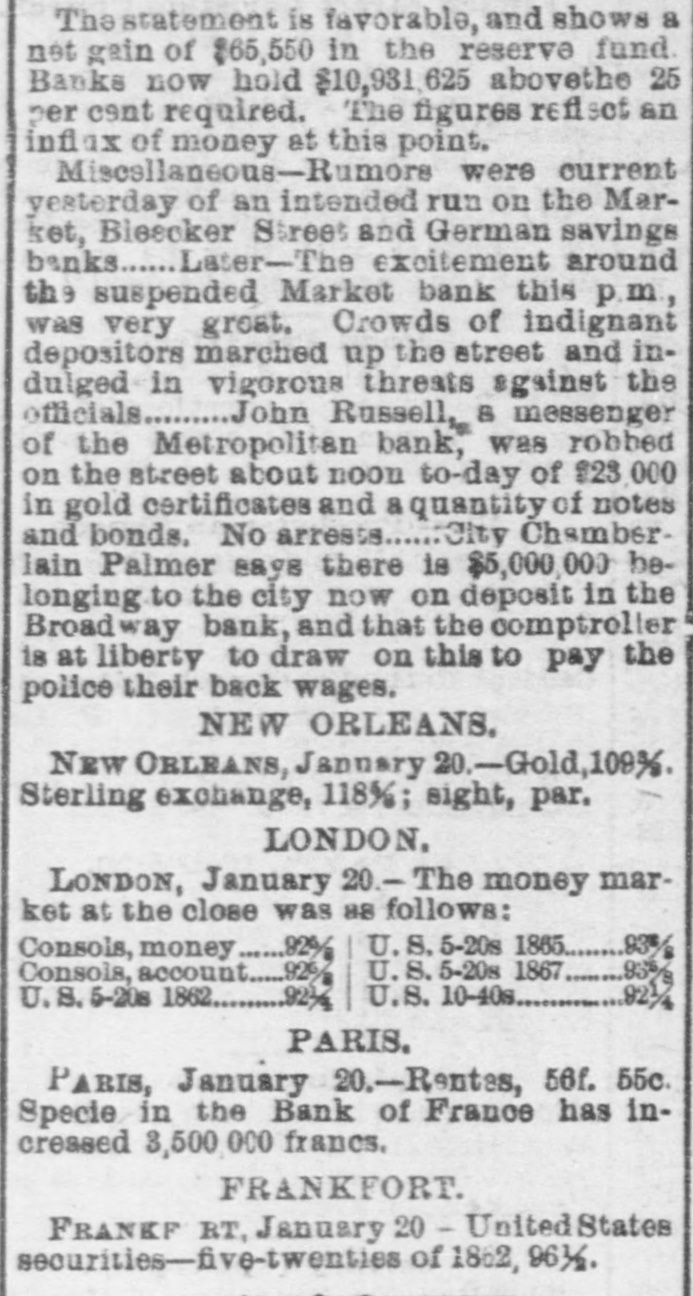

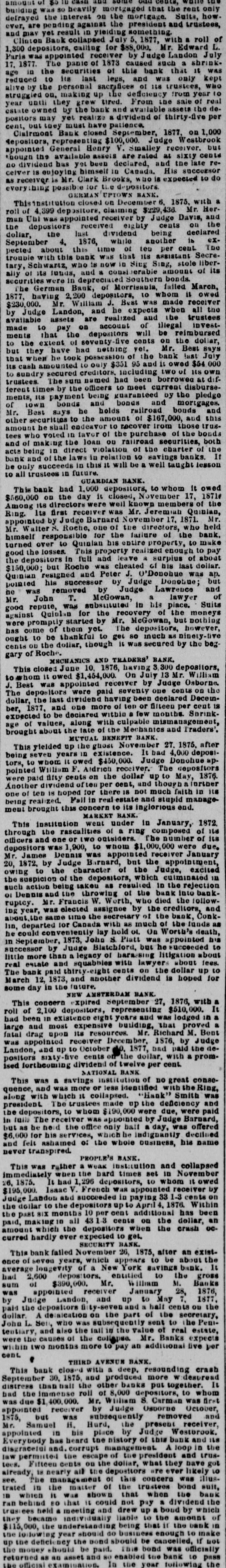

Article Text

amount of $0 building was so heavily mortgaged that the rent only defrayed the interest on the mortgage. Suits, how. ever, are pending against the president and trustees, and may yet result in yielding something. Clinton Baok collapsed July 5, 1877, with a roll of 1,300 depositors, calling for $88,000. Mr. Edward L. Paris was appointed receiver by Judge Landon July 17. 1877. The panie of 1873 caused such a shrinkage in the securities of this bank that It was reduced to 118 last legs, and was only kept alive by the personal sacrifices of 118 trustees, Who struggled on, making up the deficiency from year 10 year until they grew tired. From the sale of real estate owned by the bank and available assets the depositors may yet realize a dividend of thirty-five per cent, out toey must have patience. Clairmont Bank closed September, 1877, on 1,000 Repositors, representi $100,000. Judge Westbrook appointed General Henry V. Smalley receiver. but though the available assets are rated at sixty cents no dividend bus yet been declared, and the late recelver is enjoying himself in Canada. His successor as receiver is Mr. Clark Brooks, no is expected to do thing possible for the depositors GERMAN UPTOWN BANK. This institution closed on December 6, 1875, with a roll of 4,399 depositors, claiming $229,436. Mr. Herman Uni was appointed receiver by Judge Davis, and the depositors received eighty cents on the dollar, the last dividend being declared September 4, 1876, while another is expected about this time of teu per cent. The trouble with this bank was that its assistant Secretary, Schwartz, who is now in Sing Sing, stole liberally of its lunds, and a consi erable amount of its securities were in depreciat Southern bonds. The German Bank, of Morrisauia, failed March, 1877, having 2,200 depositors, 10 whom 11 owed $230,000. Mr. William J. Best was made receiver by Judge Landon, and he expects when all the available assets are realized and the trustees made to pay on account of illegal investments that the depositors will be reimbursed to the extent of seventy five cents on the dollar, but they have had nething yet. Mr. Best says that when he took possession of the bank last July its cash amounted to only $351 95 and it owed $54 000 to sundry secured creditors. including two of its own trustees The sum named had been borrowed at different times by the officers LO meet current disbursements, its payment being guaranteed by the pledge of 10wn bonds and bonds and mortgages. Mr. Best says he holds railroad bonds and other securities to the amount of $167,000, and this amount he shall endeavor to recover from those trustees who voted in favor of the purchase of the bonds and of making the loan on railroad securities, both acts being in direct violation of the charter of the bank and of the laws in relation to savings banks. If he only succeeds in this it will be a well taught lesson to all trustees in future. GUARDIAN BANK. This bank had 1,000 depositors, to whom it owed $560,000 on the day it closed, November 17, 1871# Among its directors were well known members of the Ring. Its first receiver was Mr. Jeremiah Quinlan, appointed by Judge Barnard November 17, 1871. Mr. Mr. Walter S. Roche, one of the directors, who held himself responsible for the failure of the bank. turned over to Quinlan his entire property, to make good the losses. This property realized enough to pay the depositors in full and leave a surplus of about $150,000; but Roche WMS cheated of his last dollar. Quintan resigned and Peter J. O'Donohue was ap. pointed his successor by Judge Donohue; but no Was removed by Judge Lawrence and Mr. John T. McGowan, a lawyer of good repute, WILL substituted in his place. Suits against Quiolan for the recovery of the moneys were promptly started by Mr. McGowan, but nothing has come of them yet. The depositors, however, ought to be thankful to get so much as ninety live cents OD the dollar, though it Was secured by the beggary of Roche. MECHANICS AND TRADERS' BANK. This closed June 10, 1876, having 3, 300 depositors, to whom it owed $1,454,000. On July 13 Mr. William J. Best was appointed receiver by Judge Osborne. The depositors were paid seventy one cents on the dollar, the last dividend having been declared December, 1877, and one more of ten or filteen per cent 18 expected to be declared within a few months. Snrinkage of values, along with culpable mismanagement, brought about the tate of the Mechanics and Traders'. MUTUAL BENEFIT BANK. This yielded up the ghost November 27. 1875, after being seven years in existence. It bad 4,000 depositors, to whom It owed $450,000. Judge Donohue appointed William F. Addried receiver. The depositors were paid fifty cents on the dollar up to May, 1876. Another dividend of ten per cent, and though a (orther one of ten 18 hoped for there 18 not much faith in its being realized. Fall in real estate and stupid management brought this concern to its inglorious end. MARKET BANK. This institution went under in January, 1872. through the rasculities of ring composed of its officers and one or two outsiders. The number of its depositors was 1,900, to whom $1,000,000 were due. Mr. James Dennis was appointed receiver January 20, 1872, by Judge Barnard, but the appointment, owing to the character of the Judge, excited the suspicion of the depositors, which culminated 12A such action being taken as resulted in the rejection 01 Dennis and the throwing of the bank into bankruptcy. Mr. Francis W. Worth, who died the following year, was elected assignee by the creditors, and about the same time the secretary of the bank, Conklin, departed for Canada with as much of the funds as he could conveniently lay hold OI. On Worth's death, in September, 1873, John S. Platt was appointed his successor by Judge Blatchford, but he succeeded to little more than a legacy of barassing litigation about real estate and squabbles with lawyers about fees. The bank paid thirty-eight cents on the dollar up to March 12. 1873, and another dividend is hoped for some day in the future. NEW AMSTERDAM BANK. This concern expired September 27, 1876, with a roll of 2,100 depositors, representing $510,000. It had been in existence eight years and was lodged in a large and most expensive building, that proved a fatal drag upon its resources. Mr. Richard M. Bent was appointed receiver December, 1876, by Judge Landon, and up to October 1877, bad paid the depositors sixty-five cents our the dollar. with a promised forthcoming dividend of twelve per cent. NATIONAL BANK This was a savings institution of no great consequence, and was more or less identified with the Ring, along with which It collapsed. "Hank" Smith was president. The trustees made up the deficiency and the depositors, to whom $190,000 were due, were paid in falls The receiver was appointed by Judge Barnard, but as be neid the office only ball a day, was offered $6,000 for his services, which he indignantly declined and felt ashamed o: the whole business, his name never transpired. PROPLE'S BANK. This was rather a weak institution and collapsed immediately when the hard times set in November 26, 1875. It had 1,296 depositors, to whom it owed $195,000. Isaac V. French Was appointed receiver by Judge Landon and succeeded in paying 33 1-3 cents on the dollar to the depositors up to April 4, 1876. Within the past SIX months 10 per cent additional has been paid, making 10 all 431-3 cents on the dollar, an amount which the depositors when the crash OCcurred hardly ever expected to get. SECURITY BANK. This bank failed November 26, 1875, after an existonce of seven years, which appears to be about the average longevity of a New York savings bank. It had 2,600 depositors, entitled to the gross sum of $390,000. Mr. William M. Banks was appointed receiver January 28, 1876, by Judge Landon, and up to May 1877, paid the depositors ty-seven and a half cents on the dollar. A delalcation on the part of the secretary, John L. Sen, who was subsequently sent to the Pemtentiary, and also the tall 10 the value of real estate, were the causes of the collepse. Mr. Banks expects within two months more to pay an additional live per cent THIRD AVENUE BANK. This bank closed with a deep. resounding crash September 30, 1875, and produced more w despread distress than hall the other banks put together. It bad the immense roll of 8,000 depositors, to whom was due $1,400,000. Mr. William S. Carman was first appointed receiver by Judge Osborne October, 1875, but was subsequently removed and Mr. Samuel H. Hurd, the present receiver, appointed in bis place by Judge Westbrook. Everybody has heard the history of this bank and its disgraceful and. corrupt management A loop in the law permited the escape of the president and trustees. Fifteen cents on the dollar, what they have got already is nearly all the depositors are ever likely LO see. The management of this concern was illustrated in the matter of the trustees bond suit, ID which " was shown that when the bank ran behind 80 that it could not pay a dividend the trusiees held a meeting and drew up a bond by which they became individually liable to the amount of