Article Text

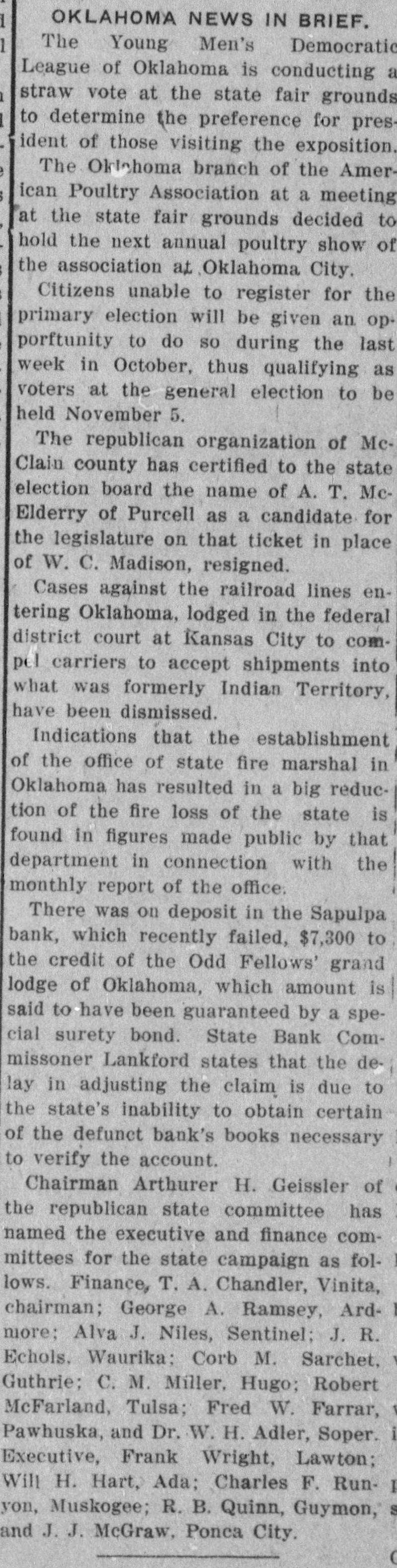

# OKLAHOMA NEWS IN BRIEF. The Young Men's Democratic League of Oklahoma is conducting a straw vote at the state fair grounds to determine the preference for president of those visiting the exposition. The Oklahoma branch of the American Poultry Association at a meeting at the state fair grounds decided to hold the next annual poultry show of the association at Oklahoma City. Citizens unable to register for the primary election will be given an opportunity to do so during the last week in October, thus qualifying as voters at the general election to be held November 5. The republican organization of McClain county has certified to the state election board the name of A. T. Mc-Elderry of Purcell as a candidate for the legislature on that ticket in place of W. C. Madison, resigned. Cases against the railroad lines entering Oklahoma, lodged in the federal district court at Kansas City to compel carriers to accept shipments into what was formerly Indian Territory, have been dismissed. Indications that the establishment of the office of state fire marshal in Oklahoma has resulted in a big reduction of the fire loss of the state is found in figures made public by that department in connection with the monthly report of the office. There was on deposit in the Sapulpa bank, which recently failed, $7,300 to the credit of the Odd Fellows' grand lodge of Oklahoma, which amount is said to have been guaranteed by a special surety bond. State Bank Commissioner Lankford states that the delay in adjusting the claim is due to the state's inability to obtain certain of the defunct bank's books necessary to verify the account. Chairman Arthurer H. Geissler of the republican state committee has named the executive and finance committees for the state campaign as follows. Finance, T. A. Chandler, Vinita, chairman; George A. Ramsey, Ardmore; Alva J. Niles, Sentinel; J. R. Echols. Waurika; Corb M. Sarchet, Guthrie; C. M. Miller, Hugo; Robert McFarland, Tulsa; Fred W. Farrar, Pawhuska, and Dr. W. H. Adler, Soper. Executive, Frank Wright, Lawton; Will H. Hart, Ada; Charles F. Runyon, Muskogee; R. B. Quinn, Guymon, and J. J. McGraw, Ponca City.