Article Text

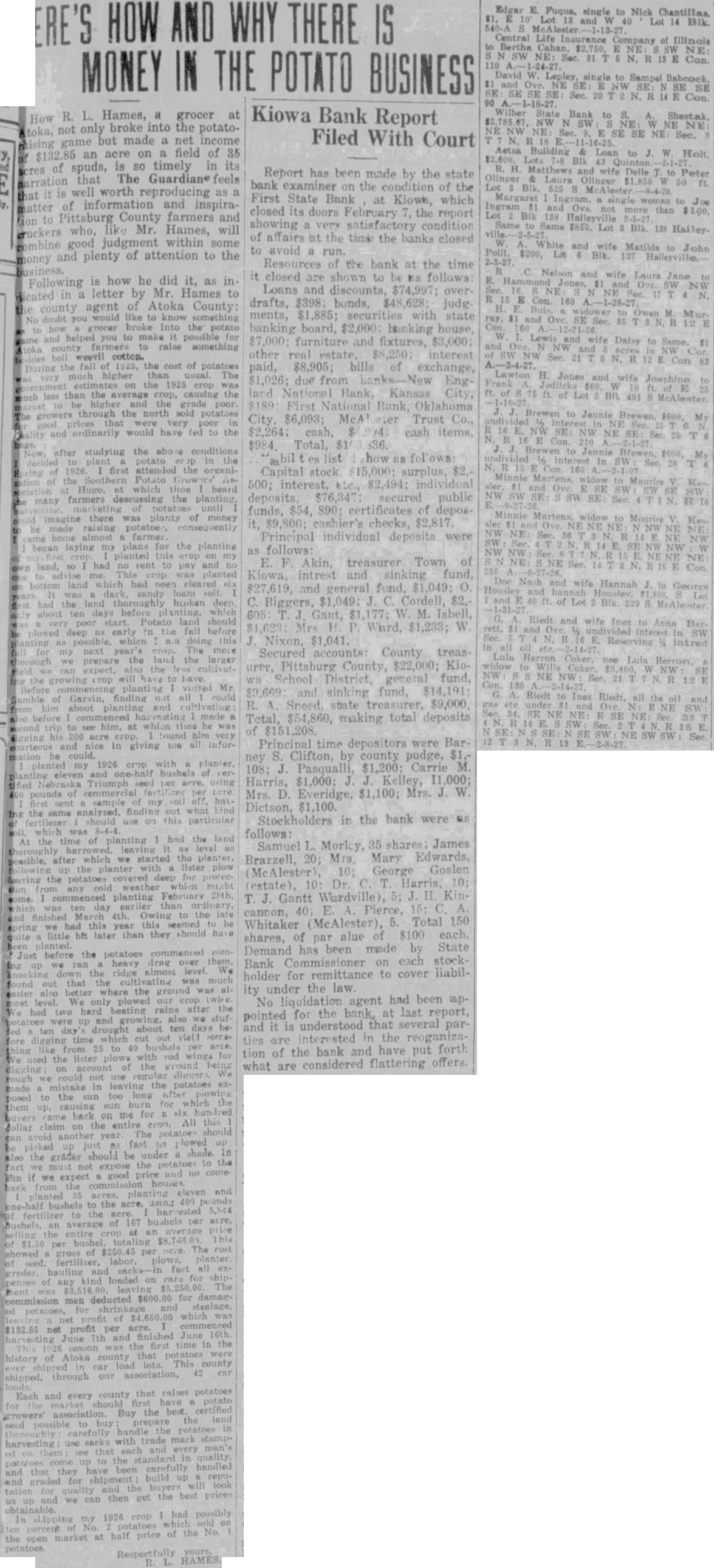

ERE'S HOW AND WHY THERE IS MONEY IN THE POTATO BUSINESS How R. L. Hames, a grocer at toka, not only broke into the potatogame but made a net income $132.85 an acre on a field of 35 of spuds, is SO timely in its that The Guardian feels is well worth reproducing as matter of information and inspirato Pittsburg County farmers and bruckers who, Mr. Hames, will good judgment within some and plenty of attention to the Following is how he did it, as in in a letter by Mr. Hames to county agent of Atoka County like to doubt you grocer into the potato and you to possible for farmers to raise something weevil cotton. fall 1925, the cost of potatoes the higher than usual The the 1925 less than the average causing the higher the grade through the north sold potatoes that were very poor and have the studying the above conditions after in 1926 first attended the organithe time many farmers descussing the planting there was planty made farmer plans for the planting land, had cleared thoroughly broken deep fall The prepare the the Mr. of finding and he was 200 him in giving my 1926 with planier crop and bushels Triumph cemmercial the finding out same was of planting the the level which we started the planter after for the planting February March the this this be bit than they should before the heavy over them We that was better where the rains had two about ten time the use the to the on me All The the and acre, The deducted was net per the every and for the best prices we can then get obtainable. possibly 1926 crop sold half of the at price the market Respectfully HAMES. Kiowa Bank Report Filed With Court Report has been made by the state bank examiner on the condition of the First State Bank at Kiowe, which closed its doors February the report showing a very satisfactory condition of affairs at the time the banks closed to avoid Resources of the bank at the time it closed are shown to be MS follows: Loans and discounts, $74,997; over drafts, $398 bonds, $48,628; judg ments, $1,885; securities with state banking board, $2,000 banking house, furniture and fixtures, $3,000 other interest paid, $8,905; bills of exchange, $1,026; due from banks-New England National Bank, Kansas City, $189 First National Bank Oklahoma City, $6,093; McA ster Trust Co., $2,264: cash, 14 cash items list how as follows: Capital stock $15,000 surplus, $2. 500; interest, $2,494; deposits $76,347 secured public funds, $54, 890: certificates of deposPrincipal individual deposits were as E. F Akin, treasurer Town of Kiowa, intrest fund, Gant, W Isbell $1,233; W J. Nixon, $1,041. Secured accounts: County treasPittsburg County, $22,000; Kio District, general fund $9,669 sinking fund, $14,191 R. $9,000 Total $54,860, making total deposits of $151,208 Principal time depositors were Bar ney S. Clifton, by county pudge, 108; J Pasqualli $1,200: Carrie M $1,000 J. J. Kelley, Harris, Mrs. D. Everidge, $1,100; Mrs. J. W Dictson, $1,100 Stockholders in the bank were MS Samuel L. Morky, 35 shares James Brazzell 20; Mrs, Mary Edwards, George Goslen Mc Dr. T Harris, 10: T J. Gantt Wardville), 5; H. Kincannon, Pierce, Whitaker McAlester), Total 150 shares, of par alue of $100 each. Demand has been made by State Bank Commissioner on each stock holder for remittance to cover liabil under the law ity No agent had been ap pointed for the bank at last report, and it is understood that several par ties are interested in the reoganiza tion of the bank and have put forth considered flattering what Edgar E. Fuqua, single to Nick Chantillas and Lot 14 Blk. Central Bertha Life Insurance Company of Illinois E NE SW 110 SW NE See. 31 N. R 13 E NE Con. David single to Sampel Babcock and NE SE SE: See. 20 R 14 SE Con. SE Wilber State Bank Shestak NW NE NE NE NW NE: SE SE NE: N. Aetsa Building to W. Blk Olinger H. Matthews & and wife Delle Peter $1,850 50 Lot woman Joe Ingram and Ova not more than $100, Blk Same Lot 138 Blk. White and wife Matilda to $200, Lit Blk. 137 John Nelson and wife Laura Jane to SW NW Con. 160 Owen and SE 85 W wife to and NW Sec. R Con 83 Lawton H. Jones wife Josephine E ft. 491 S J. Jennie $600, NE T See SW See NE See NE NE Con and Hannah to Bar nee NE See Riedt SW See