Article Text

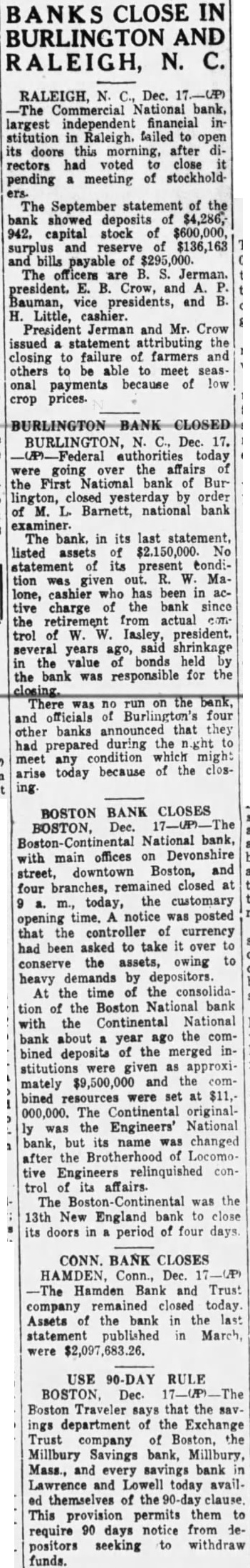

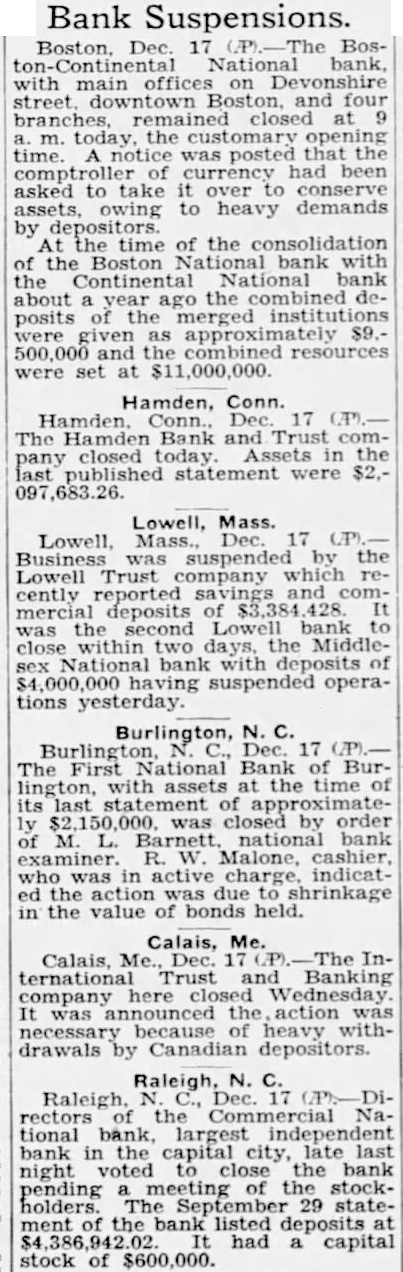

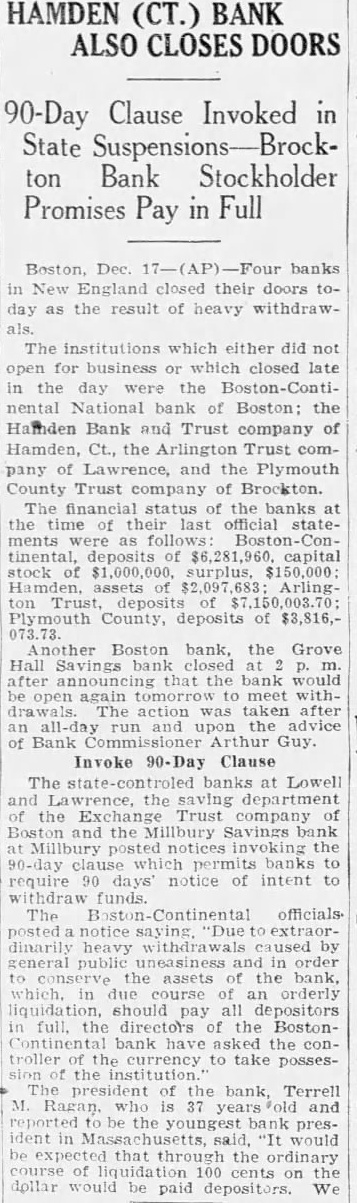

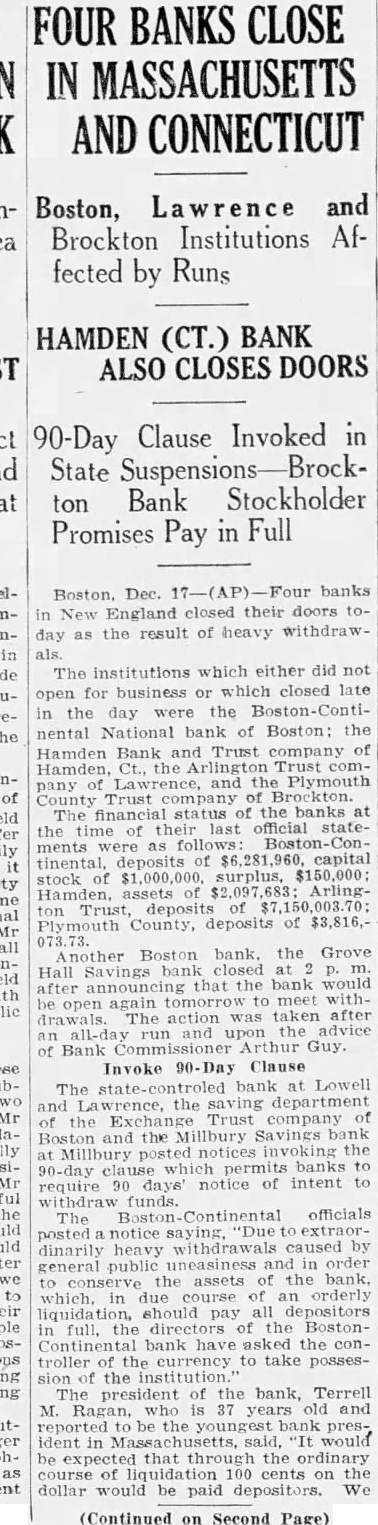

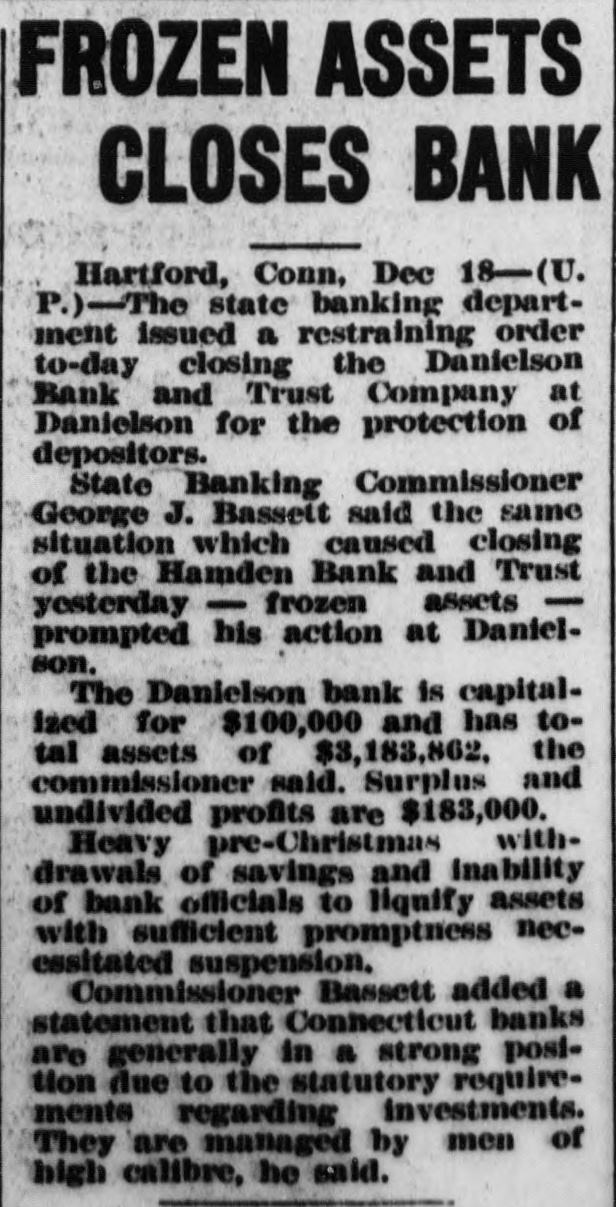

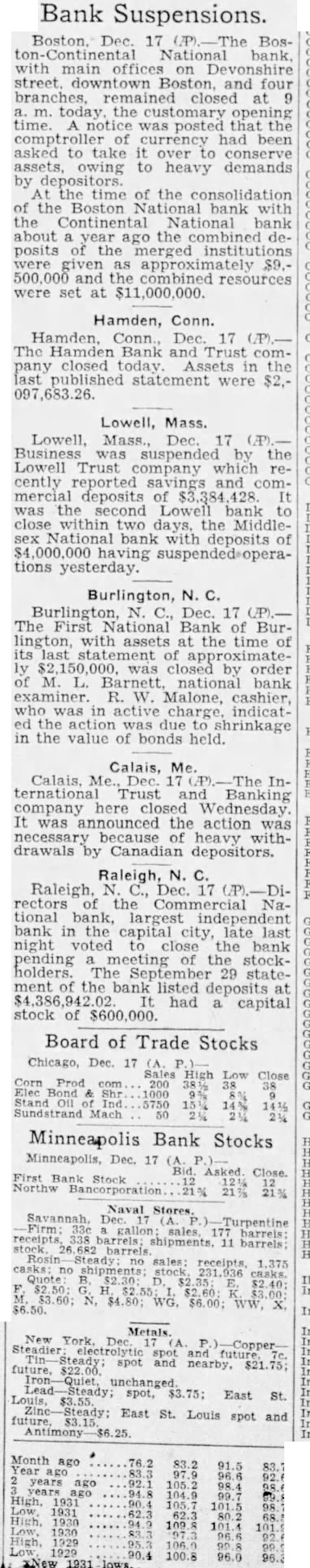

CLOSE IN BURLINGTON AND RALEIGH, N. C. RALEIGH, Dec. Commercial National bank, largest independent financial institution in Raleigh. failed to open its doors this morning, after rectors had voted close pending meeting of stockhold- The September statement of bank showed deposits of $4,286,942, capital stock of $600,000, surplus and reserve of $136,163 bills payable of $295,000. The officers are B. S. Jerman. president. Crow, and Bauman, vice presidents, and Little, cashier. President Jerman and Mr. Crow issued statement attributing the closing failure of farmers and others to be able to meet seaspayments because of low crop prices. Dec. 17. authorities today going over the affairs the First National bank of Burlington, closed yesterday by order Barnett, national bank examiner. The bank. in its last statement. listed assets of $2,150,000 No statement its present tondition given out. Malone, cashier who has been tive charge of the bank since the from actual control of Iasley, president. several years ago, said shrinkage the value of bonds held bank was responsible for the There run on the bank, was officials Burlington's four and banks announced that they other had prepared during the condition which might meet because of the clostoday ing. BOSTON BANK CLOSES BOSTON, Dec. National bank, offices on Devonshire main downtown Boston, and street, branches, remained closed at four today, the customary time. notice posted opening that the controller of currency had been asked to take it over to the assets, owing to conserve heavy demands by depositors. the time the consolidaAt Boston National bank tion the Continental National with the about ago the combank year bined deposits of the merged stitutions given approxi$9,500,000 and the mately bined were set at 000,000. The Continental originalthe Engineers' National was bank, but its name was changed after the Brotherhood Locomotive Engineers relinquished trol affairs. The the 13th New England bank to close its doors period of four days. CONN. BANK CLOSES Conn., Dec. Hamden Bank Trust company remained closed today. Assets the bank in the last statement published March, USE 90-DAY RULE BOSTON, Dec. Boston Traveler says that the savdepartment of the Exchange Trust company of Boston, the Millbury Savings bank, Millbury, Mass., and every savings bank Lawrence and Lowell today availed themselves of This provision permits them require 90 days notice from positors seeking to withdraw funds.