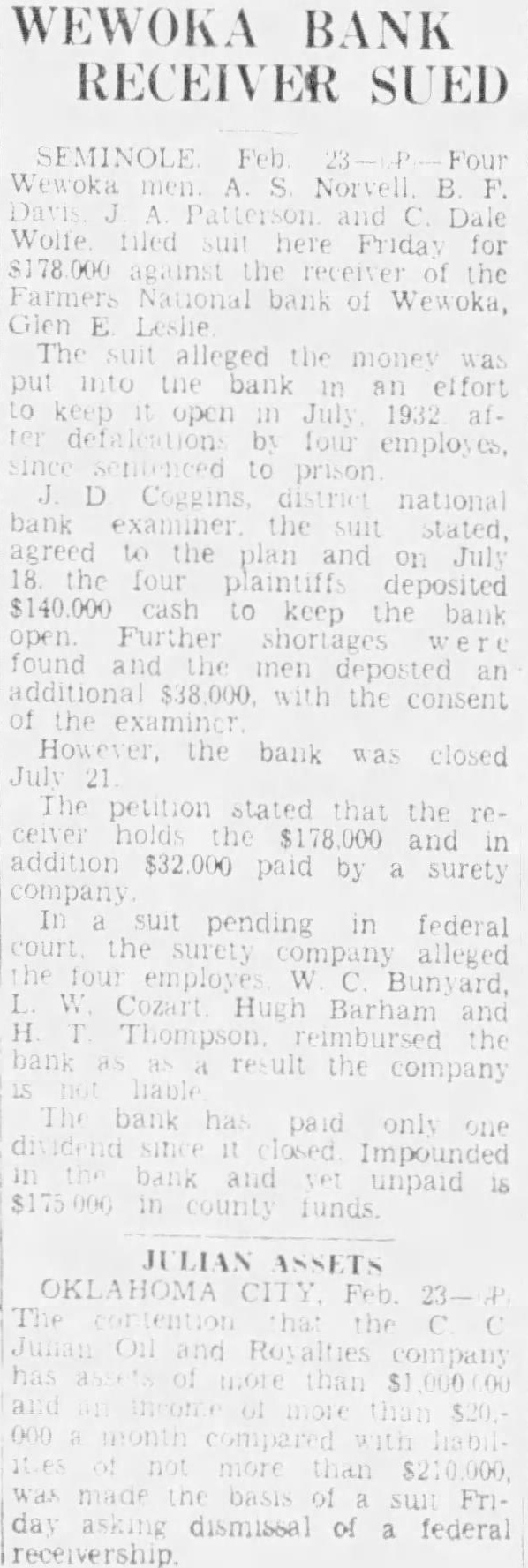

Article Text

WEWOKA BANK RECEIVER SUED SEMINOLE Feb Four Norvell Wolfe here for the bank of Wewoka, E alleged the money was the open July by to D national the stated agreed the plan and July plaintiffs deposited $140.000 cash keep the bank Further deposted an $38,000 the consent of However, bank closed The petition stated the and in addition $32.000 paid by surety In pending in federal company alleged he W = Hugh Barham and the company The paid Impounded unpaid funds ASSETS Feb has 000 was day asking dismissal of federal a