Article Text

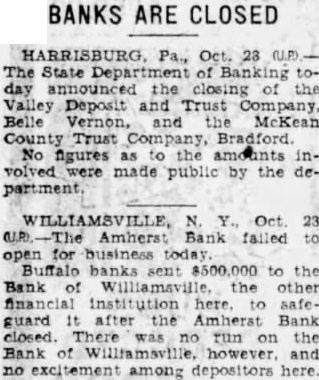

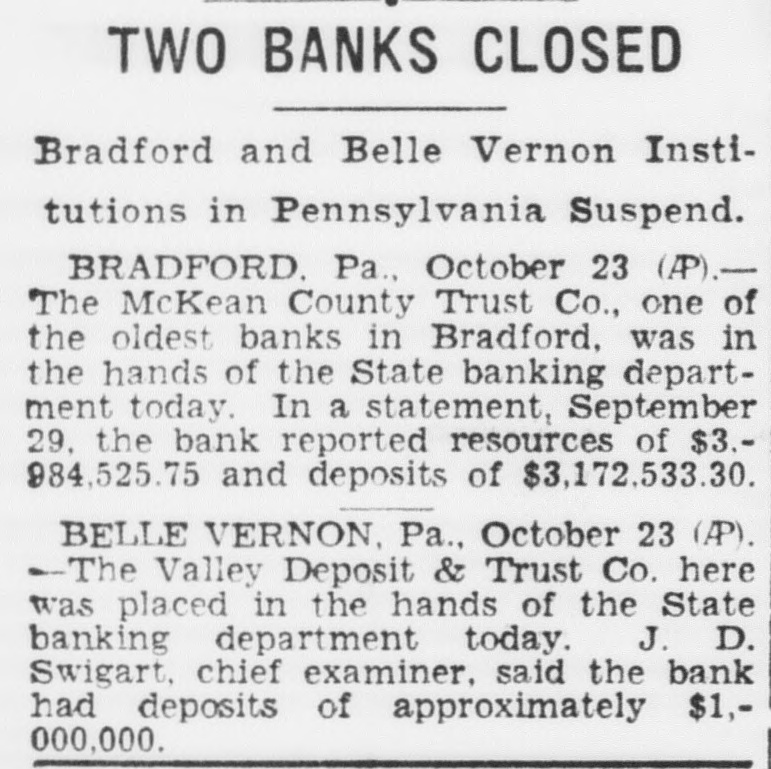

BANKS ARE CLOSED HARRISBURG, Pa., Oct. 23 The State Department of Banking today announced the closing of the Valley Deposit and Trust Company, Belle Vernon, and the McKean County Trust Company, Bradford. No figures as to the amounts involved were made public by the department WILLIAMSVILLE, Y., Oct 23 open for business today Buffalo banks sent $500,000 to the Bank of Williamaville. the other financial institution here. to safeguard It after the Amherst Bank closed. There was no run on the no excitement among depositors here.