Article Text

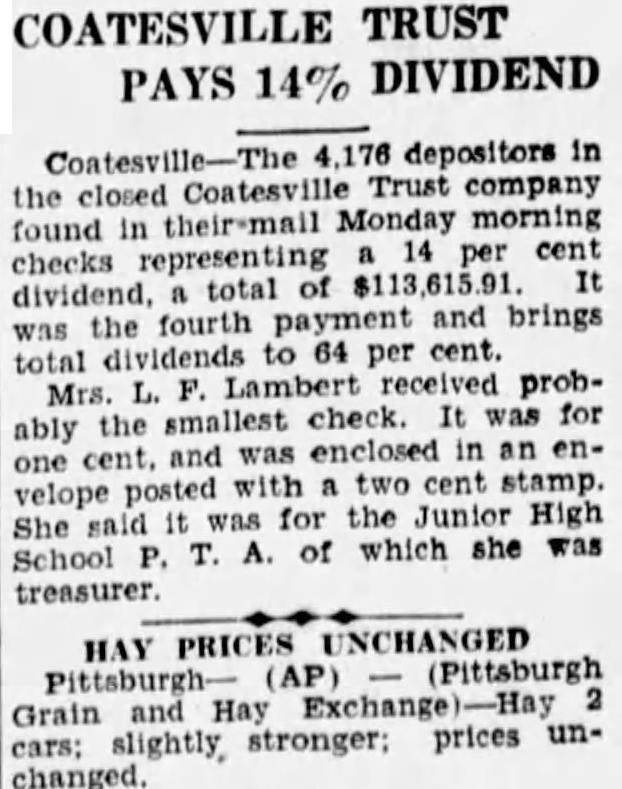

COATESVILLE TRUST PAYS 14% DIVIDEND Coatesville- The 176 depositors in the closed Coatesville Trust company found in their-mail Monday morning checks representing 14 per cent dividend, total of $113,615.91. fourth payment and brings was the total dividends to 64 per cent. Mrs. F. Lambert received probably the smallest check. It was for one cent. and enclosed in an envelope posted with two Junior ent High for the She T. of which she was School P. treasurer. HAY PRICES UNCHANGED (AP) Grain Hay slightly stronger; prices unchanged.