Click image to open full size in new tab

Article Text

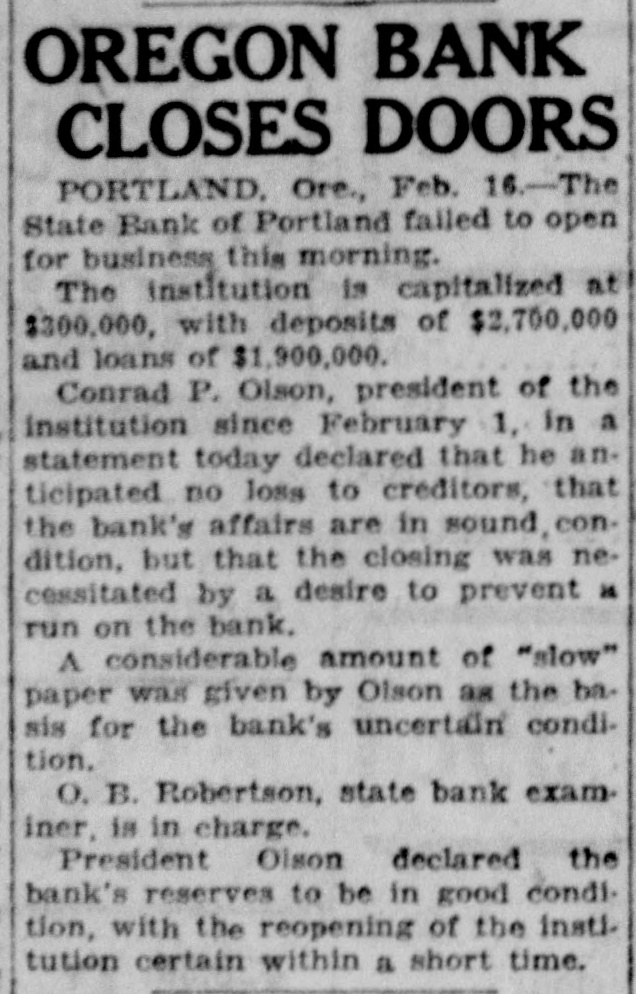

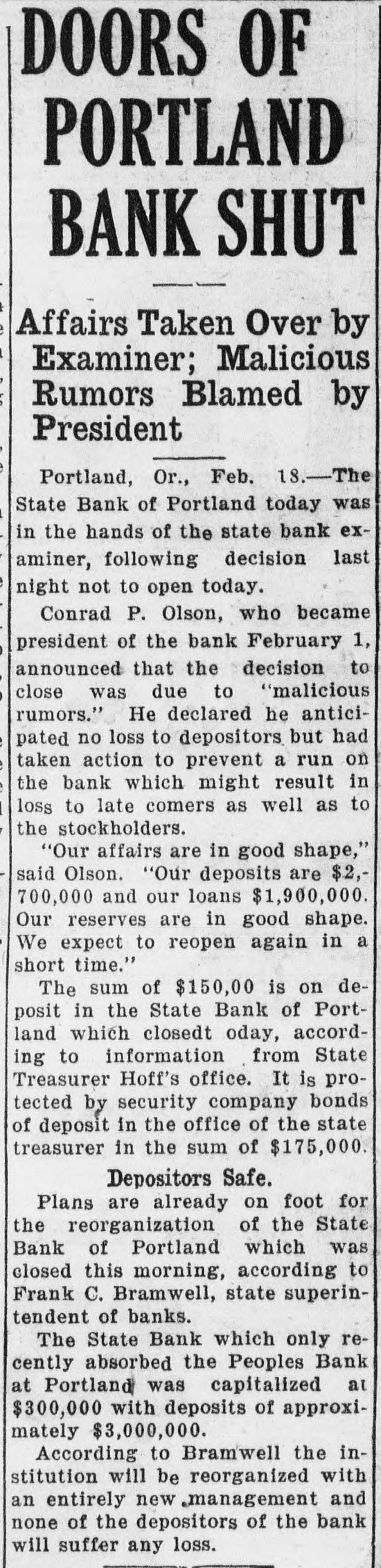

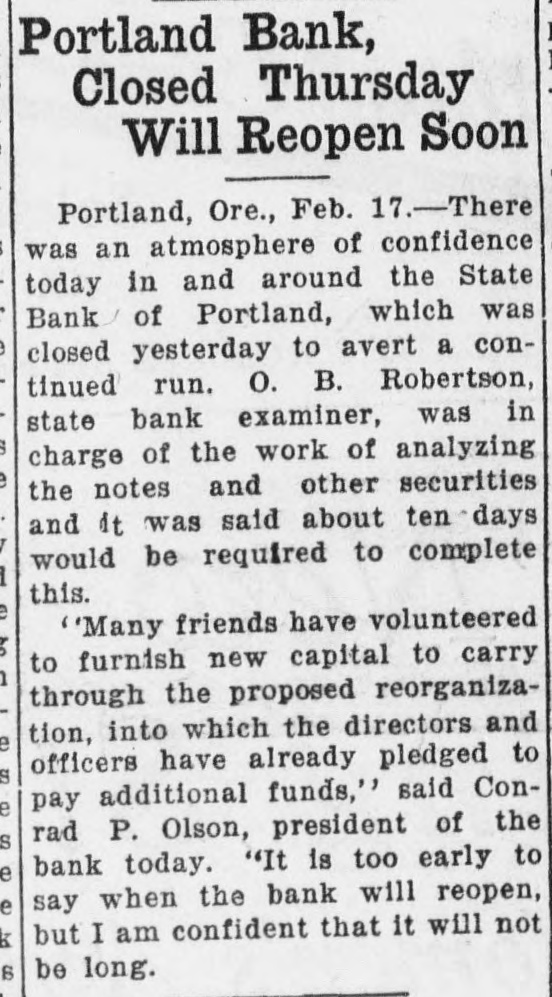

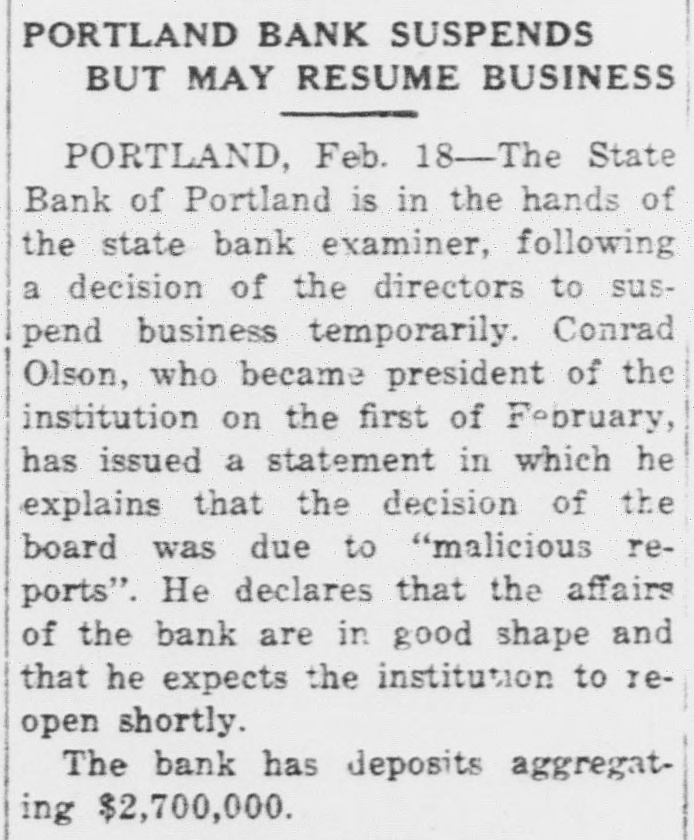

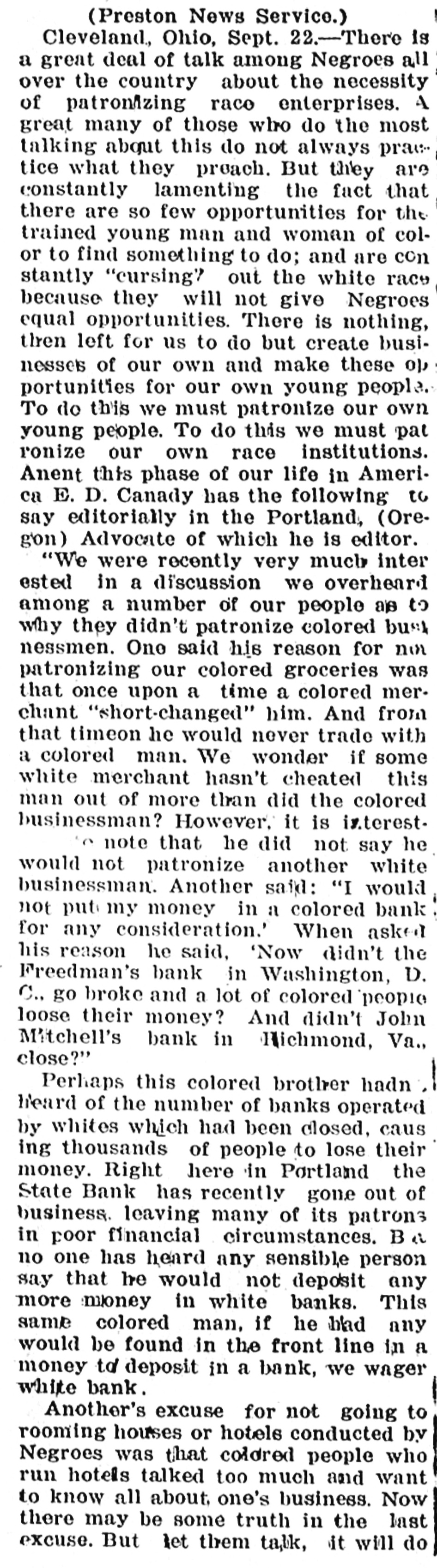

TAX HARDING ADVISES SALES FOR BONUS Man's Bail Paid High School Jammed; ROBBERY DOORS OF HARDING By Wagon Load Fall POSTPONEMENT OF Problem Looms; of Half Dollars PORTLAND OF TAYLOR ASKED No Solution Yet Seen Oakland, Cal., Feb. 16. * RELIEF ACTION IS An express wagon load of * BANK SHUT SUSPECTED silver half dollars-$2000 * Just what is the Salem school worth of them-was brought * unsolved at several board meetFOR DATA board to do with its Salem high to the Oakland police station * ings because the directors were in school students next fall? by George Bruno, manager * Movie Director's Oil no position to take any definite ONLY ALTERNATIVE Affairs Taken Over by Enrollment in the school grows of an Italian bank, to pro- * action. Talk there has been of a Senate Passes ResoluExaminer; Malicious Stocks and Money -and continues to grow. J. C. vide bail money for Lorenzo * new building, of another annex, Nelson, principal, announced this Suissi, under arrest today * tion Reguesting Deor portable schools-but nothing Rumors Blamed by Not Yet Found, Inafternoon that there are now 823 Recommendation Leaves Situation More Com has been done. on a charge of failing to ren- * tailed Inf ormation President students registered-13 more than vestigator Declares der assistance to a woman * In the meantime months roll by, plicated Than Ever; Home Republicans were in attendance earlier in the who had been run down by * the fall term comes closer, and the On Treaty Session Los Angeles, Cal., Feb. 16. Portland, Or., Feb. The week and more than 50 more than his automobile. Bruno, in * question looms bigger. Understood To Oppose Suggested Methods Oil stock and money, believed to State Bank of Portland today was * were in the rolls one year ago. explaining the half dollars, * As a result of the large gain in Washington, Feb. 16.-The have constituted part of the esEvery inc * in the hands of the state bank exterally-of availsaid all other money in the * attendance when the new semesof Financing and Bill May Be Killed tate of William Desmond Taylor, able floor resolution asking President * bank was locked in a time * in the building last ter started this week, two new aminer, following decision murdered film dfrector, are misshas been ut * vault. Next year, officlass rooms were provided in the for full information regarding night not to open today. ing, according to Charles A. rill be an incomcials say, th * basement where the manual trainWashington, Feb. 16.-President Harding informed con the negotiations of the four Conrad P. Olson, who became tudanta ing class of Jones. investigator for the district