Article Text

ROUND ABOUT US

Marriage licenses were issued in Atoka County last week, as follows: J. D. Syarrow and Warmah Beck, Coalgate; Oather Lovett and Mollie Jarnagan, Caney; Walter Smith, Waldron, Ark., and May Muse, Wardville.

Suits for divorce were filed in Atoka County as follows, last week: H. W Sutherland against May Bell Sutherland, and Hannah Wallace against Monroe Wallace.

The Baptist congregation at Stringtown has built a new church.

M. A Bailey of near Wilson, charged with the killing of William Hunt, last May was convicted at Ardmore last week and given 20 years in prison. Family trouble led to the killing, it is said.

Henry Beckelman. aged 15. for the past 27 years an engineer the Santa Fe railway between Texas and Ardmore, was killed in an auto accident in Ardmore, one evening last week He Mrs. Bertha McDermitt and came to town at a high speed. The car got out control corner turn and turtled. killing Beckelman and ously injuring his companion

Kiowa last week defeated the proposition for an issue of $20.000 in bonds to erect new school building to take care of the overcrowded conditions in the city schools. The vote was 161 against and 66 for the bonds.

Eufaula reports rainfall of 10 inches in 36 hours, last week creating one of the worst flood conditions in the history of the community. River KS flowed out of their banks rops were badly damaged Some business houses in Eufaula had water six inches deep over their floors.

Ed Williams, living near Pearce, in McIntosh County, is in jail at Eu faula. He admits killing Jess Ward. of Lenna, two weeks ago, by cutting his throat during a row, but claims self defense. He fled from officers at first. but later surrendered.

Loraine Wicher and Nettie Hensley, two high school girls from Whitesboro, Texas, were arrested at Eufaula last week by the sheriff and held until relatives could come and get them. They left home afoot, but had caught numerous car on their way up the Jefferson Highway

Seven men were arrested by Me Intosh County officers, last week, on the South Canadian River. some fif teen miles southwest of Eufaula, charged with operating a mammoth still. The still was confiscated and 40 gallons of liquor taken The still was running whiskey when the officers broke up the game The men arrested are Jim Boyd, John Monroe, Arthur Campbell, John Cook. Bill Pierce, Howard Norman and Amos Harris.

Muldrow sustained $60,000 fire last week, the principal losers being W D. Blackard & Son, Mrs. S. D Moreland, H. 0 Wolfe, Tay Brown Mercantile Company, J. R. Parker, C. A. Woods, Fred Leach, Noble Bryan Drug Company and others

C. E. English formerly a merchant at Walters, was arrested at Laredo, Texas. last week, on charges of embazzlement bankrupt funds The charges had been pending 14 years, the alleged embez zlement having taken place in 1912.

Four prominent Anadarko merchants, charged with making false claims to the government in connection with the furnishing of supplies for the Anadarko Indian School, must serve terms in federal prison, as the result of a decision in the U. S. circuit court of appeals. The men are B. W. Hammert, one of the wealthiest men of the city, and Clyde Thompson, each of whom get ten months in federal jail; also Frank Callahan, manager of the Anadarko Lumber Company and Ray Jennings manager of the Anarim Lumber Company each of whom get two years in federal penitentiary at Leavenworth.

Prevailing bad weather during the state fair at Oklahoma City threw the $50,000, and this amount was raised fair association "in the hole' about by merchants in that city and all debts paid before the fair was con

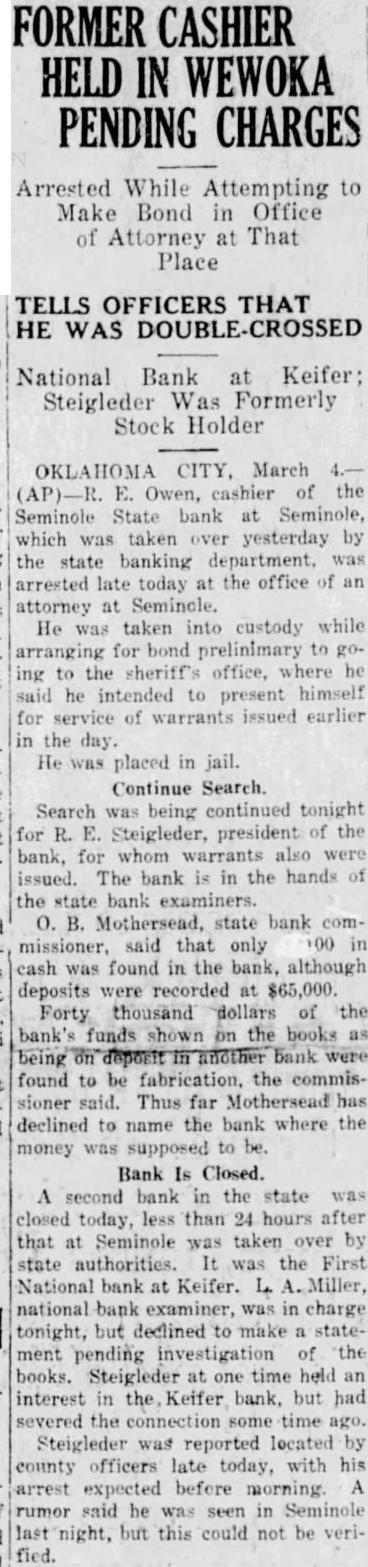

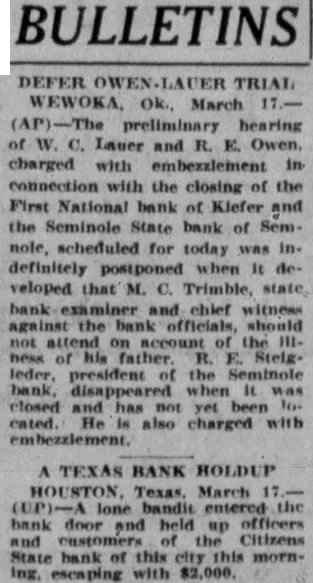

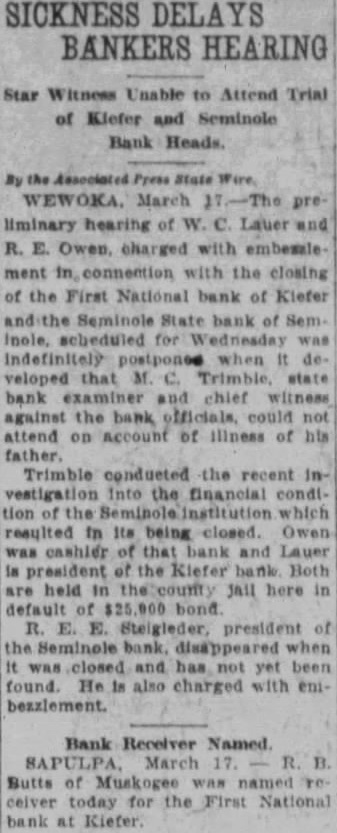

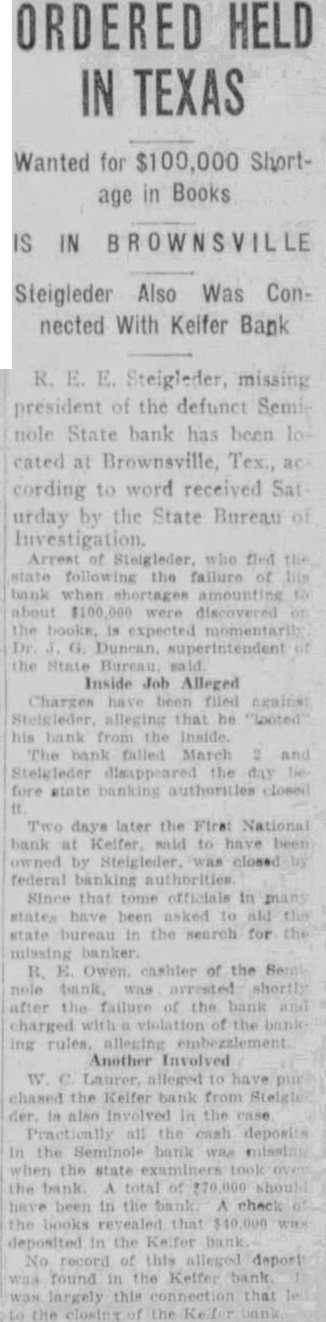

A state wide search is on for R E. E. Steigelder former president of the defunct Seminole State Bank, and for R. E. Owens, his cashier and Clay Holt, #3 negro. New indict ments have been returned against the men, it is said, Steigelder and Owens alread being under heavy bond for alleged irregularities in connection with the operation of the bank Holt is said to have run a used car exchange financed on funds alleged to have been taken from the bank by Steigelder and Owens.

Lee Cruce, former state governor, is to speak at Holdenville October 15. in support of the democratic ticket.

District court was concluded at Wilburton last week with the fol lowing in the crfiminal divi sion: G. S. Phillips, arson, years in prison; J. D. Dodd, driving while drunk, fined $25 and costs; Freeman Williams, seduction, acquitted; Haskell Welch, seduction, dismissed on payment of costs by defendant: Luther Hall, assault to-rape, 60 days in jail and $250 fine: Walter Jeffrey, seduction, dismissed on payment of costs by defendant; J. H. Garland, perjury, dismissed; W. B. Turner, disposing of mortgaged property, dismissed. John F Wallace, charged with the murder of Lem Brazzle, was acquitted. issued in Latimer County recently as follows:

Nathan Greenmyer and Tillie Spring er, Yanush; E. W. Roe and Callie Deatheridge, Cambria; S. V. Bell, and Francis Nichols, Henryetta; Vergil Baker and Bertha Batman, Hartshorne; Marshal Cox and Monnie Colvard, Wilburton: Herbert Rose and Edna Meadows, Talihina; Haskell Noah and Ethel Adams, Red Oak Bennie Adams and Lorena Brown, Red Oak; Elmer Erwin, Cambria, and Grace Nation, Haileyville; Willie Hughes, Hot Springs, Ark. and Hat tie Black, Wilburton Jesse Allen, Hartshorne, and Eva Roe Wilburton.

Allen Burk aged 25, was shot and killed by Ethelburt Milburn, at Hugo, one night last week, as he was in the act of taking the Milburn car from its parking in the front yard. Milburn was awakened by his wife who said some one was trying to steal the car. When he went out on the porch he saw Burk at the car and fired, with fatal effect.

The state criminal court of appeals has held valid the indictments returned some months ago against four Pushmataha County officers, and they are no wfacing removal from office The indicted men are County Judge George R. Childers, County Attorney Louis Gossett, Sheriff Nevins Kil patrick and W D. Hastings, county clerk

Citizens of Hugo and Paris, Texas and other immedaote points held joint celebration at Arthur City Red River, Tuesday in honor og the completion and opening of the new bridge across Red River that point This takes the place of the bridge that was washed away by floods two years ago

Elmer White, aged 12, living at Swink, Choctaw County, was ac cidentally shot and killed by a com panion one day last week, while the two boys were out hunting doves

Joe Sloan. of Ada, former sheriff of Pontotoc County, died last week He W native of Arkansas and 52 years old

Prof. A. Floyd, principal of junior high school at Ada, has gone into the poultry business, and will undertake to incubate young chickens 12,000 at time.

The Pontotoc County fair associa tion is in such healthy condition that it was able this year to pay a dividend to stockholders. after all ex penses of the fair had been met.

T A Ehope, formerly in the em ploy of the Katy railway at Atoka was one of the victims of the recent storm at Miami, Fla., according to word by his son. L. Shope, of Atoka, last week.

Antlers, has called bond ue election for October 25. when votes will be taken on the question of is suing $25,000 in bonds to improve the city waterwarks.

Marriage licenses were issued in Hughes County last week, as follows Mike Eneff and Ruth Call. Cromwell: Thomas Morsythe and Katherine

Doyle, Atwood; M. Johnson and Mrs. M. A. Rigsby, Ada; J. M Underwood and Annie McNinn, Holdenville; Miles Harwoodand Esther Smith, Holdenville; Raymond Nichols, Castle, and Velma Farrell, Wetumka; Willie Harjo and Lizzie Walker, Wewoka; Ernest Allen and Roma Harwell, Wetumka: Verda Cobb, Wewoka, and Lillian Bryson, Tecumseh.

Suit for divorce was filed at Holdenville last week in the following case Nora Gatewood against Shelley Gatewood.

Nearly nine inches of rainfall was reported at Holdenville. last week, and considerable crop damage was in

Oscar Wiseman, adopted son of Mr and Mrs Ed Wiseman, of Holdenville, died last week from an attack of typhoid

Contract will be awarded October 12 for the hard-surfacing of the Seminole County section of the Hol-