Click image to open full size in new tab

Article Text

# KEYSTONE STATE CULLINGS

# WILL TEST MILEAGE BOOK PLAN

Attorney General Carson Has Started Suit to Restrain the Pennsylvania Railroad.

Attorney General Hampton L. Carson filed a bill in equity in the Dauphin courts to restrain the Pennsylvania and allied companies from collecting a $10 rebate on each interchangeable mileage book sold. The reasons cited by the attorney general for bringing suit are similar to those given at the time his bill was sent to the State printer for printing. The date of hearing has not yet been fixed.

The standing committees of the Pennsylvania state board of trade, which was organized at Harrisburg, to make a systematic campaign for the election of legislators pledged to a 2-cent flat passenger vote on the railroads, were appointed by ex-Mayor Vance C. McCormick of Harrisburg, president of the board. Following is a list of the standing committees: Constitution and by-laws: William H. Stevenson and W. A. Griffith, Pittsburgh; Wilmer Crow, Harrisburg; J. D. Wentz, Washington. Finances: William R. Brinton, Lancaster; Clarence E. Greesey, York; Joseph C. Smith, Harrisburg. Baggage and transportation: D. C. Shaw, Pittsburgh; F. H. MacIntyre, Philadelphia; H. D. Burlingame, Altoona. Interurban railways: D. D. Harmon, Pittsburgh; Representative William T. Creasy, Catawissa; A. M. Howes, Erie.

W. A. Stone has bought 150 acres of coal near Smock, from the Pittsburgh Coal Company for $1,300 an acre. He has also purchased the plant of the O'Connell Coal and Coke Company, near Smock for $70,000, and will increase the plant from 35 to 150 ovens. A new company will be organized with a capital stock of $200,000, and among those interested are W. A. Stone, L. H. Frasher, W. E. Crow and Dr. W. H. Hopwood of Uniontown.

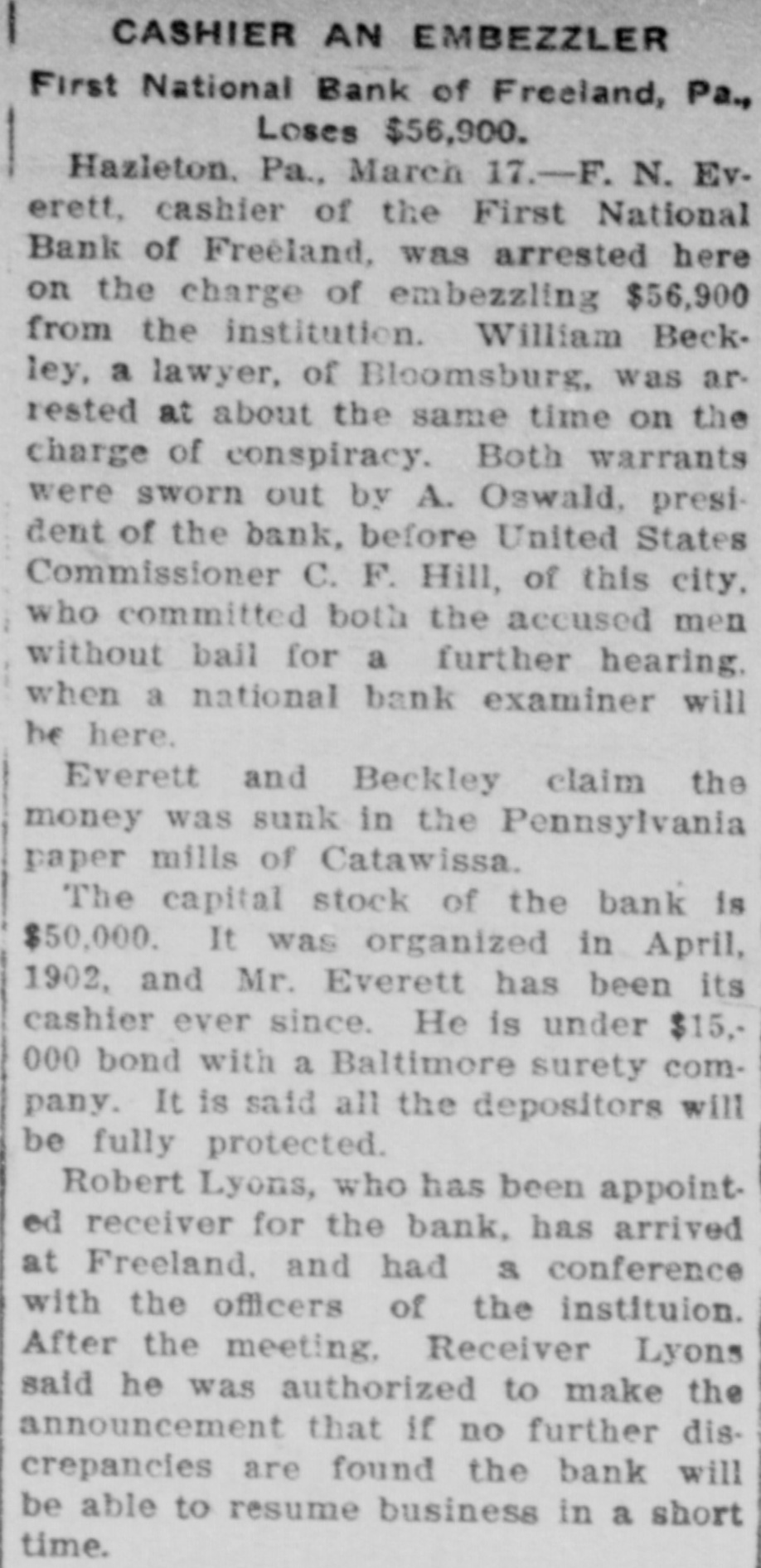

The First National Bank of Freeland, which was declared insolvent, and placed in the hands of a receiver March 17, 1906, having complied with the conditions imposed by the comptroller of the currency, precedent to resmuption, and its capital not being unimpaired, has been permitted to resume business as an active national banking association.

Two men were taken to the hospital in a dying condition, a third is seriously stabbed, several others are injured and seven men are in the Windber lockup as the result of a clash between union and non-union men at Paint Creek, near Windber.

Newton B. Weddell, of Chambersburg, who was arrested while running away with $400 he had secured from Mrs. Zlipha Ruthrauff on the representation that he meant to buy her a grocery store, was sentenced to three years in the penitentiary.

Gov. S. W. Pennypacker issued a requisition on Gov. Pardee, of California, for the return to Pennsylvania of L. H. Mitchell, who is wanted in Luzerne county to answer a charge of conspiracy in connection with a mining deal.

The Pennsylvania railroad has ordered the employes of the maintenance of way department to work 10 hours a day instead of 9. This gives an additional hour to about 12,000 men between Philadelphia and Pittsburgh.

Capt. Charles J. Harrison and Milton J. Pritts of the Somerset County National bank, sold 1,500 acres of "A" and "B" vein coal to the Penwood Coal Company, a $150,000 corporation composed mainly of New York capitalists.

Five footpads held up and robbed Leo Marks of $50 at a lonely bridge in North Bridgewater. Marks was so severely injured that it was an hour before he could crawl into the village and give an alarm.

George G. Gans has purchased from W. F. Patterson of Waynesburg 300 acres of coal land in Center township, Greene county, and 100 acres of coal land in Marion county, W. Va.

Palmyra, 10 miles west of Lebanon, had a serious fire. The blaze started in Shiner's bake shop, soon spreading and destroying a residence and several large barns.

Governor Pennypacker reappointed General John A. Wiley of Franklin and George F. Davenport of Meadville trustees of the Polk Institution for the Feeble Minded.

The poor directors of Fayette county have taken action to provide needy persons bitten by mad dogs with proper medical attention.

New Castle council ordered the city solicitor to file a bill in equity to compel the Bell Telephone company to use the new city conduit, which cost nearly $100,000.

The body of Luther Neiman, a Pennsylvania railway engineer who had been missing from his home in Harrisburg 10 days, was found in the Susquehanna river.

The Governor issued a death war-