Article Text

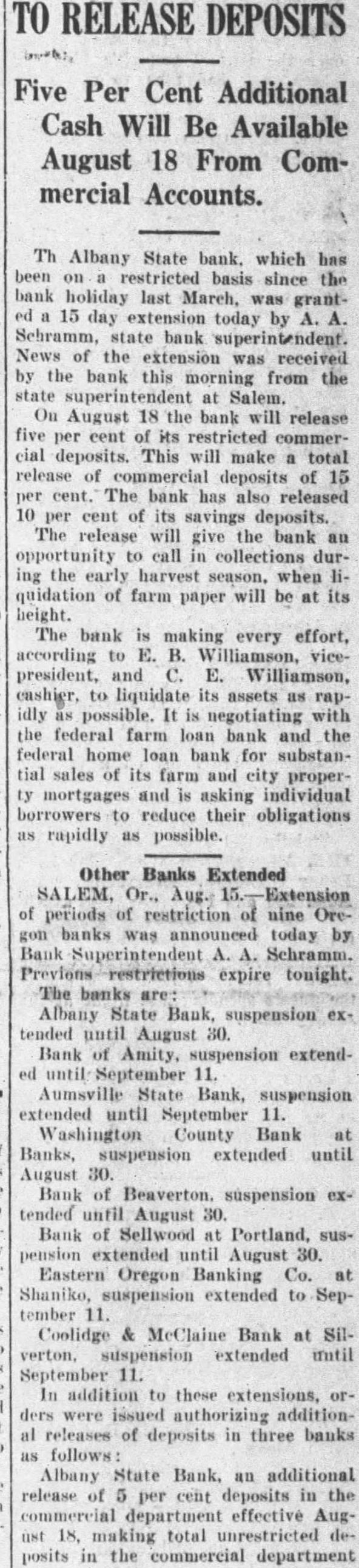

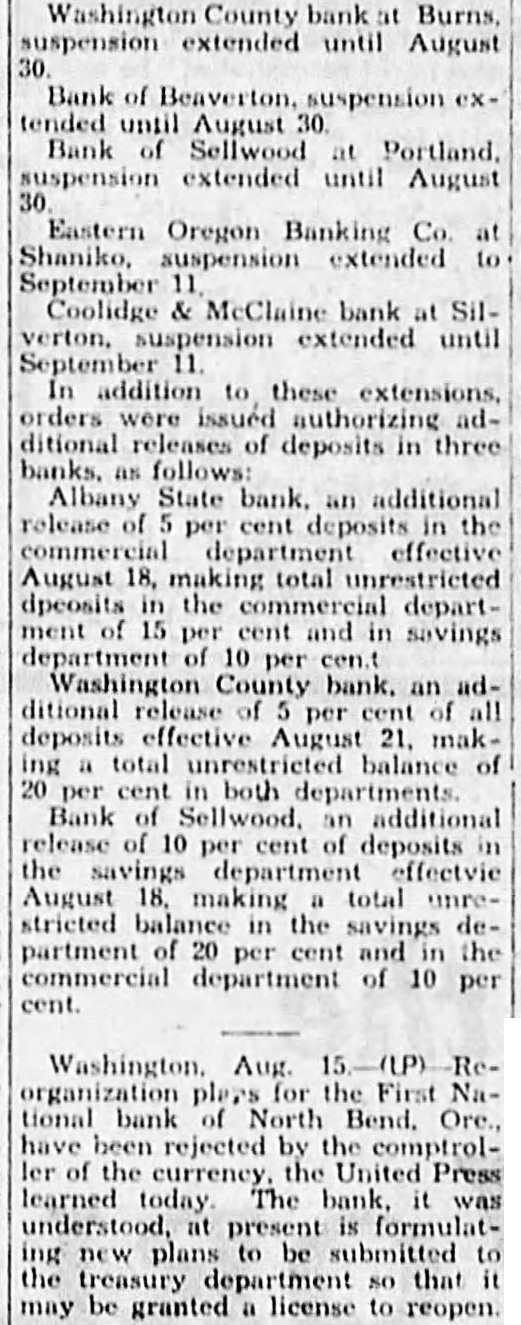

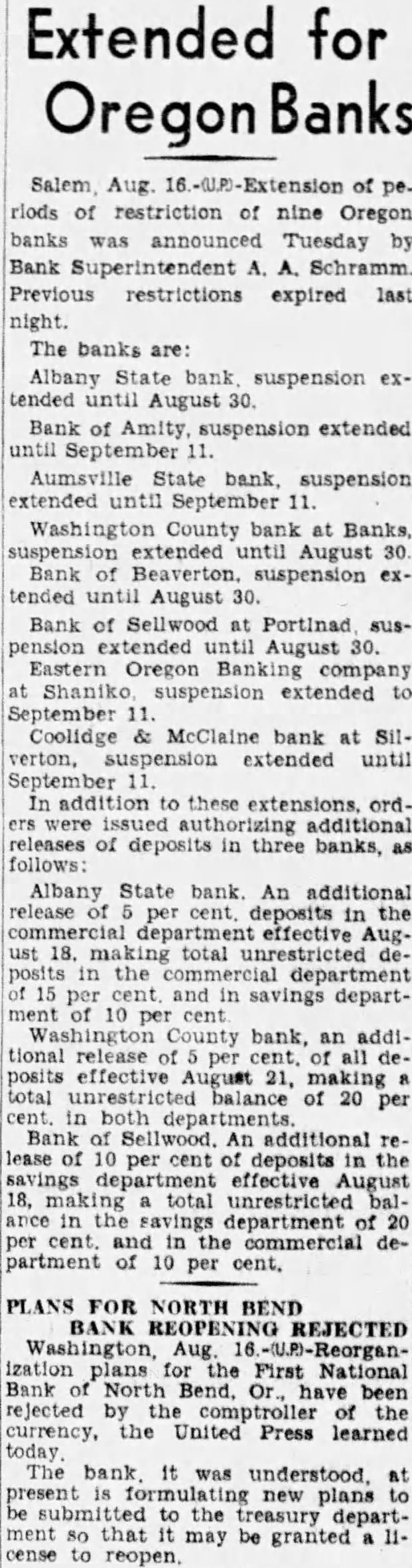

TO RELEASE DEPOSITS Five Per Cent Additional Cash Will Be Available August 18 From Commercial Accounts. Th Albany State bank. which restricted basis since the holiday last March, was grant15 day extension today by Schramm, state bank superintendent. News the extension received by the bank this morning from the state superintendent Salem. On August 18 the bank will release five cent of its restricted commercial deposits. This will make total release of commercial deposits of 15 per cent. The bank has also released 10 per cent its savings deposits. release will the bank an opportunity call collections during the early when quidation of farm paper will be at its height. The bank making every effort, according E. president, and E. Williamson, cashier, to its assets as rapidly possible. negotiating with the federal farm loan bank and the federal loan bank for substantial sales of its farm city propermortgages asking individual borrowers reduce their obligations as rapidly as possible. Other Banks Extended SALEM. Or., Aug. of periods restriction nine Orebanks was today by Bank Schramm. expire tonight. The banks are: Albany State Bank. suspension tended until August 30. Bank Amity. suspension extenduntil State Bank, suspension extended until September Washington County Bank Banks, suspension extended until August 30. Bank Beaverton. suspension extended August 30. Bank of Sellwood Portland, suspension extended until August 30. Eastern Oregon Banking Co. at Shaniko, suspension extended to September 11. Coolidge & Bank at Silsuspension extended until September 11. In addition these extensions, orders were issued authorizing additional releases of deposits in three banks as follows: Albany State Bank, an additional release of per cent deposits in the commercial department effective August 18, total unrestricted posits in the commercial department