Article Text

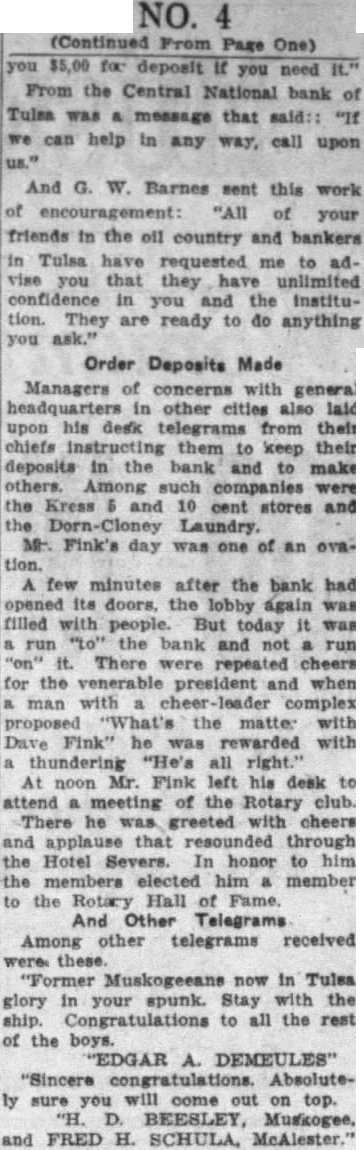

NO. 4 (Continued From Page One) you $5,00 for deposit If you need From the Central National bank of Tulsa was message that said:: "If we can help in any way, call upon And G. W. Barnes sent this work encouragement: "All of your friends in the oil country and bankers in Tulsa have requested me to ad. vise you that they have unlimited confidence in you and the Institution. They are ready to do anything you ask." Order Deposits Made Managers of concerns with general headquarters in other cities also laid upon his desk telegrams from their chiefs instructing them to keep their deposits in the bank and to make others. Among such companies were the Kress and 10 cent stores and the Laundry. Mt. Fink's day was one of an ova- few minutes after the bank had opened its doors, the lobby again was filled with people. But today it was run the bank and not run "on" it. There were repeated cheers for the venerable president and when man with complex proposed "What's the matter with Dave Fink" he was rewarded with thundering "He's all At noon Mr. Fink left his desk to attend of the Rotary club. There he was greeted with cheers and applause that resounded through the Hotel In honor to him the elected him member to the Rotary Hall Fame. And Other Telegrams Among other telegrams received Muskogeeans now in Tulsa glory in your spunk. Stay with the ship. Congratulations to all the rest of the boys. "EDGAR A. DEMEULES" "Sincere Absolutely sure you will come out on top. and FRED H. SCHULA, McAlester.'