Article Text

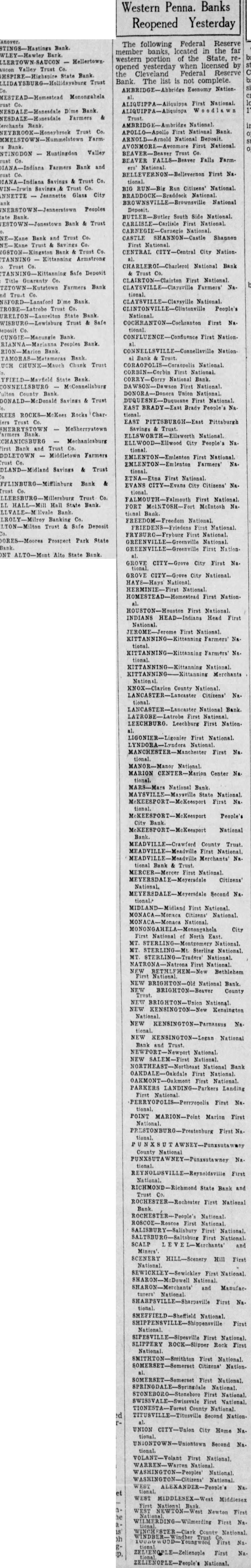

Western Penna. Banks Reopened Yesterday The following Federal Reserve member banks, located the far western portion the State, reopened yesterday when licensed by the Cleveland Federal Reserve Bank. The list is not complete. Economy Nation First National. National APOLLO-APOLLO National Bank ARNOLD-Arnold National First National. BEAVER FALLS-Beaver Falls FarmFirst Na. tional. BIG RUN-Bis Run Citizens National. National Deposit. South Side National. CARLISLE-Carlisle First National. National. CASTLE SHANNON-Castle Shannon CENTRAL CITY-Central City Nation. CHARLEROL-Charlerol National Bank Trust First National National. People's First Na. First Nation. CORBIN-Corbin First CORRY-Corry First National. Union National. First National People's EAST PITTSBURGH-East Pittsburgh Savings National. ELLWOOD-Ellwood City People's Na. National CITY-Evans City Citizens' Na. First National. First National. FRYBURG-Fryburg National. GREENVILLE-Greenville First Nation GROVE CITY-Grove City First Na. GROVE City National. First Nation. First National. INDIANS HEAD-Indians Head First Farmers' Na. KITTANNING-Kittanning Farmers' Na. National Merchants KNOX-Clarion County National. LANCASTER-Lancaster Citizens' Na. National Bank. First LEECHBURG. Leechburg First Nation LIGONIER-Lisonier First National. LYNDORA-Lyndora First Na. National. MARION Center Na. tional. National Bank. People's National County Trust First Merchants' Na. MERCER-Mercer First National. Second Na. MONACA-Moraca Citizens' National. City North East National. STERLING-Mt Sterling National. National. National. Bethlehem NEW Bank. NEW BRIGHTON-Beaver County NEW BRIGHTON-Union National KENSINGTON-New National NEW National and National SALEM-First National National Bank OAKDALE-Oakdale First National. First National. PARKERS First Na. POINT MARION-Point Marion First County National Na. First State Bank and ROCHESTER-Rochester First National First First National. First National. SCALP and Miners' SCENERY HILL-Scenery Hill First First National and First Na. National First First National SLIPPERY ROCK-Slipper First First National. First National. National. First National First National. National UNION CITY-Union City Home Na. UN10NTOWN-Uniontown Second Na. First National National WEST MIDDLESEX-West Middlesex Newton First First Na. Trust First Na. First Na. National.