Click image to open full size in new tab

Article Text

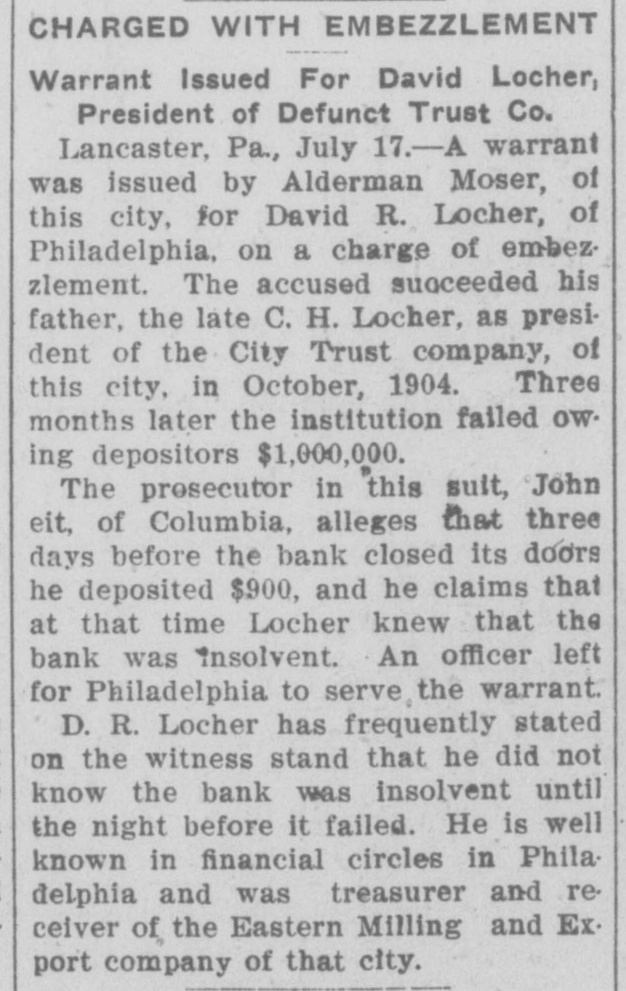

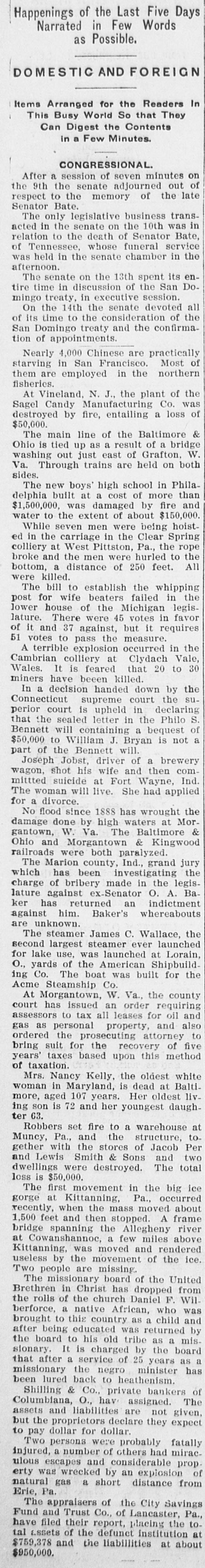

Happenings of the Last Five Days Narrated in Few Words as Possible. DOMESTIC AND FOREIGN Items Arranged for the Readers In This Busy World So that They Can Digest the Contents in a Few Minutes. CONGRESSIONAL. After a session of seven minutes out on of the senate adjourned late respect the 9th to the memory of the Senator Bate. The only legislative business was trans- in in the senate on the 10th Bate, relation acted to the death of Senator service Tennessee, whose funeral in the was of held in the senate chamber afternoon. senate on the 13th spent its Do- enThe time in discussion of the San tire treaty, in executive session. devoted mingo the 14th the senate of the all On time to the consideration of San its Domingo treaty and the confirmation of appointments. 4,000 Chinese are practically Most of Nearly in San Francisco. northern them starving are employed in the fisheries. Vineland, N. J., the plant Co. of was the At Candy Manufacturing loss of destroyed Sagel by fire, entailing a $50,000. main line of the Baltimore bridge & The is tied up as a result of a W. Ohio out just east of Grafton, both Va. washing Through trains are held on sides. The new boys high school in Phila- than built at a cost of more fire and $1,500,000, delphia was damaged by $150,000. water to the extent of about hoistseven men were being While the carriage in the Clear Spring rope ed colliery in at West Pittston, Pa., the to the and the men were hurled All killed. broke bottom, a distance of 250 feet. were bill to establish the whipping the The wife beaters failed in post for house of the Michigan legis- favor There were 45 votes requires it and 37 against, but it of lature. lower measure. in 51 votes to pass the the A terrible explosion occurred in Vale, Cambrian colliery at Clydach to 30 Wales. It is feared that 20 miners have beeen killed. In a decision handed down the by the suConnecticut supreme court declaring perior court is upheld in Philo S. the sealed letter in the of Bennett that will containing a bequest not a $50,000 to William J. Bryan is part of the Bennett will. Joseph Jobst, driver of a brewery comshot his wife and then Ind. The wagon, mittted suicide at Fort Wayne, woman will live. She had applied for divorce. No a flood since 1888 has wrought Mor- the done by high waters at & damage W. Va. The Baltimore Kingwood gantown, Ohio and Morgantown & railroads were both paralyzed. The Marion county, Ind., grand jury the has been investigating legiswhich of bribery made in the A. Balature charge against ex-Senator indictment O. has returned an unknown. against ker him. Baker's whereabouts are steamer James C. Wallace, launched the The largest steamer ever Lorain, second lake use, was launched at for of the American Shipbuild- the ing O., yards Co. The boat was built for Acme Steamship Co. At Morgantown, W. Va., the county has issued an order requiring and assessors court to tax all leases for and oil also personal property, gas ordered as the prosecuting attorney of five to suit for the recovery method years' bring taxes based upon this of taxation. Mrs. Nancy Kelly, the oldest white Baltiwoman in Maryland, is dead oldest at livaged 107 years. Her daughter 63. ing more, son is 72 and her youngest Robbers set fire to a warehouse to- at and the structure, Muncy, with Pa., the stores of Jacob two Per gether Lewis Smith & Sons and total and dwellings were destroyed. The loss The is first $50,000. movement in the occurred big ice at Kittanning, Pa., about gorge recently, when the mass moved A frame feet and then stopped. river bridge 1,500 spanning the Allegheny above Cowanshannoe, a few miles at was moved and rendered ice. useless Kittanning, by the movement of the people are missing. Two The missionary board of the United from in Christ has dropped WilBrethren rolls of the church Daniel F. was berforce, the a native African, who brought to this country as a child and by after being educated was returned misboard to his old tribe as a board the It is charged by the stonary. that after a service of 25 years as has a missionary the negro minister been lured back to heathenism. Shilling & Co., private bankers The of Columbiana, O., hav assigned. and liabilities are not given, assets but the proprietors declare they expect to dollar for dollar. Two pay persons were probably fatally miracinjured, a number of others had prop. ulous escapes and considerable was wrecked by an explosion from of natural erty gas a short distance Erie, Pa. The appraisers of the City Savings Pa., and Trust Co., of Lancaster, toFund filed their report, placing the have assets of the defunct institution at $950,000. $759,378 tal and the liabillities at about