Click image to open full size in new tab

Article Text

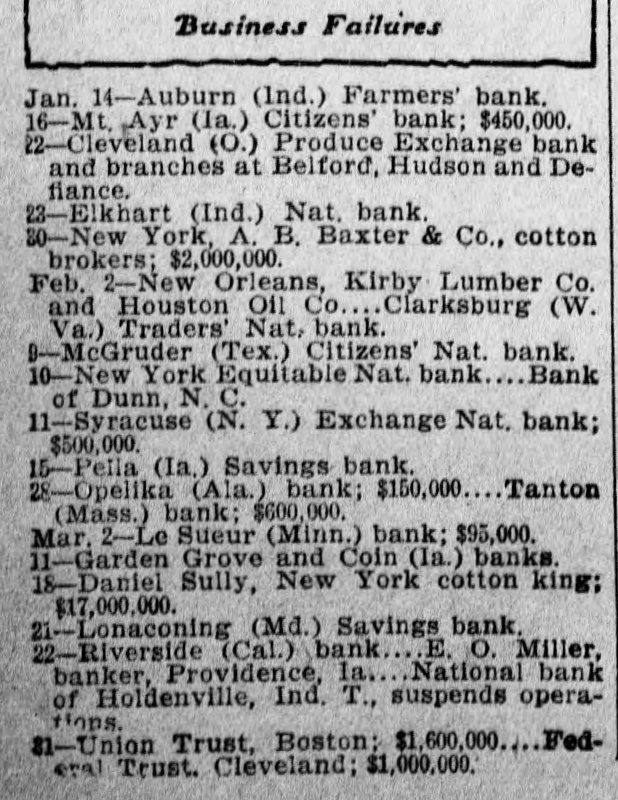

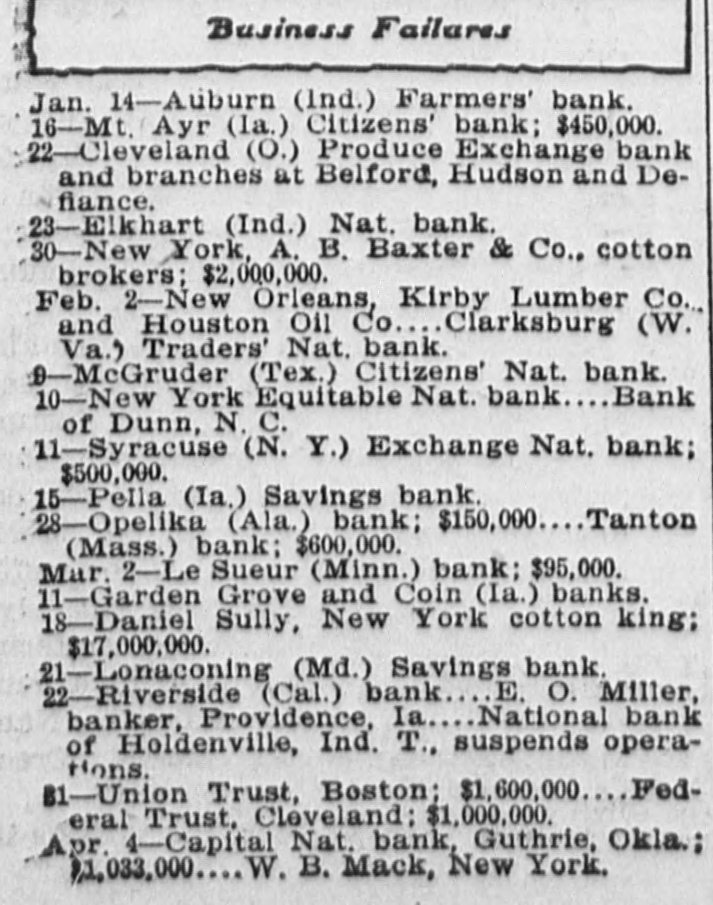

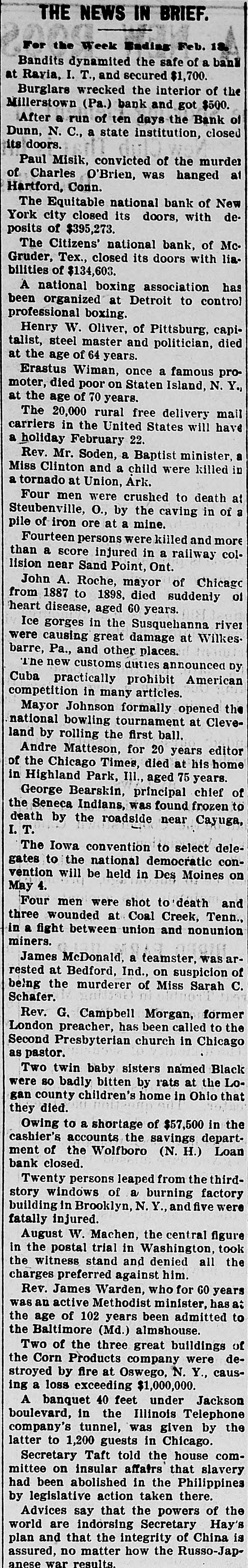

THE NEWS IN BRIEF. For the Week Ending Feb. 18. Bandits dynamited the safe of a bank at Ravia, I. T., and secured $1,700. Burglars wrecked the interior of the Millerstown (Pa.) bank and got $500. After a run of ten days the Bank of Dunn, N. C., a state institution, closed its doors. Paul Misik, convicted of the murder of Charles O'Brien, was hanged at Hartford, Conn. The Equitable national bank of New York city closed its doors, with deposits of $395,273. The Citizens' national bank, of McGruder, Tex., closed its doors with liabilities of $134,603. A national boxing association has been organized at Detroit to control professional boxing. Henry W. Oliver, of Pittsburg, capitalist, steel master and politician, died at the age of 64 years. Erastus Wiman, once a famous promoter, died poor on Staten Island, N. Y., at the age of 70 years. The 20,000 rural free delivery mail carriers in the United States will have a holiday February 22. Rev. Mr. Soden, a Baptist minister, a Miss Clinton and a child were killed in a tornado at Union, Ark. Four men were crushed to death at Steubenville, 0., by the caving in of a pile of iron ore at a mine. Fourteen persons were killed and more than a score injured in a railway collision near Sand Point, Ont. John A. Roche, mayor of Chicago from 1887 to 1898, died suddenly of heart disease, aged 60 years. Ice gorges in the Susquehanna river were causing great damage at Wilkesbarre, Pa., and other places. The new customs duties announced by Cuba practically prohibit American competition in many articles. Mayor Johnson formally opened the national bowling tournament at Cleveland by rolling the first ball. Andre Matteson, for 20 years editor of the Chicago Times, died at his home in Highland Park, Ill., aged 75 years. George Bearskin, principal chief of the Seneca Indians, was found frozen to death by the roadside near Cayuga, I.T. The Iowa convention to select delegates to the national democratic convention will be held in Des Moines on May 4. Four men were shot to death and three wounded at Coal Creek, Tenn., in a fight between union and nonunion miners. James McDonald, a teamster, was arrested at Bedford, Ind., on suspicion of being the murderer of Miss Sarah C. Schafer. Rev. G. Campbell Morgan, former London preacher, has been called to the Second Presbyterian church in Chicago as pastor. Two twin baby sisters named Black were so badly bitten by rats at the Logan county children's home in Ohio that they died. Owing to a shortage of $57,500 in the cashier's accounts the savings department of the Wolfboro (N. H.) Loan bank closed. Twenty persons leaped from the thirdstory windows of a burning factory building in Brooklyn, N. Y., and five were fatally injured. August W. Machen, the central figure in the postal trial in Washington, took the witness stand and denied all the charges preferred against him. Rev. James Warden, who for 60 years was an active Methodist minister, has at the age of 102 years been admitted to the Baltimore (Md.) almshouse. Two of the three great buildings of the Corn Products company were destroyed by fire at Oswego, N. Y., causing a loss exceeding $1,000,000. A banquet 40 feet under Jackson boulevard, in the Illinois Telephone company's tunnel, was given by the latter to 1,200 guests in Chicago. Secretary Taft told the house committee on insular affairs that slavery had been abolished in the Philippines by legislative action taken there. Advices say that the powers of the world are indorsing Secretary Hay's plan and that the integrity of China is assured no matter how the Russo- Jan-