Article Text

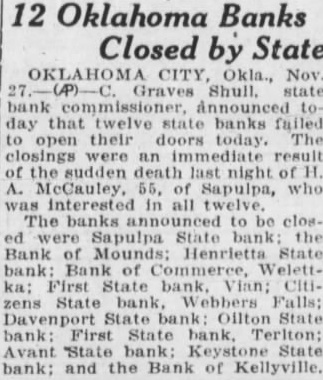

12 Oklahoma Banks Closed by State OKLAHOMA CITY, Okla., Nov. 27. Graves Shull. state bank announced today that twelve state banks failed to open their doors today. The closings were an immediate of the death last night of H. A. McCauley, 55, of Sapulpa, who interested in all The banks to be closed were Sapulpa State bank the Bank of Mounds: Henrietta State bank Bank of Commerce, Welettka: First State bank, Vian: Citizens State bank Webbers Falls; State State bank: First State bank, Terlton: Avant State bank: bank: and the Bank of Kellyville.