Click image to open full size in new tab

Article Text

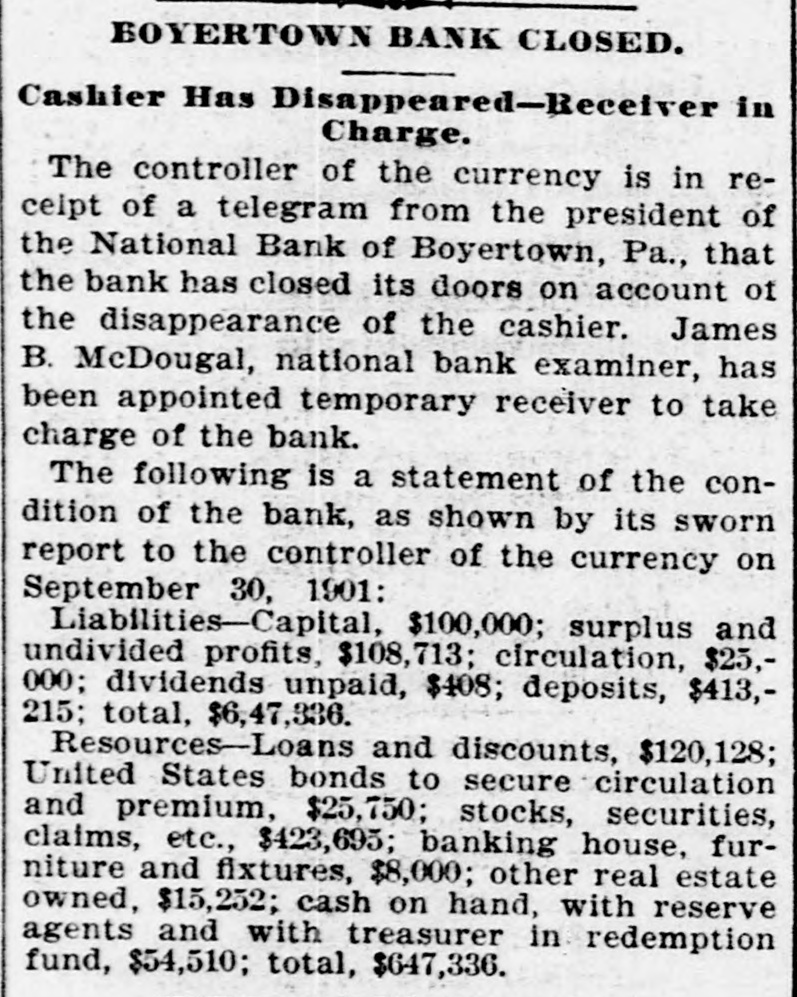

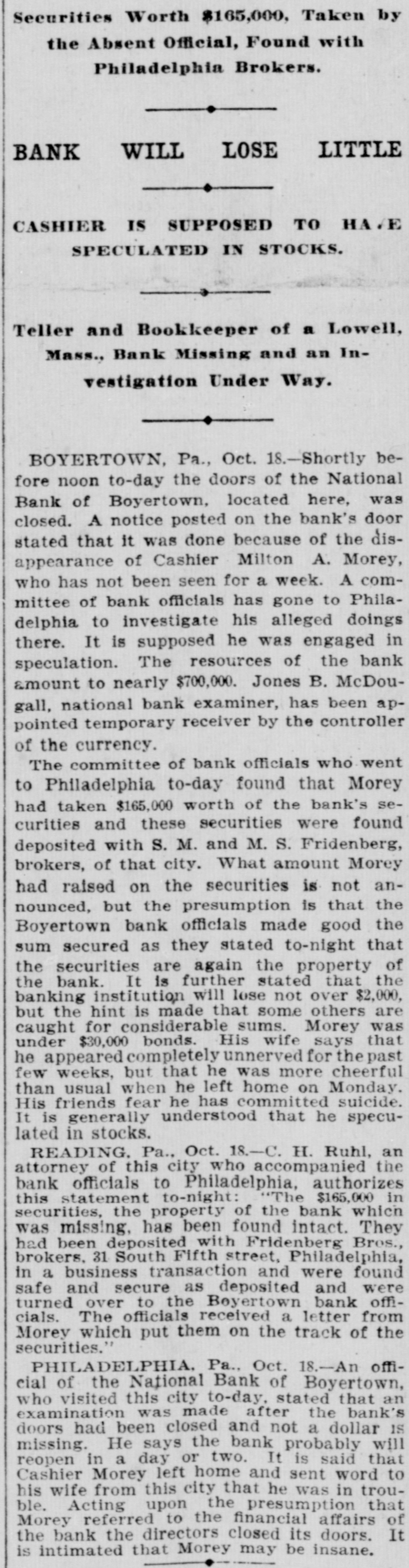

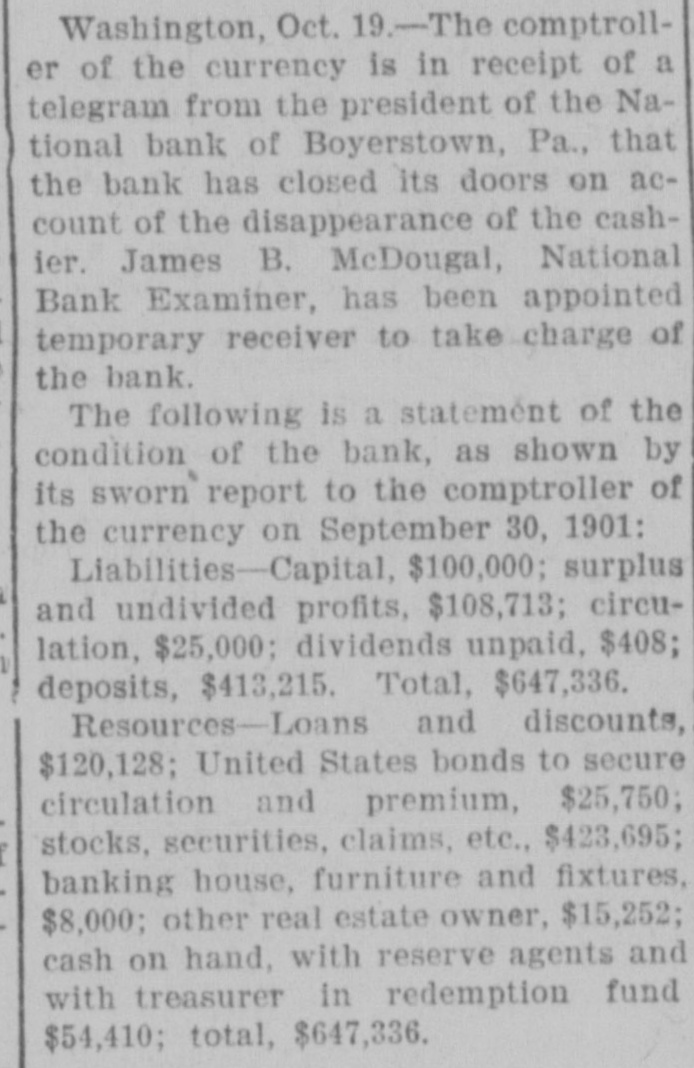

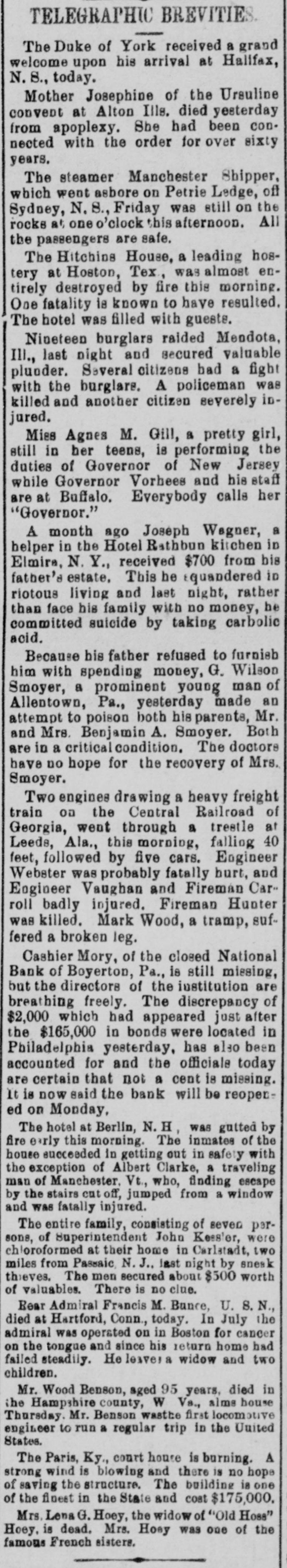

TELEGRAPHIC BREVITIES The Duke of York received a grand welcome upon his arrival at Halifax, N. S., today. Mother Josephine of the Ursuline convent at Alton Ills. died yesterday from apoplexy. She had been connected with the order for over sixty years. The steamer Manchester Shipper, which went asbore on Petrie Ledge, off Sydney, N. S., Friday was still on the rocks at one o'clock this afternoon. All the passengers are safe. The Hitchins House, a leading hostery at Hoston, Tex, was almost entirely destroyed by fire this morning. One fatality 18 known to have resulted. The hotel was filled with guests. Nineteen burglars raided Mendota, III., last night and secured valuable plunder. Several citizens bad a fight with the burglars. A policeman was killed and another citizen severely injured. Miss Agnes M. Gill, a pretty girl, still in her teens, is performing the duties of Governor of New Jersey while Governor Vorhees and his staff are at Buffalo. Everybody calls her "Governor." A month ago Joseph Wagner, a helper in the Hotel Rathbun kitchen in Elmira, N. Y., received $700 from bis father's estate, This he aquandered in riotous living and last night, rather than face his family with no money, be committed suicide by taking carbolic acid. Because his father refused to furnish him with spending money, G. Wilson Smoyer, a prominent young man of Allentown, Pa., yesterday made an attempt to poison both his parents, Mr. and Mrs. Benjamin A. Smoyer. Both are in a criticalcondition. The doctors have no hope for the recovery of Mrs. Smoyer. Two engines drawing a heavy freight train on the Central Railroad of Georgia, went through a trestle at Leeds, Ala., this morning, falling 40 feet, followed by five cars. Engineer Webster was probably fatally burt, and Engineer Vaughan and Fireman Car" roll badly injured. Fireman Hunter was killed. Mark Wood, a tramp, suffered a broken leg. Cashier Mory, of the closed National Bank of Boyerton, Pa., is still missing, but the directors of the institution are breathing freely. The discrepancy of $2,000 which had appeared just after the $165,000 in bonds were located in Philadelphia yesterday, has also been accounted for and the officials today are certain that not a cent is missing. It is now said the bank will be reopened on Monday, The hotel at Berlin, N.H, was gutted by fire early this morning. The inmates of the house succeeded in getting out in safety with the exception of Albert Clarke, a traveling man of Manchester. Vt., who, finding escape by the stairs cut off, jumped from a window and was fatally injured. The entire family, consisting of seven persons, of Superintendent John Kessler, were chloroformed at their home in Carlstadt, two miles from Passaic, N. J., last night by snesk thieves. The men secured about $500 worth of valuables. There is no clue. Rear Admiral Francis M. Bunce, U. S. N., died at Hartford, Conn., today. In July the admiral was operated on in Boston for cancer on the tongue and since his return home had failed steadily. He leave; & widow and two children. Mr. Wood Benson, aged 95 years, died in the Hampshire county, W Va., alms house Thursday. Mr. Benson wasthe first locomotive engineer to run a regular trip in the United States. The Paris, Ky., court house is burning. A strong wind is blowing and there is no hope of saving the structure. The building is one of the finest in the State and cost $175,000. Mrs. Lena G. Hoey, the widow of "Old Hoss" Hoey, is dead. Mrs. Hoey was one of the famous French sisters.