Article Text

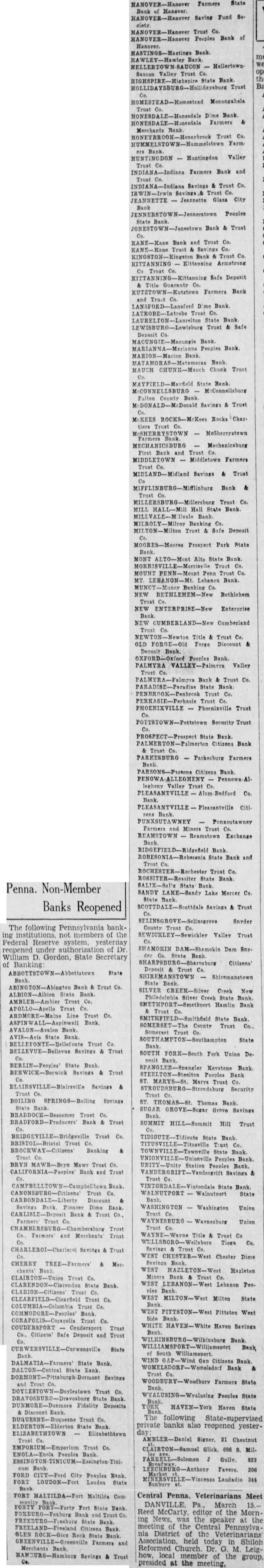

Penna. Non-Member Banks Reopened The following Pennsylvania banking institutions, not members of the Federal Reserve system, yesterday reopened under William D. Gordon, State Secretary of Banking State Bank Trust Co. ALBION-Albion Bank AMBLER-Ambler Trust Co. APOLLO-Apollo Trust ARDMORE-Maine Line Trust Co. Bank Trust Co. BELLEVUE-Bellevue Savings Trust BERLIN-Peoples' Bank. BERWICK-Berwick Trust BLAIRSVILLE-Blairsville Savings & BOILING SPRINGS-Boiling Springs Trust Co. BRADFORD-Producers Bank Trust Trust Co. Banking BRYN MAWR-Bryn Mawr Trust Bank and Trust Bank Trust Co. Dime Bank CARLISLE-Deposit Bank Trust Co., Farmers Farmers' and Merchants Savings Trust CHERRY & chants' Trust Co. Bank Trust Co. Trust Co. Trust Co. COUDERSPORT Coudersport Trust Citizens' Safe Deposit and Trust DALMATIA-Farmers' State Bank. DALTON-Central Savings Trust Co. Bank. DUNMORE-Dunmore Fidelity Deposits Discount Trust ELDERTON-Elderton State Bank. ELIZABETHTOWN Elizabethtown Trust Co. Bank FORD CITY-Ford City Peoples Bank. FORT LOUDON-Fort Loudon State Bank FORT MALTILDA-Fort Maltilda Com. Fort State Bank Bank State Bank. Citizens Bank ROCK-Gien State Bank Farmers and Merchants Savings Trust Farmers State HANOVER-Hanover Saving Fund Trust HANOVER-Hanover Peoples Bank of Bank Hellertown Trust State Bank Trust Trust Dime Bank HONESDALE-Honesdale Farmers Merchants Trust Co. HUNTINGDON Huntingdon Valley Trust Farmers Bank and Trust INDIANA-Indiana Savings Trust Co. IRWIN-Irwin Trust JEANNETTE Glass City Peoples JONESTOWN-Jonestown Bank Trust KANE-Kane Bank and Trust Co. KANE-Kane Trust Savings Co. Bank Trust Co. KITTANNING Kittanning Armstrong Trust Safe Deposit Farmers Bank Bank. LATROBE-Latrobe Trust State Bank. Trust Safe Bank. Peoples Bank CHUNK-Mauch Chunk Trust MAYFIELD-Mayfeld State McCONNELLSBURG McConnellsburg Fulton McDONALD-McDonald Savings Trust MECHANICSBURG Mechanicsburg First Trust Middletown Farmers MIDLAND-Midland Savings Trust Bank Trust Co. HALL-Mill Hall State Bank Bank. MILROLY-Milroy Banking MILTON-Milton Trust Safe Deposit MOORES-Moores Prospect Park State ALTO-Mont Alto State Bank. Trust MOUNT PENN-Mount Penn Trust Co. MT. LEBANON-Mt. Bank. BETHLEHEM-New Bethlehem NEW ENTERPRISE-New Enterprise Bank NEW Cumberland Trust Title Trust Co. OLD FORGE-Old Forse Discount OXFORD-Oxford Peoples Bank. PALMYRA VALLEY-Palmyra Valley Bank Trust Co. PARADISE-Paradise State Trust PHOENIXVILLE Phoenixville Trust Security Trust PROSPECT-Prospect Bank. Citizens Bank PARKESBURG Parkesburg Farmers Bank legheny Co. PUNXSUTAWNEY Farmers REAMSTOWN Reamstown Exchange Bank State Bank and Trust Co ROSSITER-Ressiter State Bank Bank. SANDY LAKE-Sandy Lake Mercer Co. State Savings Trust Snyder County SEWICKLEY-Sewickley Valley Trust SHAMOKIN Dam Sny. Citizens' Deposit SHIREMANSTOWN Shiremanstown State SILVER CREEK-Silver Creek New Philadelphia State Bank. Hamlin Bank SMITHFIELD-Smithfeld State Bank. County Trust Trust State SOUTH FORK-South Fork Union De. Keystone Bank Peoples Bank MARYS-St. Trust Security Trust THOMAS-St. Thomas Bank SUGAR GROVE-Sugar Savings SUMMIT HILL-Summit Hill Trust State Bank State Bank. State Bank. Walnutport State WASHINGTON Washington Union Union Trust Trust Co Tioga Co. Savings Trust WEST CHESTER-West Chester Dime Savings WEST HAZLETON-West Hazleton WEST LEBANON-West Lebanon Peo. WEST MILTON-West Milton State WEST PITTSTON-West Pittsten West WHITE HAVEN-White Haven Savings Bank Bank South Gan Bank. Bank WOODBURY-Woodbury Farmers State Peoples State HAVEN-York Haven State The following State-supervised private banks also reopened yesterSigner 21 Chestnut CLAIRTON-Samuel Glick. 606 Mil. Gully. 823 Laudadio 344 Central Penna. Veterinarians Meet DANVILLE. March 15.Reed McCarty editor the Morn ing News, was the the the Pennsylva nia District of the Veterinarians Association. held today in Shiloh Reformed Church. Leiglocal member the group, presided at the meeting.