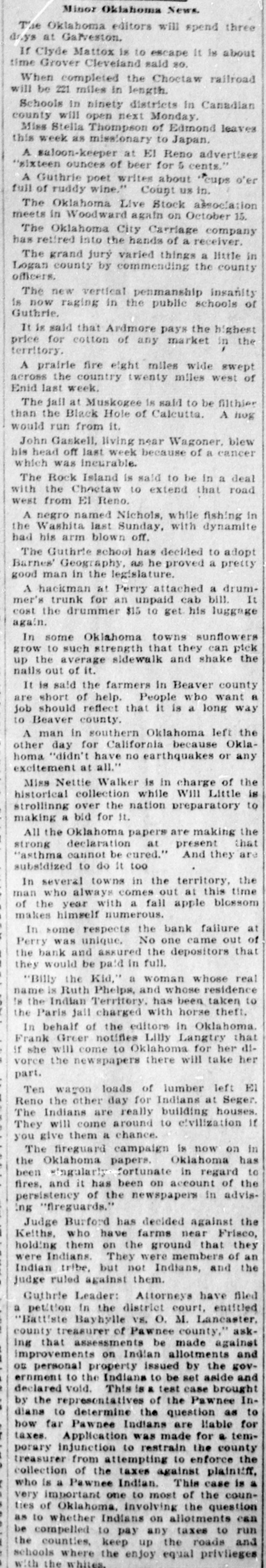

Article Text

Minor Oklahoma News. The Oklahoma editors will spend three dr.ys at Galveston. If Clyde Mattox is to escape It is about time Grover Cleveland said 80. When completed the Choctaw railroad will be 221 miles in length. Schools in ninety districts in Canadian county will open next Monday. Miss Stella Thompson of Edmond leaves this week as missionary to Japan. A saloon-keeper at El Reno advertises "sixteen ounces of beer for 5 cents." A Guthrie poet writes about "cups o'er full of ruddy wine." Count us in. The Oklahoma Live Stock association meets in Woodward again on October 15. The Oklahoma City Carriage company has retired into the hands of a receiver. The grand jury varied things a little in officers. Logan county by commending the county The new vertical penmanship insanity is now raging in the public schools of Guthrie. It is said that Ardmore pays the highest , territory. price for cotton of any market in the A prairle fire eight miles wide swept across the country twenty miles west of Enid last week. The jail at Muskogee is said to be filthier than the Black Hole of Calcutta. A hug would run from it. John Gaskell, living near Wagoner, blew his head off last week because of a cancer which was incurable. The Rock Island is said to be in a deal with the Chactaw to extend that road west from El Reno. A negro named Nichols, while fishing in the Washita last Sunday, with dynamite had his arm blown off. The Guthrie school has decided to adopt Barnes' Geography, as he proved a pretty good man in the legislature. A hackman at Perry attached a drummer's trunk for an unpaid cab bill. It cost the drummer $15 to get his luggage again. In some Oklahoma towns sunflowers grow to such strength that they can pick up the average sidewalk and shake the nails out of it. It is said the farmers in Beaver county are short of help. People who want a job should reflect that It is a long way to Beaver county. A man in southern Oklahoma left the other day for California because Oklahoma "didn't have no earthquakes or any excitement at all." Miss Nettie Walker is in charge of the historical collection while Will Little is strollinng over the nation preparatory to making a bid for 11. All the Oklahoma papers are making the strong declaration at present that "asthma cannot be cured." And they are subsidized to do It too In several towns in the territory, the man who always comes out at this time of the year with a fall apple blossom makes himself numerous. In some respects the bank failure at Perry was unique, No one came out of the bank and assured the depositors that they would be paid in full. "Billy the Kid," a woman whose real name is Ruth Phelps, and whose residence 18 the Indian Territory. has been taken to the Paris jail charged with horse theft. In behalf of the editors in Oklahoma. Frank Greer notifies Lilly Langtry that if she will come to Oklahoma for her divorce the newspapers there will take her part. Ten wagon loads of lumber left El Reno the other day for Indians at Seger. The Indians are really building houses. They will come around to civilization If you give them a chance. The fireguard campaign is now on in the Oklahoma papers. Oklahoma has been singularly fortunate in regard to fires, and it has been on account of the persistency of the newspapers in advising "fireguards." Judge Burford has decided against the Keiths, who have farms near Frisco, holding them on the ground that they were Indians. They were members of an Indian tribe, but not Indians, and the judge ruled against them. Guthrie Leader: Attorneys have filed a petition in the district court, entitled "Battiste Bayhylle vs. O, M. Lancaster, county treasurer of Pawnee county," asking that assessments be made against improvements on Indian allotments and on personal property issued by the government to the Indians to be set aside and declared void. This is & test case brought by the representatives of the Pawnee Indians to determine the question as to how far Pawnee Indians are liable for taxes. Application was made for a temporary injunction to restrain the county treasurer from attempting to enforce the collection of the taxes against plaintiff, who is a Pawnee Indian This case