Article Text

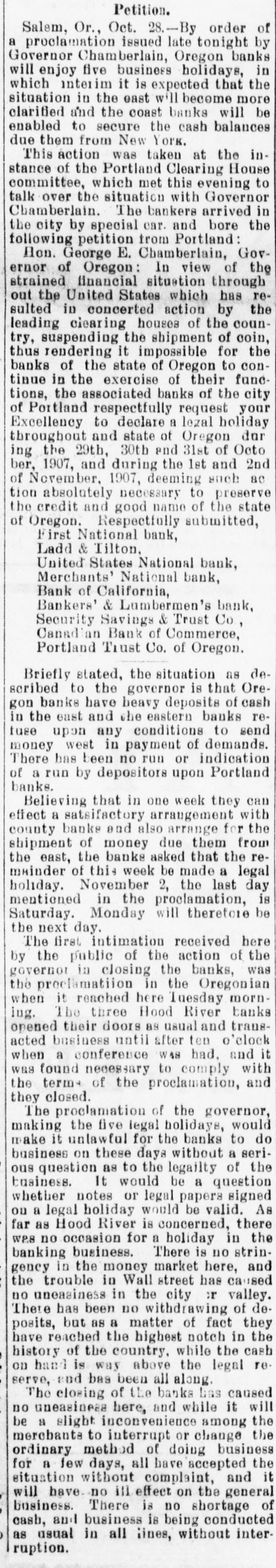

Petition. of Salem, Or., Oct. issued 28.-By late tonight order by a proclamation Chamberlain, Oregon holidays, banks in Governor five business that the will enjoy interim it is expected more which in the east will become will be situation the coast banks clarified and to secure the cash balances enabled them from New York. indue was taken at the This of action the Portland Clearing evening House to stance which met this Governor committee, the situation with arrived in talk Chamberlain. over The bankers and bore the the city by petition special from car. Portland: E. of the following Hon. George Chamberlain, view Govof Oregon: In through ernor financial situation has restrained United States which by the out the in concerted action the counsulted clearing houses of of coin, leading suspending the shipment for the try, rendering it impossible to conthus of the state of Oregon their funcbanks the exercise of the city tinue in the associated banks of your of Portland declare a lezal holiday and state of tions, throughout Excellency respectfully to of request Oregon Octo dur 2nd 29th, 30th and 31st and ing the and during the 1st such ac ber, November. 1907, 1907, deeming preserve tion of absolutely good necessary name to of the state of the Oregon: credit and Respectfully submitted, First National bank, Ladd & Tilton, United States National bank, Merchants' National bank, of California, Bank & Lumbermen's Co., bank, Security Bankers' Savings & Trust an Bank of Commerce, Portland Canad Trust Co. of Oregon. stated, the situation is that as Ore- deBriefly to the governor of cash scribed have heavy deposits banks regon banks east and she eastern to send in the any conditions demands. tuse upon west in payment or of indication money There has been depositors no run upon Portland that in one with of banks. a run by arrangement week they can Believing gatsifactory for the effect a banks and also arrange them from shipment county of money banks asked due that the legal rethe mainder east, of the November this week 2, be the made last a day is holiday. in the proclamation, be the Saturday. mentioned Monday will therefore next day. intimation received of here the The first public of the action banks, was by the in closing the the Oregonian the proclamation Tuesday it three Hood River trauggovernot when The reached here in and morn- banks ing. their doors as usual o'clock opened business until after ten and it acted conference WAS had, with when a necessary to and was found of the proclamation, they the term closed. the comply governor, of would The five legal to making unlawful for the banks a proclamation the holidays, seri- do make it these days without of business on as to the legailty be a business. notes or legal papers valid. As holiday would be there ous whether question legal It would concerned, question signed the ou a River is in the far as no occasion for a holiday is no strinbanking the money market has caused in in Wall street gency wes Hood business. There here, valley. and the in the city or of been no withdrawing they There a matter of in the posits, but as the highest notch the cash no uneasiness trouble reached has while fact dehave of the country. the legal re. on bas been all along. and of the banks has it will The here, and while among the serve, history uneasiness hand closing is way above caused slight inconvenience be a to interrupt or of doing the ordinary days, all have and it no for merchante method accepted change business the a few without complaint, general situation no ill effect on the of will have There is no shortage conducted as business. business is being intercash, usual and in all lines, without ruption.