Article Text

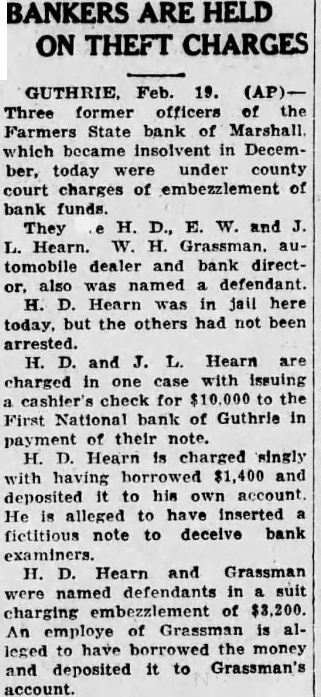

BANKERS ARE HELD ON THEFT CHARGES Feb. 19. Three former officers the Farmers State bank of Marshall which became insolvent in December, today were under county court charges of embezzlement of bank funds. They H. D., E. W. and Hearn. W. H. Grassman. tomobile dealer and bank director, also named defendant. H. D. was in jail here today, but the others had not been arrested. H. D. and J. L. Hearn are charged in case with Issuing cashier's for to the First National bank of Guthrie in payment of their note. H. Hearn charged singly with having and deposited to his own account He alleged to have inserted fictitious note to deceive bank examiners. H. D. Hearn and Grassman were named defendants in suit charging of $3,200. An employe of Grassman leged to the money and deposited it to Grassman's account.