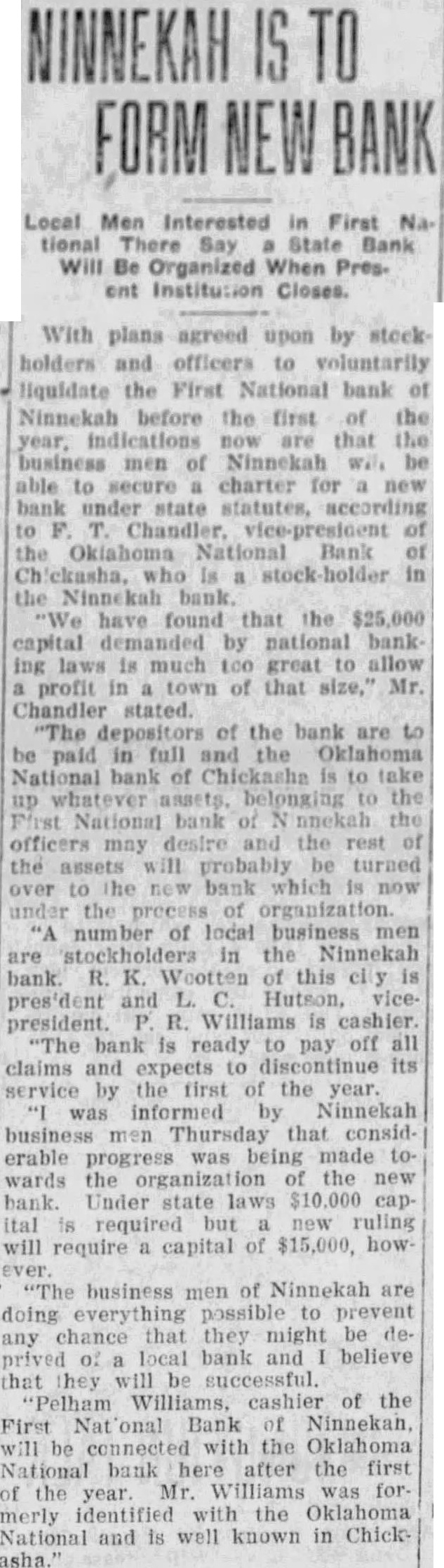

Article Text

Local Men Interested First tional There Say State Bank Will Be Organized When Pres. ent Institution Closes. With plans agreed upon by stock holders and officers to voluntarily liquidate the First National bank of Ninnekah before the first of the are that the business men of Ninnekah be able secure charter for new bank under state statutes, according to Chandler, vice-president the Oklahoma National Bank who in the Ninnekah bank "We have found that the capital demanded by national bank ing laws much great to allow profit in town of that Mr Chandler stated. depositors of the bank are paid in full the Oklahoma National bank of Chickasha up National officers the the assets probably be turned which now organization "A number of local business stockholders the Ninnekah are bank K. Wootten this president and viceWilliams is cashier president bank is ready pay off all claims and its by the the year. was informed by Ninnekah business Thursday that considerable was being made to wards the new bank. Under state laws cap required but new ruling will require a capital of $15,000. how ever. "The business men of Ninnekah are doing possible to prevent any chance that they might be deprived local bank believe that they be successful. "Pelham Williams, cashier of the First Bank of will be connected with the Oklahoma National bank here after the first of the year Mr. Williams was formerly identified with the Oklahoma National and is well known in Chickasha."