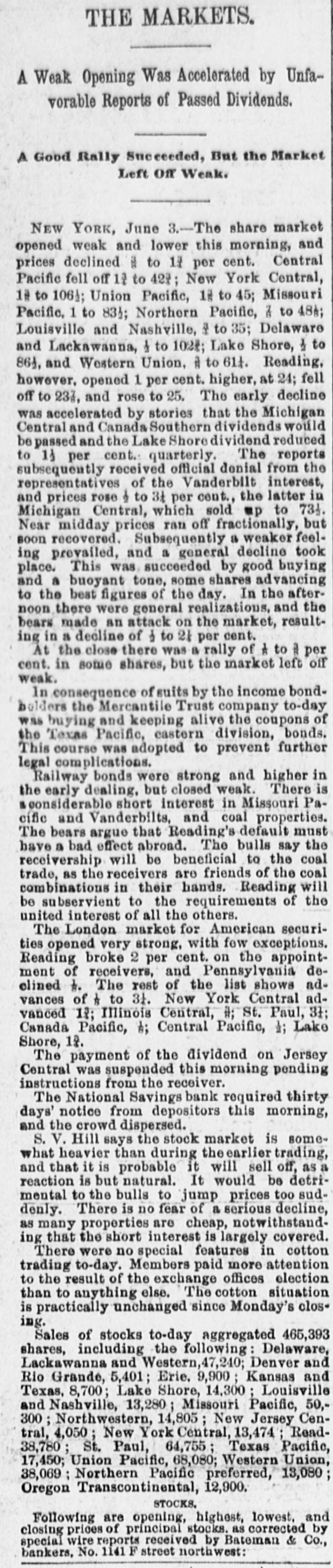

THE MARKETS. A Weak Opening Was Accelerated by Unfavorable Reports of Passed Dividends. A Good Rally Succeeded, But the Market Left Off Weak. NEW YORK, June 3.-The share market opened weak and lower this morning, and prices declined i to 11 per cent. Central Pacific fell off 11 to 423; New York Central, 1@ to 1061; Union Pacific, 1@ to 45; Missouri Pacific, 1 to 83}; Northern Pacific, 7 to 48#; Louisville and Nashville, I to 35; Delaware and Lackawanna, 1 to 1021; Lake Shore, 1 to 861, and Western Union, à to 614. Reading, however, opened 1 per cent. higher, at 24; fell off to 23], and rose to 25. The early decline was accelerated by stories that the Michigan Central and Canada Southern dividends would be passed and the Lake Shore dividend reduced to 11 per cent. quarterly. The reports subsequently received official denial from the representatives of the Vanderbilt interest, and prices rose à to 3t per cent., the latter in Michigan Central, which sold up to 731. Near midday prices ran off fractionally, but soon recovered. Subsequently a weaker feeling prevailed, and a general decline took place. This was succeeded by good buying and a buoyant tone, some shares advancing to the best figures of the day. In the afternoon there were general realizations, and the bears made an attack on the market, resulting in a decline of 1 to 21 per cent. At the close there was & rally of 1 to # per cent. in some shares, but the market left off weak. In consequence of suits by the income bondbolders the Mercantile Trust company to-day was buying and keeping alive the coupons of the Texas Pacific, eastern division, bonds. This course was adopted to prevent further legal complications. Railway bonds were strong and higher in the early dealing, but closed weak. There is a considerable short interest in Missouri Pacific and Vanderbilts, and coal properties. The bears argue that Reading's default must have a bad effect abroad. The bulls say the receivership will be beneficial to the coal trade, as the receivers are friends of the coal combinations in their hands. Reading will be subservient to the requirements of the united interest of all the others. The London market for American securities opened very strong, with few exceptions. Reading broke 2 per cent. on the appointment of receivers, and Pennsylvania declined 1. The rest of the list shows advances of # to 31. New York Central advanced 12; Illinois Central, #; St. Paul, 31; Canada Pacific, #; Central Pacific, 1; Lake Shore, 1%. The payment of the dividend on Jersey Central was suspended this morning pending instructions from the receiver. The National Savings bank required thirty days' notice from depositors this morning, and the crowd dispersed. S. v. Hill says the stock market is somewhat heavier than during the earlier trading, and that it is probable it will sell off, as a reaction is but natural. It would be detrimental to the bulls to jump prices too suddenly. There is no fear of a serious decline, as many properties are cheap, notwithstanding that the short interest is largely covered. There were no special features in cotton trading to-day. Members paid more attention to the result of the exchange offices election than to anything else. The cotton situation is practically unchanged since Monday's closing. Sales of stocks to-day aggregated 465,393 shares, including the following Delaware, Lackawanna and Western,47,240; Denver and Rio Grande, 5,401; Erie, 9,900 ; Kansas and Texas, 8,700; Lake Shore, 14,300 Louisville and Nashville, 13,280 ; Missouri Pacific, 50,300; Northwestern, 14,805 New Jersey Central, 4,050 New York Central, 13,474 ; Read38,780; St. Paul, 64,755; Texas Pacific, 17,450; Union Pacific, 68,080; Western Union, 38,069 ; Northern Pacific preferred, 13,080 Oregon Transcontinental, 12,900. STOCKS. Following are opening, highest, lowest, and closing prices of principal stocks. as corrected by special wire reports received by Bateman & Co., bankers, No. 1141 F street northwest: