Article Text

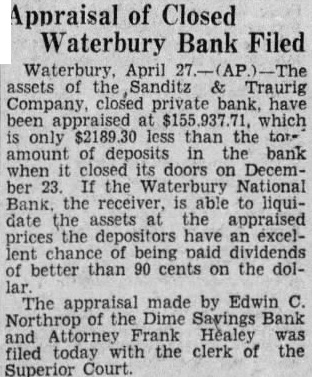

Appraisal of Closed Waterbury Bank Filed Waterbury, April The of Sanditz Traurig Company closed bank. have appraised which less than the the bank doors on December If National the to date the assets appraised prices the depositors have excelbeing of better than 90 cents on the dol- The appraisal made by Edwin Northrop Dime Savings Attorney Frank Healey filed today with clerk of Superior Court.